With the Aphria, Tilray (NASDAQ: TLRY) merger finalized and Aphria shares consolidated earlier this month, many analysts are now updating their models, price targets, and ratings. Tilray now has 18 analysts covering the combined company with a weighted 12-month price target of U$19.75. Alliance Global has the street high with a U$32 price target and the lowest comes from GLJ Research with a U$1.27 price target. Two analysts have strong buy and buy ratings. 13 analysts have hold rating and one analyst has a sell rating.

In Haywoods note issued on May 18th, their analyst Neal Gilmer reiterates their hold rating and U$16.50 price target, saying this merger creates a clear leader in the Canadian market with significant European and U.S exposure.

For the Canadian assets, Gilmer believes that the company is now a leader in the space, with the idea that the company could potentially reach 25-30% of total market share. The combined company now has a bunch of different brands, ranging from a variety of different categories. Gilmer believes that they will be able to be a “profitable leader in Canada.”

For international, Gilmer likes the combination of CC Pharma and Tilray’s 2.7 million sq feet facility in Portugal which can serve as a low-cost producer for the medical markets.

Gilmer ends the note by saying that Tilray has now, “distinguished itself among its peer group,” and they are encouraged by the international opportunity and U.S optionality. But he is somewhat cautious of how their main market, Canadian cannabis, remains and believes that there will be prolonged COVID-19 headwinds.

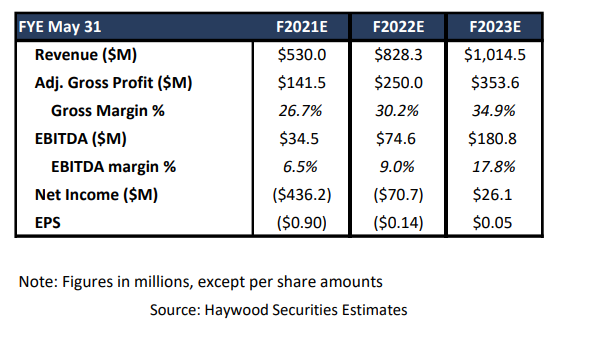

Below you can see the consolidated 2021-2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.