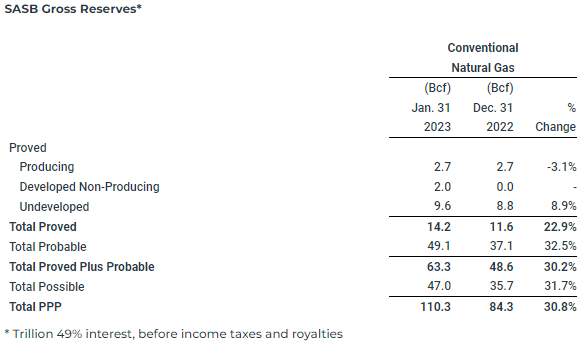

A revised reserve report was released by Trillion Energy (CSE: TCF) this morning, with the company demonstrating significant growth in their gas reserves for their flagship SASB gas field in Turkey.

Trillion has seen its proved and probable (2P) gas reserves climb to 63.3 BCF, a 30% improvement over the 48.6 BCF reported as of the end of 2022. The net present value (NPV10%) of those reserves meanwhile improved 29% to US$548 million, representing US$1.43 per share.

The net present value (NPV10%) of proved, probable, and possible reserves meanwhile improved 28%, climbing from US$725 million to US$925 million, or roughly US$2.41 a share. The figures are based on Trillion’s 49% ownership interest in the SASB gas field.

“We are very pleased that our initial 2023 exploration and development program efforts have already begun to pay off with a substantial increases in reserves already this year. We expect that our continued drilling program will continue to grow our reserves throughout the year, further enhancing value to shareholders,” commented Arthur Halleran, CEO of Trillion.

At the same time, the firm this morning reported that it will be raising $15.0 million via a bought deal led by Eight Capital. Funds are to be raised via the sale of convertible debentures, with each debenture priced at $1,000 per each. The debentures are to bear interest at 12% per annum, payable semi-annually, and are convertible at $0.60 per share. Each debenture is to contain 1,667 common share purchase warrants, with a conversion price of $0.50 per share, and an expiry of June 29, 2025.

The financing is slated to close April 20, 2023.

Trillion Energy last traded at $0.38 on the CSE.

FULL DISCLOSURE: Trillion Energy is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Trillion Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.