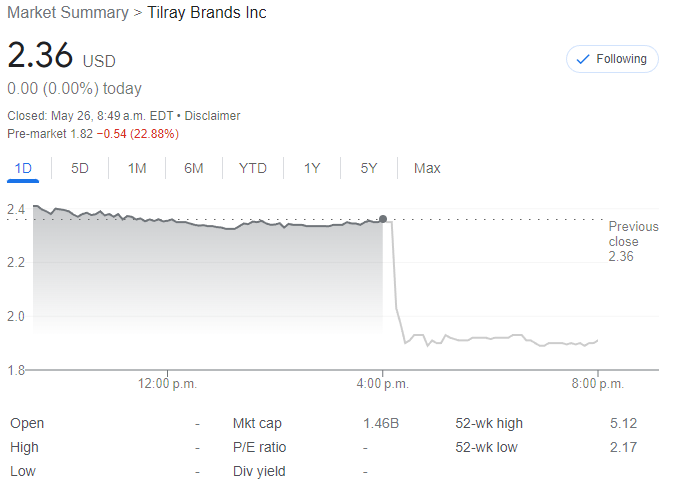

Tilray Brands (NASDAQ: TLRY) is currently down nearly 23% in pre-market trading follow the after-hours announcement that it would be raising funds via unsecured convertible notes.

The offering, which will see gross proceeds of $150 million, plus a $22.5 million over-allotment option, consists of 5.20% convertible senior notes, which are due June 15, 2027. The notes are payable semi-annually in arrears, with the conversion price equivalent to $2.66 per share, a 12.5% premium to the firms most recent closing price.

Net proceeds from the offering are slated to amount to $144.8 million, or as much as $166.6 million if the over-allotment option is fully exercised.

A portion of the proceeds are slated to be used to repurchase some of the firms 5.00% convertible senior notes dude 2023, and some of its 5.25% convertible senior notes due 2024. Tilray has indicated it will repurchase $12.5 in principal amount of 2023 notes for $12.6 million in cash, and $122.5 million in principal amount of 2024 notes for $125.7 million in cash.

As part of the offering however, Tilray has entered into a share lending agreement with Jefferies LLC, which will see the company lend 38.5 million shares to the investment bank.

READ: Hexo To Be Acquired By Tilray For US$56.0 Million

The shares are to be newly issued, which Tilray expects to be used to enter a short position to establish a hedge in relation to the notes offering. The shares are to be held in treasury once returned under the lending agreement.

Tilray Brands last traded at $2.36 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.