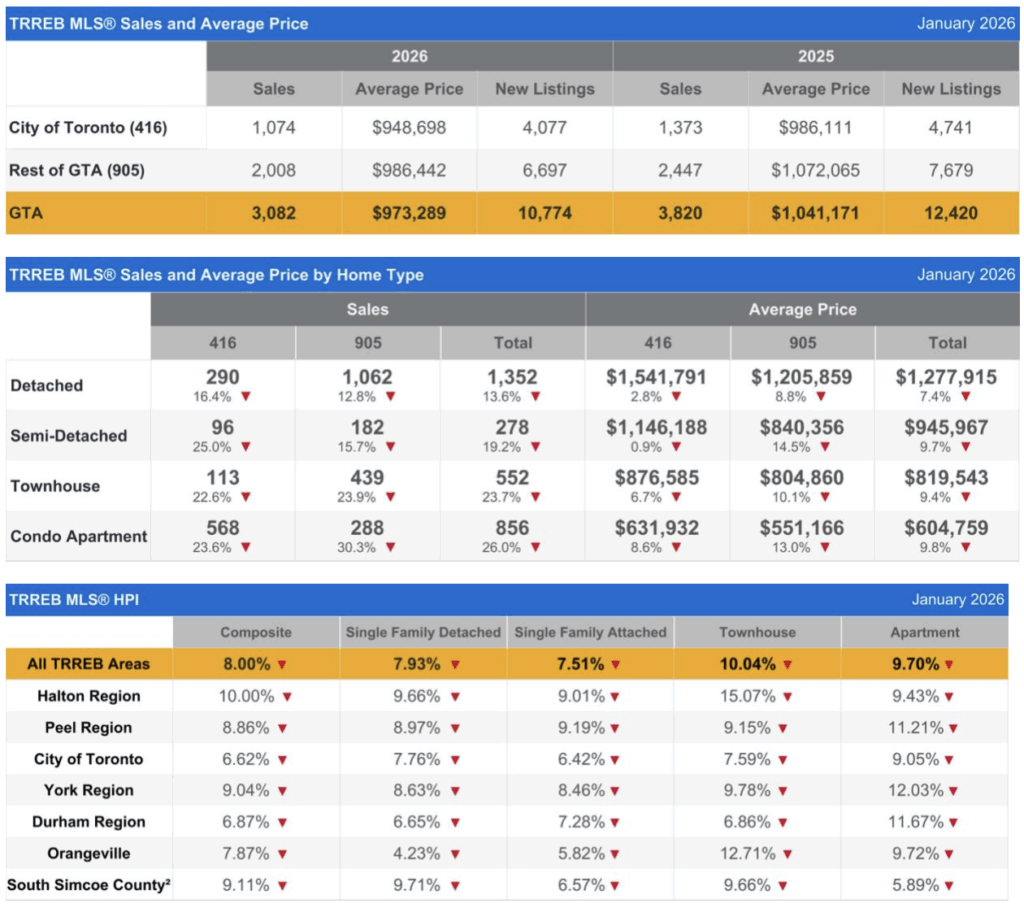

Greater Toronto Area home prices fell to $973,289 in January, marking a 6.5% decline from the same month last year as buyers gained negotiating power in a market flooded with inventory, the Toronto Regional Real Estate Board reported Wednesday.

The figure sits below the industry group’s forecast range of $1 million to $1.03 million for the full year 2026. TRREB released its annual market outlook alongside January statistics showing the region’s housing market continues to grapple with cautious consumer sentiment despite improved affordability.

Home sales dropped 19.3% year over year to 3,082 transactions in January, while new listings fell 13.3% to 10,774 properties. The MLS Home Price Index composite benchmark declined 8% compared to January 2025.

TRREB forecasts between 60,000 and 70,000 home sales across the region in 2026, with activity in the first half of the year expected to mirror 2025 levels as households remain hesitant to commit to long-term mortgages.

“The housing market reflects the tension many households are feeling as we look ahead to 2026,” TRREB President Daniel Steinfeld said in a statement. “Affordability has improved, but uncertainty continues to weigh on long term decisions like homeownership.”

The board’s outlook suggests average prices will remain below year-ago levels through the first half of 2026 before stabilizing if buyers return to the market and inventory levels tighten in the second half.

Elevated supply across most market segments continues to give buyers substantial negotiating power, particularly in the condominium apartment sector. On a seasonally adjusted basis, January sales fell month over month from December 2025, while new listings rose slightly.

“With the cost of borrowing flattening out, affordability gains in 2026 will largely be seen on the pricing front, as buyers continue to benefit from negotiating power,” TRREB Chief Information Officer Jason Mercer said. “A boost in consumer confidence could see buyers move off the sidelines later this year, which could provide support for home prices as market conditions tighten up.”

An Ipsos survey commissioned by TRREB found homebuying intentions for 2026 declined five percentage points to 22% compared to 2025, highlighting persistent challenges with consumer confidence despite better affordability conditions.

The survey showed 45% of intending homebuyers will be first-time purchasers, underscoring demand for entry-level properties. However, renter households face a gap of nearly $600 per month between affordable mortgage payments and the payments required to purchase their desired home type, which may keep many in the rental market longer than anticipated.

TRREB’s report also examined population growth impacts, traffic congestion, and policy challenges affecting housing delivery across the region, with recommendations aimed at addressing planning delays and development costs.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.