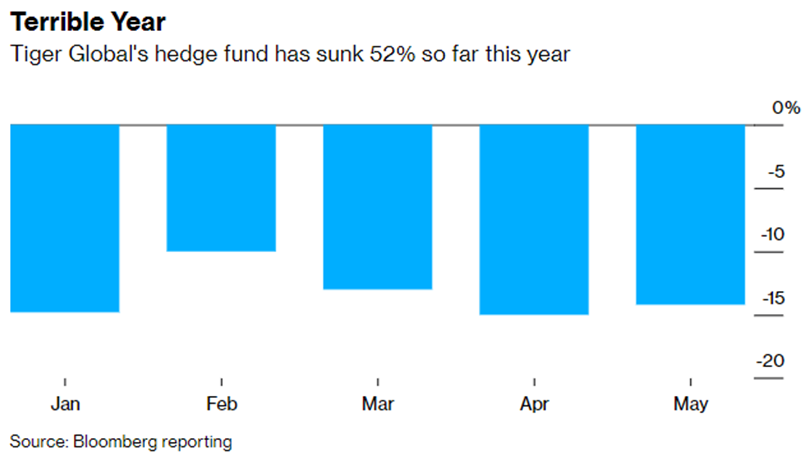

Hedge fund Tiger Global Management tumbles 14.2% in May alone, putting its losses for the year at around 52%. This is a significant decline compared to the 7% contraction it sustained in 2021.

According to a Bloomberg report, the monthly loss stemmed mainly from the decline “in several stocks and substantial markdowns in its private assets.”

“We take very seriously that our recent performance does not live up to the standards we have set for ourselves over the last 21 years and that you rightfully expect,” the company told its investors in a letter. “Our team remains maximally motivated to earn back recent losses.”

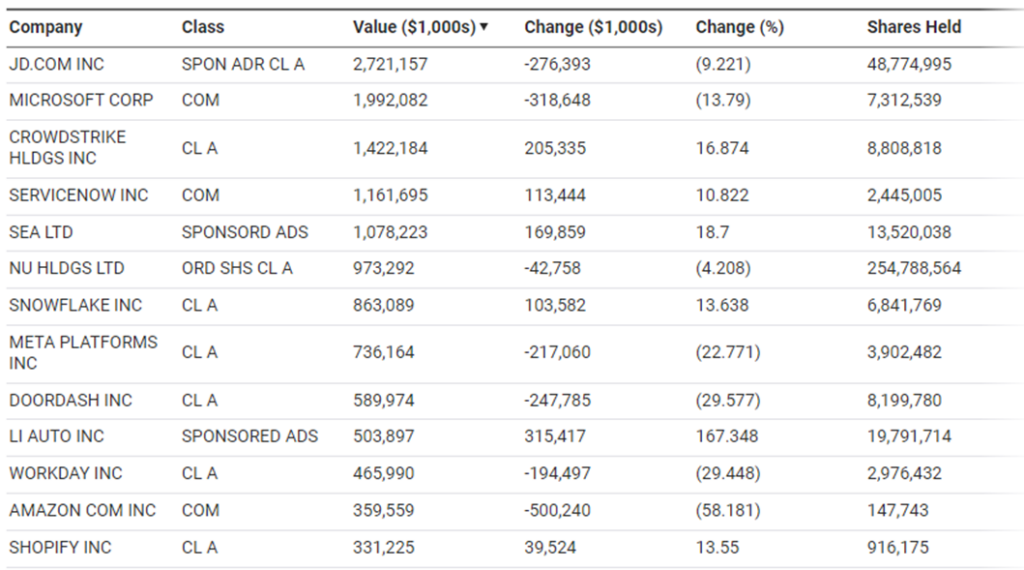

The decline of the tech-heavy hedge fund left its portfolio exposed to the illiquid bets it amassed in the hopes of capitalizing on windfall gains during the height of an optimistic market and IPO spree. But when the economy turned sour in Q1 2022, the company’s holdings plummeted by more than half.

Prior to the decline in May, it is estimated that the investment firm lost around 44% throughout the first four months of 2022, valued at around US$17 billion in losses.

To put a band-aid on the bleed, Tiger Global is offering its investors to put their investments in a separate account that can be cashed out at a later date. It will also start to temporarily allow clients to redeem as much as 33% of their holdings, adjusting from the 25% upper limit, to entice investments.

Further, the hedge fund is cutting down its management fees by 50 basis points until December 2023. The company told its investors that it “has adequate resources” to accommodate the fee cut without it affecting the quality of its service.

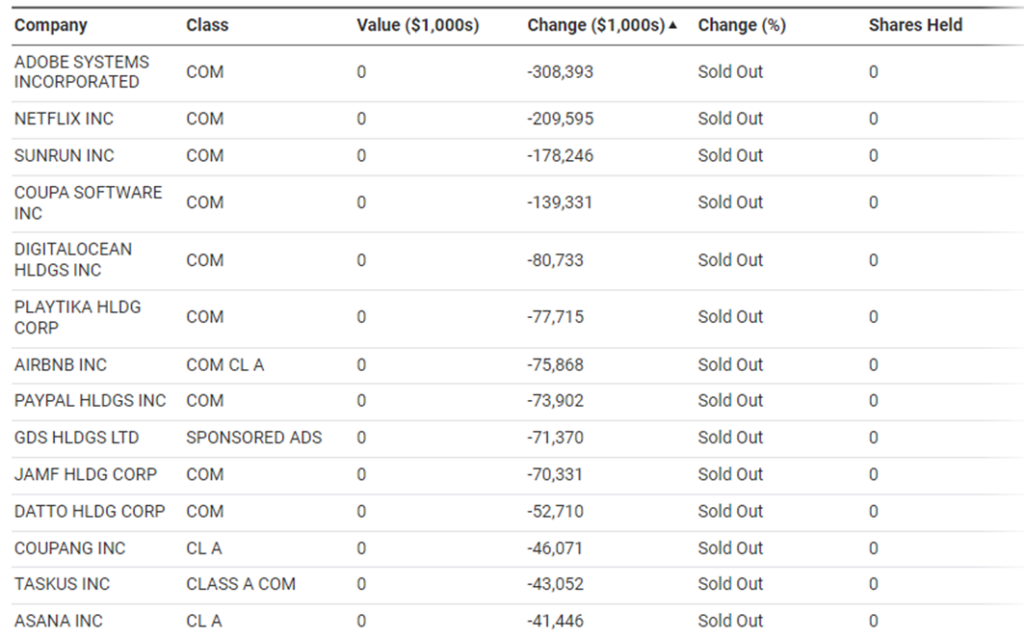

In its latest SEC filing, the hedge fund closed out its holdings in major tech names, including Adobe, Netflix, Airbnb, Paypal, Bumble, and Rivian. It also reduced its position in Alibaba, Uber, Peloton, Zoom, Spotify, Robinhood, and Coinbase.

Information for this briefing was found via Bloomberg and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.