Home prices across the Greater Toronto Area were sent skyrocketing once again, as lack of supply created competition among potential homebuyers.

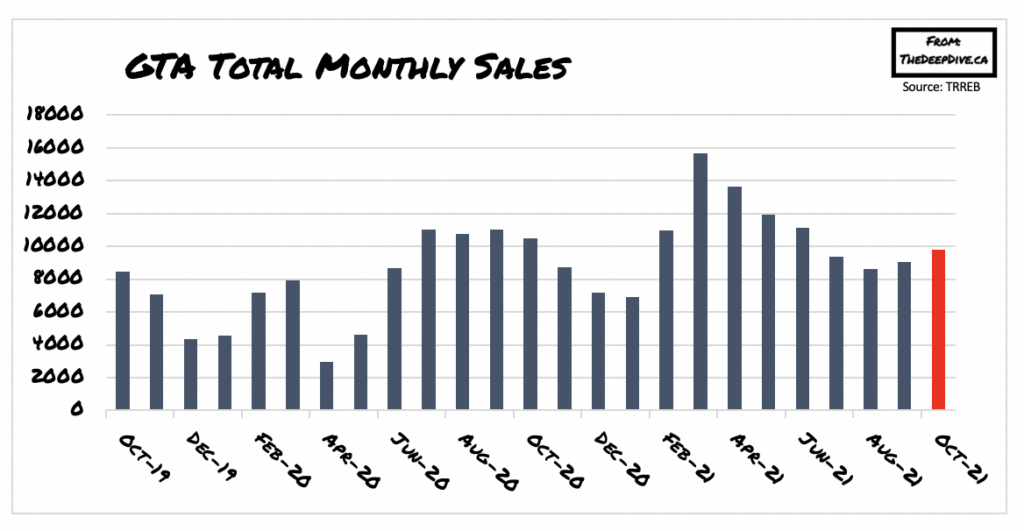

According to data published by the Toronto Regional Real Estate Board (TRREB) on Wednesday, a total of 9,783 properties traded hands in October, marking an 8% increase from the month before, but a 6.9% drop from October 2020, as a tighter inventory was unable to keep up with demand.

The number of new listings slumped 13% month-over-month, and compared to October of last year, inventory was down 34%. Market conditions remained tight across all home types last month, with prices sustaining significant double-digit growth, once again. “The only sustainable way to address housing affordability in the GTA is to deal with the persistent mismatch between demand and supply. Demand isn’t going away. And that’s why all three levels of government need to focus on supply.” said TRREB president Kevin Crigger.

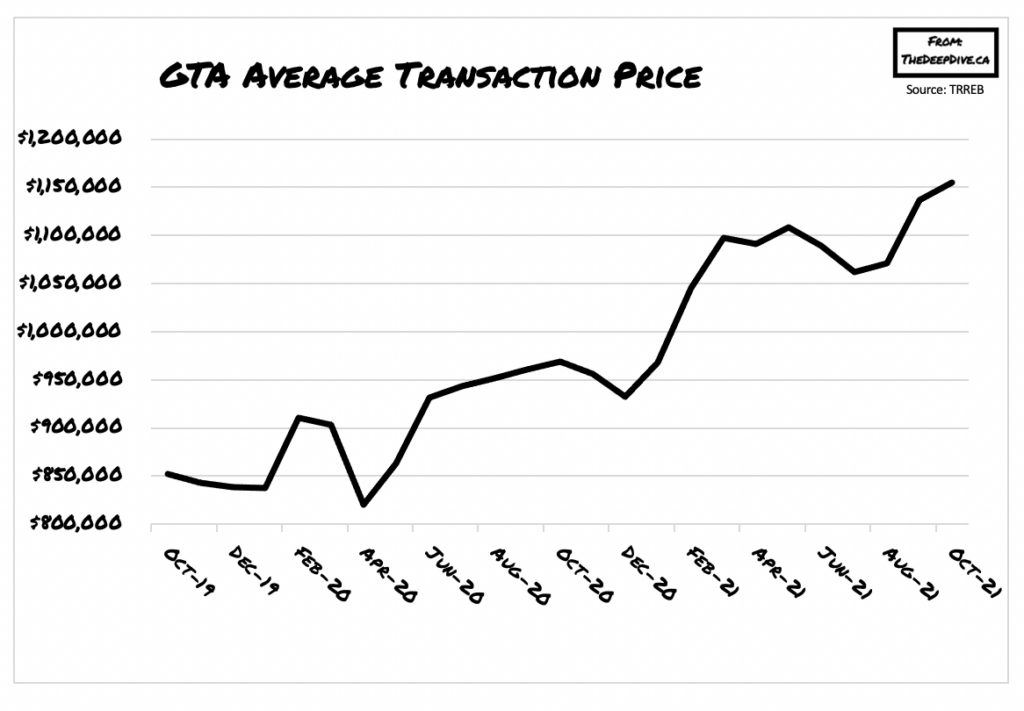

Indeed, the average selling price of a home in the GTA was up 19.3% from October 2020 to $1,155,345— a new record-high. The majority of the price increase was led by the low-rise segment of the market, with the condo market also reporting double-digit price gains. “The tight market conditions across all market segments and areas of the GTA is testament to the broadening scope of economic recovery in the region and household confidence that this recovery will continue,” added TRREB chief market analyst Jason Mercer.

However, with the Bank of Canada expected to pull back its monetary support and hike interest rates as early as 2022, real estate activity may finally cool from its historically-elevated levels.

Information for this briefing was found via TRREB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.