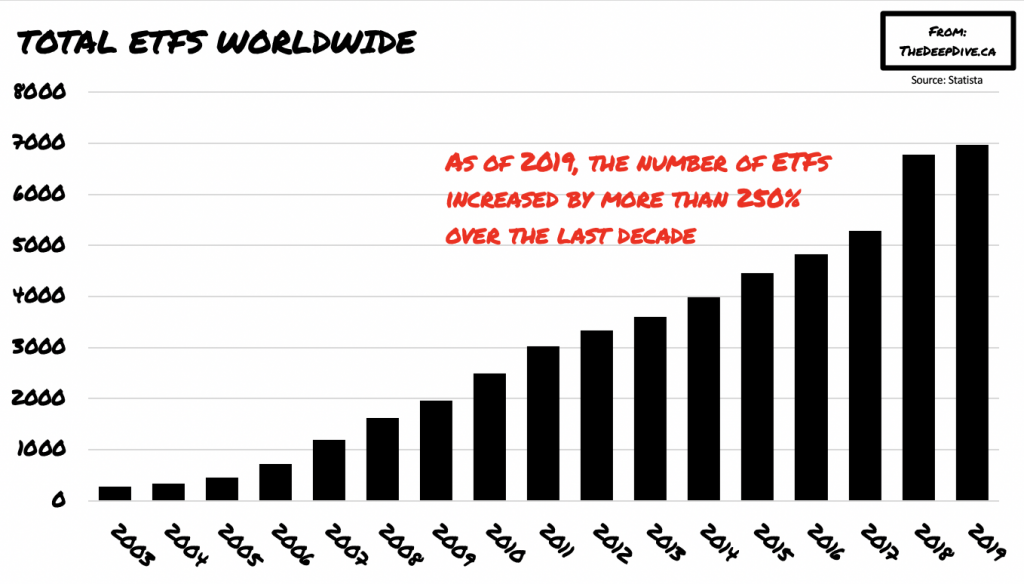

There are many widely-known benefits of owning ETFs because they allow investors to gain exposure to the stock market while encompassing diversification and risk mitigation. As such, they have been the go-to for both issuers and buyers. Now however, amid all the stock market chaos brought on by the pandemic, a startling realization comes to light.

It appears that ETFs have become so popular, that they are now significantly surpassing the number of publicly traded companies as a result. Three years ago the Wall Street Journal reported their observation on the dwindling numbers of public companies, where in 1996 there were a total of 7,322 listed on US stock exchanges, but come 2017, there only 3,671 remaining.

As it becomes increasingly easier to gain access to private-equity, growth, and venture capital, many companies have been foregoing initial public offerings as a method of liquidity and growth funding. Now, there are less than 4,000 public companies remaining; however, the number of ETFs has grown to nearly 7,000 across the world. And, as the popularity of ETFs continues to rise, a liquidity crisis could potentially unfold.

According to Michael Burry, who, over a year ago, noted that passive investments including ETFs artificially inflate bond and stock prices – much like collateralized debt obligations affected subprime mortgages during the Financial Crisis. Burry likened the developing ETF phenomenon to a bubble, where the longer it continues, the more severe its downfall will be.

Information for this briefing was found via the Wall Street Journal. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.