On November 15th, Trulieve Cannabis (CSE: TRUL) reported its third quarter results, announcing record revenues of $224.1 million, up a marginal 4.2% sequentially but up 64% year over year. The company saw gross profits grow to $153.9 million or a gross margin of 68.7%. Net income for the quarter was $18.6 million, representing their 15th consecutive profitable quarter and a positive cash flow from operations of $75.1 million. Adjusted EBITDA came in at $98 million and the company held cash of $213.6 million as of September 30th.

Trulieve Cannabis currently has 17 analysts covering the stock with an average 12-month price target of C$84.53, or a 120% upside from the current stock price. Out of the 17 analysts, 5 have strong buy ratings and 12 have buy ratings. The street high sits at C$135 from Stifel-GMP while the lowest comes in at C$54.

In Canaccord’s third quarter review, they reiterate their buy rating and C$97 12-month price target, saying, “Another quarter of industry-leading profitability with Harvest integration underway.”

For the quarterly results, Trulieve came in above their estimates as Canaccord expected revenues to be $219.84 million, and a gross profit of $149.29 million or a gross margin of 67.9%. They also beat Canaccord’s EBITDA estimates with Canaccord expecting adjusted EBITDA to be $87.97 million and a 40% margin versus the reported $98.03 million or 43.7% margin.

Canaccord attributes the beat to Trulieve’s retail expansion during the quarter. Trulieve opened 7 stores this quarter, bringing the total to 155 stores.

Canaccord notes that Trulieve’s rebranding of Harvest locations in Florida has potentially helped increase these stores’ revenues by 35% on an annualized basis. Trulieve expects to rebrand Harvest’s 20 other locations outside Florida during 2022.

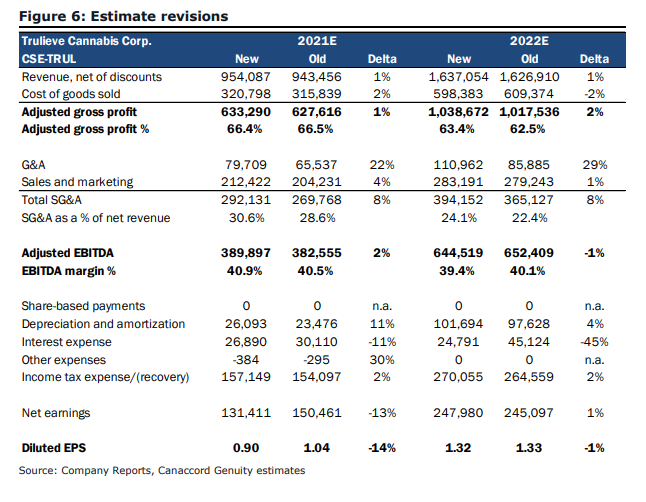

Below you can see Canaccord’s full-year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.