“What makes a story stock, Mr. Lebowski?”

“…”

“Is it being able to stay in the spotlight, no matter how the news landscape shifts?”

“Mmm… that and a few rocket emojis.”

“Joking. But… perhaps you’re right.”

I once met Karl Rove in an airport

Even in terms of regional airports, the airport in Austin, Texas is still pretty small. It isn’t on the way to anywhere, and there are only 500,000 people in Austin proper, so it’s still all one terminal on one level, and there isn’t all that much to it. On this particular Monday evening in 2016, traffic around the baggage carousel was pretty light. Not even half a dozen people milling around. Just locals coming back from wherever, eager to get home, see what’s in the fridge and wash off the road. I looked over at this portly guy in a suit, and it turned out he wasn’t just any portly guy in a suit, it was the man himself: Karl Rove.

There’s a good case to be made that Rove is a war criminal, but telling him that wasn’t going to make any difference and, on that particular Monday, in the year of our lord 2016, US federal politics were in the midst of being turned upside down by the six day old election of a certain real estate developer to the office of US President. The playbook of this very notable and accomplished political operator – the guy who got George W. Bush elected twice – had just become obsolete.

I walked over and said hello and Rove was nice enough. He smiled for a selfie, then listened patiently as I asked him what he thought of… everything. Donald Trump was the President! Did he really win, or was it more like Clinton lost? Clearly this has to shake the Republican party to its very foundations. Will the establishment Republicans fall in line behind this president, or will he be fighting off his own party?

Rove waited for me to run out of steam about four questions deep and replied: “Well… if you want to know what I think, you can read my column in the Wall Street Journal. It comes out Thursday.”

Normie call volume here at The Dive‘ West Coast office is at record levels as the retail trader revolution rages on. All manner of friends and acquaintances, previously uninterested in the stock market, suddenly want to talk about it. I’ve begun giving the ones who want to know what I think the Karl Rove treatment (thanks for reading!) because, as much as I like talking about investing, this particular wave of interest isn’t all that inquisitive.

They’re more interested in being listened to. Otherwise nice, socially well-adjusted people have suddenly become mouthpieces for whatever small cap or mid cap name they caught a bug for after spending too much time reading investment forums. It isn’t that they’re trying to pitch it, they’re just thrilled about their new thing.

“It’s up 50% in a month, and people are just starting to find out about it! You know, the environmental benefits of plant based eating is just starting to come into the mainstream and…” The concept that talking their book is obnoxious hasn’t yet occurred to them. But I hope that they stay solvent for long enough that they’re able to learn from experience.

Nobody cares about your fantasy team.

Interesting people do not talk about stocks in terms of gains and losses over periods of time. In fact, the most interesting people never talk about stocks at all. But among the people who do, the interesting part about equities investing isn’t what got bought and how it did, or even what is being bought and how it’s expected to do. The interesting part is the business underneath the stock and its prospects of executing, growing and capturing investor interest.

I can learn about what’s up or down from the ticker. Price action on heavy volume is good for some attention but, if that’s the best part of the story, how is it meant to be sustained? Price action that sustains itself without real world business progress, or even perceived business progress, doesn’t figure to last for any length of time. It’s not a cryptocurrency.

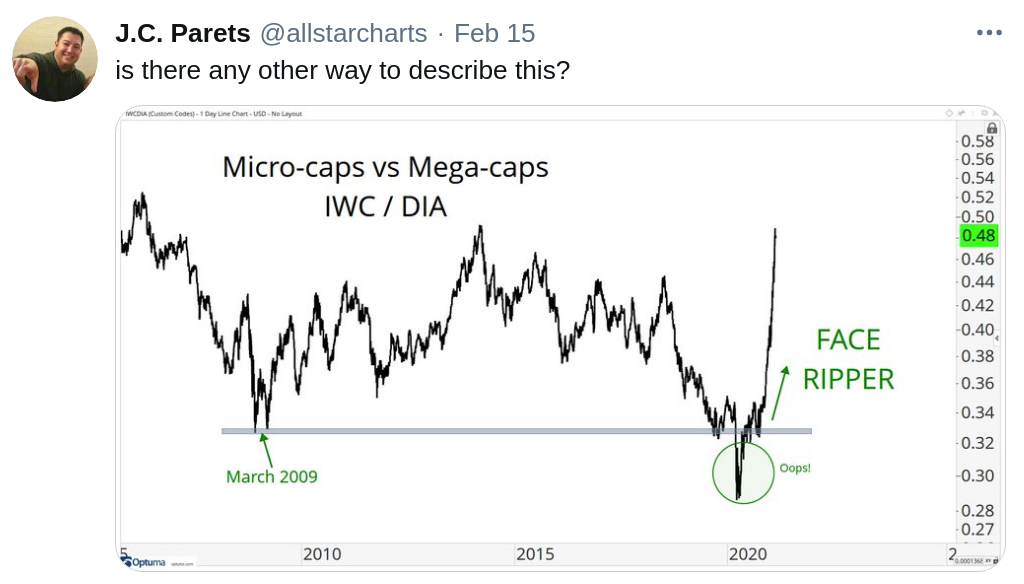

This column is on record this past January with our opinion that it’s become a story stock market, and in fact always has been. But a retail-driven market that features story-chase after story-chase doesn’t mean that fundamental analysis doesn’t count for anything anymore. It just means that the weighting has changed.

Sentiment matters more than it used to, and so does clarity of message. One could make a pretty good case for fading companies that over complicate their message, because it’s the simplest stories that wind up spending the longest time in the echo chamber.

ROCKET EMOJI!!!!!!!!🚀🚀🚀

The stories that pervade are the ones that are worth telling, and the story of the great Retail Renaissance of 2021, so far, has been the success of shallow, empty promotion. The stocks that move, the story goes, are the ones that have been relentlessly pumped by emoji-abusing hype merchants. This is a framing that gives the human megaphones a whole lot of credit for original thought.

There might not be as many diligence fiends on Reddit as there are hype-men, but they’re a vital part of the ecosystem. The men on the pump might be lazy and unoriginal, but they aren’t stupid. To the extent they’re selecting their pumps themselves (as opposed to being paid), they select companies that have gone through someone else’s due diligence layer and come out with a story that can be reduced into something that is both appealing and worth repeating.

If this rally were nothing but a big momentum trade, these people who we haven’t talked to in years are wasting their time calling us to ask what we think about stocks – we should be calling them.

But markets are made from the actions of people, all of whom have emotions and intentions. The vegan food and electric cars sectors aren’t on extended tears because of random chance: those rallies are products of investors believing in and wanting to back the futures they represent. Sure they’re being helped along by hype; no hype beast worth their gif collection jumps on an empty bandwagon. But there’s always a thesis somewhere. Investors would be prudent to ask themselves whether or not it has legs.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The Skeptical Investor’s Guide to Reading a Corporate Press Release

“I just read it, right? Why do I need a guide?” – You, likely, after...