Tilray Brands (TSX: TLRY) is expected to report its fiscal fourth-quarter results on July 26th. The consensus revenue estimate is US$152.2 million, this estimate has slowly dropped over the last year as the original estimate was US$228 million. EBITDA is expected to come in at just US$11.28 million, this consensus estimate is also down from US$30 million. Lastly, the consensus estimate for net income is ($40) million.

Tilray currently has 19 analysts covering the stock with an average 12-month price target of US$6.84, which is an upside of 120%. Out of the 19 analysts, 2 have strong buy ratings, 2 have buy ratings, 13 analysts have hold ratings and the last 2 analysts have to sell ratings on the stock. The street high price target sits at US$23, or an upside of 630%.

In Haywood Capital Markets’ note on their fourth-quarter preview, they reiterate their hold rating but slash their 12-month price target from $7.25 to $4.00, saying that “with the recent Hifyre data and increasing competition within the Canadian adult-use landscape, we have lowered our revenue expectations for the cannabis segment.”

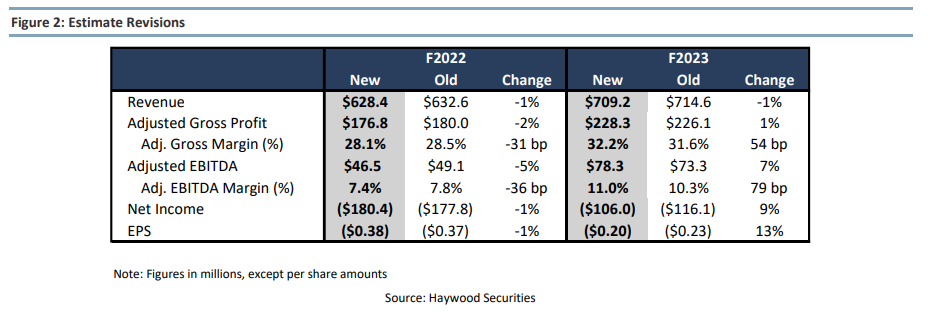

For the fiscal fourth quarter, Haywood lowered their estimates to be in line with the consensus estimates. They now expect revenues to come in at $153.3 million, which implies a 1% growth sequentially and only 8% on a year-over-year basis. They expect adjusted gross margins to come in at 26.9%, a 2.9% decrease year over year, while their adjusted EBITDA estimate is now $9.9 million, or a margin of 6.5% and flat on a quarter-over-quarter basis. They add that according to the most recent Hifyre data, Tilray has lost even more market share, falling almost 2% to 8.1% of the adult-use market.

On the strategic transaction with HEXO Corp (TSX: HEXO), Haywood says that the cost-saving of $80 million and the annual advisory fee of $18 million help offset the market share losses in Tilray’s Canadian adult-use segment.

Haywood adds though that they are optimistic for the company on its international opportunities, which mainly are its U.S investments. They remain cautious “on the overall Canadian landscape which drives a significant amount of its revenue growth opportunity.”

Lastly, Haywood has elected to lower their full-year 2023 estimates slightly and say that, “we will await a return to growth in the Canadian adult-use cannabis segment, strengthening of on-premise alcohol sales and results from the Whole Foods partnership prior to making any material near-term updates to our estimates.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.