Master Growers, that is.

As news spread of Toronto’s native son Drake cutting a deal for a 60% interest in a Scarborough, ON cannabis production facility, a small army of cannabis marketing professionals (mostly self-appointed) universally acclaimed Drake and Canopy Growth’s (TSX: WEED) (NYSE: CGC) clever end run around the Canadian laws prohibiting celebrity endorsement of cannabis products. The Post’s Vanmala Subramaniam caught up with a representative sample of these one dimensional analysts who all called the deal “clever,” “very smart,” and hailed Drake as “a progressive avant-garde celebrity,” who is, “the right fit for a brand new industry.”

The 60% interest in More Life, that Drake bought with the rights to his likeness isn’t a carried interest. It’s (AHEM!) a joint venture. Drake is responsible for 60% of the operating costs incurred at the Scarborough facility, and indications are that – like the rest of Canopy – it burns more money than it brings in.

The 50,000 foot cultivation and processing facility hasn’t been mentioned in Canopy’s investor literature since June of 2018. Canopy has been cagey in its most recent two quarterly disclosures about which of their facilities is operating and which aren’t. Facility costs on dark facilities have contributed to a tiny company-wide gross margin and a gross margin on cannabis that is impossible to calculate. Whether the Scarborough facility is producing sellable bud or not, they appear to have just made 60% of its costs Drake’s problem, and it looks like a brilliant move.

The facility’s capacity, and its ability to live up to it almost isn’t relevant. If Drake is successful moving More Life product, Canopy will surely sell product from their other facilities to the JV at a wholesale price, then smack a Topszn Owl on it so it sells, and collect 40% of the retail take. It will be interesting to see if Drake takes us on a tour of More Life to give us a better look, because there is presently very little about it on the Canopy website.

The Drake deal isn’t likely to be replicated any time soon, because very few rappers have the money and pull that Drake does along with the desire to maintain an interest in the Canadian market.

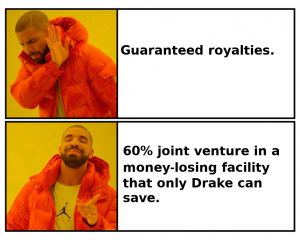

Wiz Khalifa’s deal with Supreme Cannabis Co. (TSXV:FIRE) saw holding company Khalifa Kush Enterprizes Canada (KKE) sell Supreme the rights to sell products under the KKE banner in Canada and internationally (but not in the US), for a one million dollar payment, 5.7 million shares of Supreme, and royalties on future sales. The minimum royalties due to Khalifa’s company over the life of the agreement are $6.3 million, so it’s a pretty good score for KKE, whether Supreme can move the products or not. Unlike Drake’s JV with Canopy, KKE incurs no costs for the royalty agreement.

The sole product currently available from KKE in Canada is a Jean Guy oil product. A 30 ml bottle retails for $102.75 in Ontario, but only $74.99 in BC.

Rather it seems that the marketing departments of Canadian producers are more focused on the name on the label rather than how much, and the quality of, product that actually goes out the door.

Information for this briefing was found via Sedar, The Supreme Cannabis Company, and Canopy Growth Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.