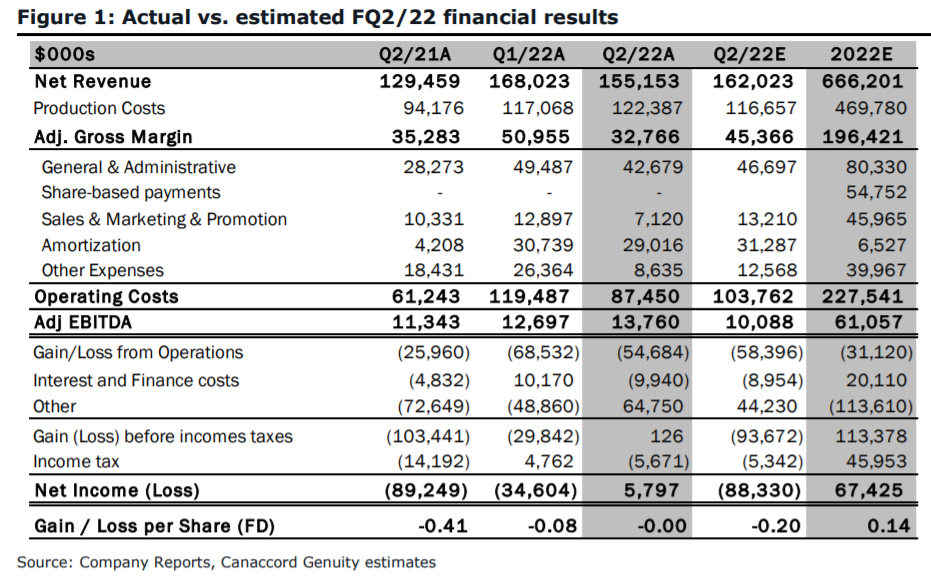

On January 10th, Tilray Inc (TSX: TLRY) reported their fiscal second-quarter financial results, the company saw net revenues of $155.15 million, an increase of 20% year over year. The company reported an adjusted EBITDA of $13.8 million and a net income of $95 million, driven by a reassessment of fair value derivative liabilities.

The companies revenues are made up of 38% cannabis, 44% distribution, 9% beverages, and 9% wellness. Once again showcasing that Cannabis revenue is not the main driver of revenue for Tilray.

For the cannabis sector, gross margins were 23%, or $13.52 million, while adjusted gross margins, which remove inventory impairment, came in at 43% or $25.52 million.

Tilray saw a number of analysts cut their 12-month price targets on the firm from US$12.38 to US$9.79, which now represents a 35% upside to the current stock price. Tilray has 20 analysts covering the stock with 1 analyst having a strong buy rating, 2 have buys, 14 have hold ratings and 3 have sell ratings. Cowen and Company has the street high price target of US$23 while GLJ Research currently has a US$0.82 price target.

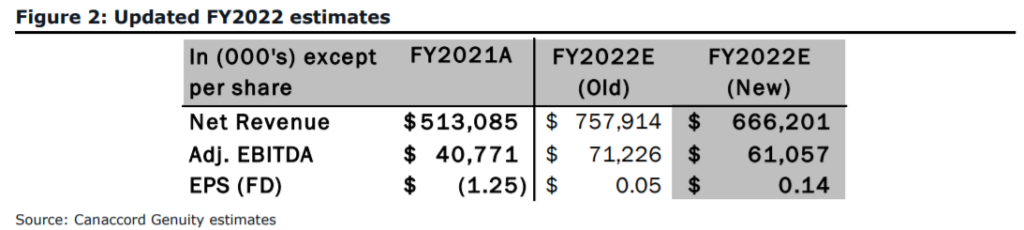

Canaccord Genuity slashed their 12-month price target from US$12 to US$9 and reiterated their hold rating on Tilray after the results, saying that sustained market saturation continues to lead to declining branded sales.

For the results, Canaccord expected Tilray to report $162 million in revenues with an adjusted gross margin of $45.36 million, which Tilray did not meet. Tilray saw Canadian adult-use revenue drop 29% while price compression continues to be the biggest problem for Tilray.

Canaccord calls Tilray’s Canadian market share decline from 16% to 12.8% well behind its goal of 30% market share, a red flag for the sector as a whole as most of the LPs are still struggling to ‘gain critical mass.”

For its other segments, Tilray holds a 20% market share in Germany which Canaccord says, “looks to be on the verge of potentially formalizing adult-use regulations.” While beverage and wellness revenue saw a 9.5% sequential decrease due to what Canaccord calls a slowing CBD market.

Below you can see Canaccord’s updated fiscal full-year 2022 and 2023 estimates below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.