On June 8th, Topaz Energy Corp. (TSX: TPZ) had a flurry of news releases. The first one announced that they closed their $201.3 million dollar bought deal which included the underwriters exercising their allotment. The second news release was around the company providing updated 2021 guidance saying that they expect 2021 processing revenue to come in at $57.3 million and have EBITDA of $158 – $160 million for the year.

This news prompted many analysts to increase their 12-month price target, bringing the average up to $18.73, up from $18.07 before the news release. Three analysts have strong buy ratings and 12 analysts have buy ratings. The street high goes to ATB Capital Markets with a $21 price target and the lowest sits at $16 from Veritas Investment.

Off the back of this news, BMO Capital Markets resumed coverage on the name with an updated price target of $18, which was $17 prior, and issued an outperform rating. Their analyst Ray Kwan says, “Topaz Energy provides investors with a unique royalty/ infrastructure structure that is a low-risk play on the success and growth of Tourmaline.”

Kwan believes that the company is making good acquisitions recently. With the most recent one being a gross overriding royalty interest on 535,000 acres in NEBC and a 10% ownership in Tourmaline’s Gundy which produces 400mmcf/d for a total of $245 million. This comes after their announcement that they acquired 192,000 acres of Marten Hills Clearwater from Cenovus Energy for $102 million.

He says that these acquisitions increase Topaz’s Montney acreage to 503,000 or 134%, and Clearwater royalty lands to 366,800, or an 83% increase. It gives the company a CAGR of 15% on their royalty production and 90% CAGR for the Clearwater acquisition over the next 2 years.

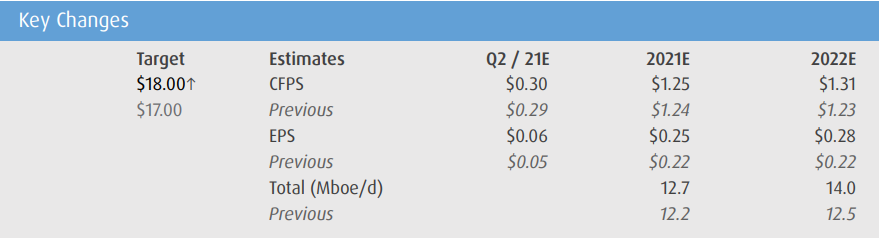

Below you can see BMO’s updated estimates for 2021 and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.