Last week, Topaz Energy Corp. (TSX: TPZ) had a series of positive developments. First, the company closed a $201.3 million bought deal financing. Then, the company rejigged their guidance for the fiscal year, indicating processing revenue is expected to climb to $57.2 million, while EBITDA is expected to hit between $158 – $160 million for the year.

This news prompted many analysts to increase their 12-month price target bringing the average up to $18.73, up from $18.07 from before the news release. Three analysts have strong buy ratings and 12 analysts have buy ratings. The street high goes to ATB Capital Markets with a $21 price target and the lowest sits at $16 from Veritas Investment.

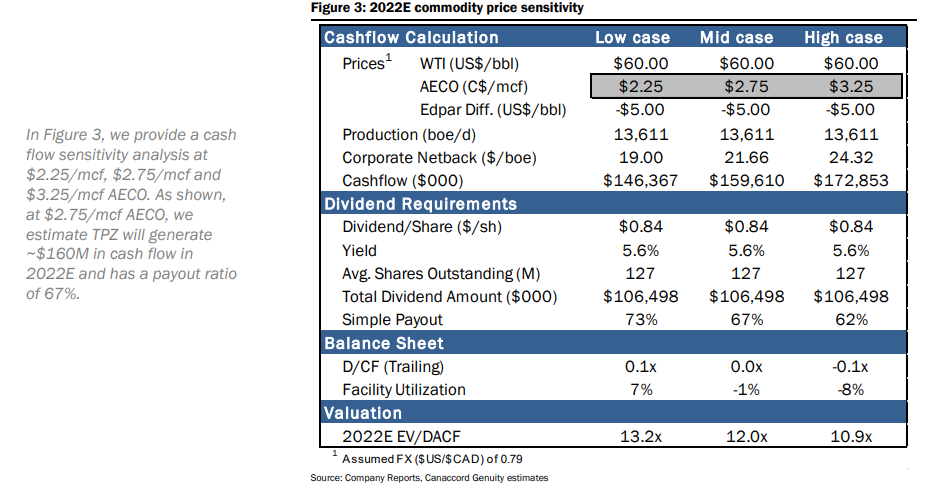

In Canaccord’s note they slightly increase their 12-month price target to C$19.00, up from C$18.50, and reiterate their buy rating on the company. Their analyst Anthony Petrucci says that these acquisitions “bolster go forward growth outlook.” He adds, “We believe Topaz is a compelling way to gain exposure to natural gas pricing, while its infrastructure assets provide enhanced stability relative to other royalty options.”

Topaz has recently announced two acquisitions which include 500,000 gross acres in NEBC Montney and roughly 200,000 gross acres in Clearwater which both include significant upside and are immediately accretive Petrucci says. These two acquisitions cost the company $347 million and were funded through a recently bought deal, existing cash on hand, and some debt.

Below you can see the 2022 updated cashflow calculations Canaccord provided.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.