Although much of Europe has been lifting restrictions and reopening economies in hopes of spurring the labour slump, it appears that the road to recovery is going to be much longer than anticipated. According to the latest Eurostat data that was released on Tuesday, the unemployment rate in the euro area rose by 0.2% to 7.9% in July.

The data paints a grim picture of nearly 15.2 million unemployed people, which increased by 344,000 in July compared to the previous month. In just the European Union alone, over 336,000 more people lost their jobs during that time frame, bringing the cumulative total to 12.8 million, or an unemployment rate of 7.2%. Moreover, it also appears that the younger generation is being disproportionately affected by the downturn in the labour market, as unemployment rate among those under 25 increased from 16.9% to 17% in the EU.

The continued increase in unemployment numbers among European countries suggests that restriction-lifting measures have had little to no avail on speeding up the labour market recovery. Since the onset of the pandemic, many European countries have been subject to to the sharpest economic contractions on record. In the second quarter alone, the EU economy decreased by 11.9%, while the entirety of eurozone shrank by 12.1%.

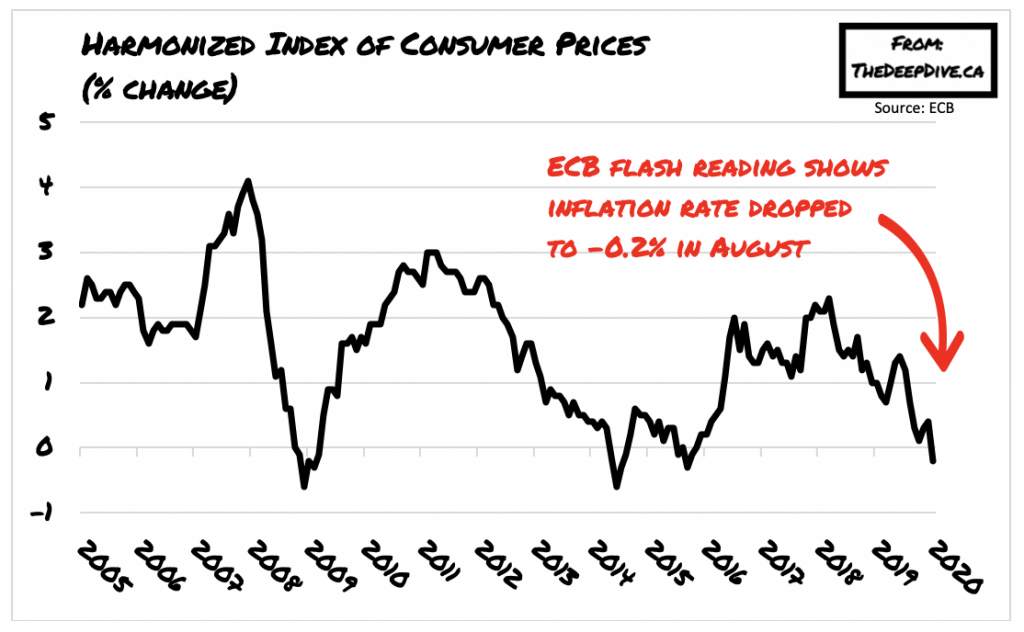

In addition to the grim labour market results, Europe faces a slew of other problems as well. According to a flash reading reported by the European Central Bank (ECB), annual headline inflation in the eurozone is expected to dip into negative territory and decline by a further 6% in August after sitting at 4% during the month of July. With respect to core inflation, which does not take volatile items such as fuel prices into consideration, declined from 1.2% in July to a mere 0.4% in August– the lowest level on record.

As a result, many analysts are now anticipating that the ECB will have to reduce its forecasts even lower, and even revisit its stimulus policy in the near future. According to Pictet Wealth Management strategist Frederik Ducrozet, the ECB may even have to increase the stimulus for the Pandemic Emergency Purchase Program by at least $599 billion come December before fiscal policy will be effective enough in guiding the economy of the current slump.

Information for this briefing was found via Eurostat and the ECB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.