Yesterday, Trulieve Cannabis (CSE: TRUL) announced their fourth quarter and year-end financial for 2020. The company reported record revenues, beating both management’s guidance and the slightly higher analyst estimates. Trulieve reported $521.5 million in revenue for the full year and $168.4 million for the fourth quarter. The company reported a net income of $63 million for the full year, while adjusted EBITDA came in at $251 for the same period.

Trulieve currently has 15 analysts covering the company with a weighted 12-month price target of C$82.58. This is up from the average before the results, which was C$61.33. Four analysts have strong buys while the other eleven have buy ratings. Street high comes from Stifel-GMP with a C$107 price target, while PI Financial has the lowest at C$50.

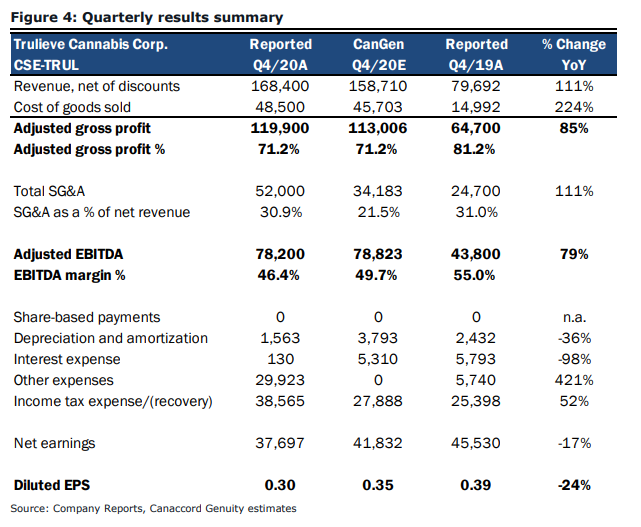

Canaccord Genuity increased its 12-month price target to C$87 from C$75 and reiterated its speculative buy rating off the back of this quarter. Derek Dley, Canaccord’s analyst, headlines, “A solid print, complete with healthy 2021 guidance.” He says the upgrade came from the better than expected earnings and upgraded 2021 guidance which, “leaves plenty of room for Trulieve to surpass expectations, similar to what we witnessed in 2020.”

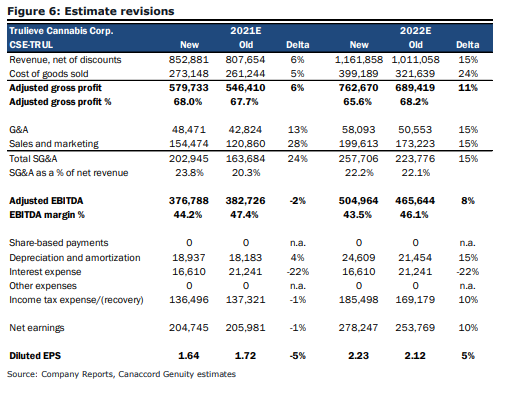

For earnings as compared to Canaccord’s estimates, you can see the breakdown below. It looks like Trulieve beat on every line item except the EBITDA margin.

Dley expects Trulieve to “step on the gas” with its initiatives within its core states of Florida, Pennsylvania, and Massachusetts, outside the already announced expected 39 new dispensaries in Florida. Dley writes, “Trulieve’s store network remains highly productive with fully ramped stores generating between $10-11 million in annual revenue.” Because of this, Dley expects CAPEX to remain high as they ramp up these initiatives but he believes that Trulieve won’t run into any major cash problems, given their $146 million cash position.

Onto guidance, Dley writes that Trulives 2021 guidance of $815-850 million in revenue and $355-375 million in EBITDA represents growth of 60% and 45% year over year respectively. It also indicates that EBITDA margins will stay in the mid 40’s, “which remains the industry standard for 2021.”

Below you can see Canaccord’s upgraded estimates for 2021 and 2022

Onto Cantor Fitzgerald, one of our favourite investment banks/analysts Pablo Zuanic, upgraded Trulieve from a $70 price target to an $84 price target. This was after he increased the price target from $63 to $70 on Monday. He says that the main reason behind the large price target increase is due to their new formula which adds weight to franchise strength.

He mainly reiterates what Canaccord had to say about Trulieve’s earnings but notably, he has only increased their revenue/EBITDA slightly above what management is guiding as he takes a more cautious outlook, “Some companies (not all) under promise and over deliver.” He also writes that he has trimmed both Pennslyvania and Massachusetts assumptions as they factor in a later rollout date for cultivation capacity.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.