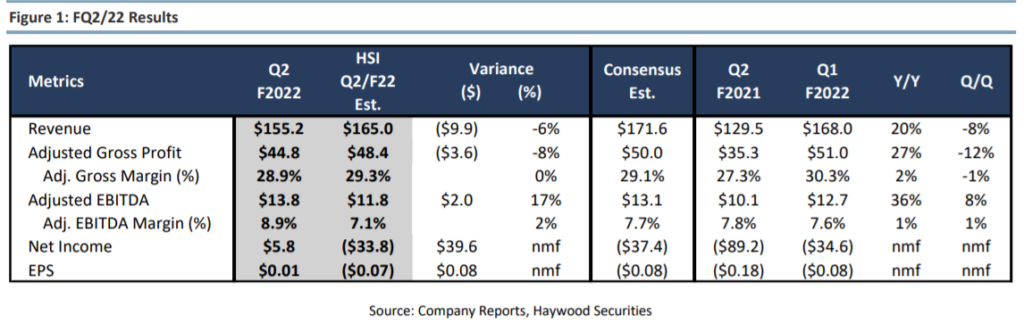

On January 10th, Tilray Inc (TSX: TLRY) reported their fiscal second-quarter financial results. The company saw net revenues of $155.15 million, an increase of 20% year over year. The company reported an adjusted EBITDA of $13.8 million and a net income of $95 million, driven by a reassessment of fair value derivative liabilities.

The companies revenues are made up of 38% cannabis, 44% distribution, 9% beverages, and 9% wellness, pnce again showcasing that Cannabis revenue is not the main driver of revenue for Tilray.

For the cannabis sector, gross margins were 23% or $13.52 million, while adjusted gross margins, which remove inventory impairments, came in at 43% or $25.52 million.

Tilray saw a number of analysts cut their 12-month price targets on Tilray from US$12.38 to US$9.79, which now represents a 35% upside to the current stock price. Tilray has 20 analysts covering the stock with 1 analyst having a strong buy rating, 2 have buys, 14 have hold ratings and 3 have sell ratings. Cowen and Company have the street-high price target of US$23 while GLJ Research currently has a US$0.82 price target.

In Haywood Capital Markets’ review, they cut their 12-month price target to $7.25 from $8.00 and reiterated their hold rating on Tilray. They say that the softer revenue was offset by “prudent” cost management.

For the results, Haywood expected total revenue to be $165 million, about $10 million higher than what was reported by Tilray, while adjusted EBITDA came in slightly higher than Haywood’s $11.8 million estimate.

Haywood recommends investors hold Tilray as it gives “optionality to longer-term U.S exposure.” They say that although Tilray’s Canadian market share has dropped from 16% to 12.8%, they still believe it’s something to be proud of. They add, “we remain cautious on the overall Canadian landscape which drives the majority of its revenue growth opportunity in the near-term.”

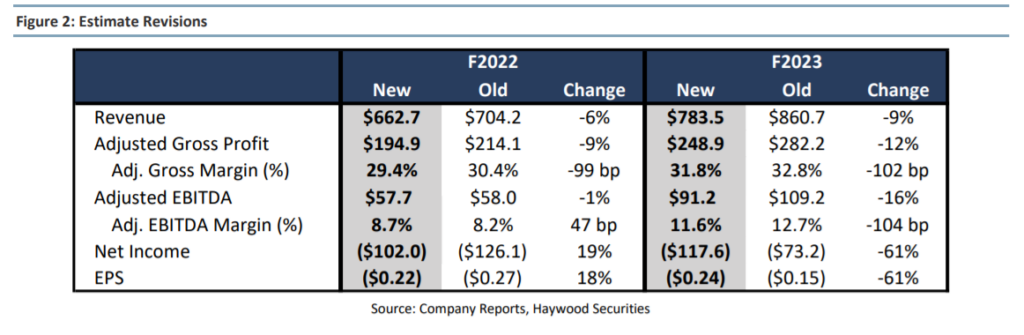

Below you can see Haywood’s updated fiscal full-year 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.