Trulieve Cannabis (CSE: TRUL) reported their second-quarter financial results this week, boasting a record U$120.8 million in revenue, up 26% quarter to quarter, and above Refinitiv’s estimate of U$106.1 million. Adjusted EBITDA came in at U$60.5 million, and they had a free cash flow of U$39.6 million. Gross margins came in at ~77%. Trulieve announced updated full-year revenue and adjusted EBITDA guidance with the company anticipating U$465 – $485 million in revenue and U$205 – $225 million in adjusted EBITDA.

Five analysts upgraded their 12-month price target while reiterating their buy rating.

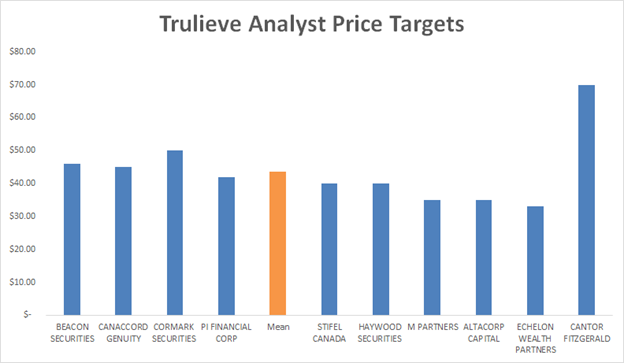

- Canaccord Genuity raises price target to C$45 from C$38

- Haywood Capital Markets raises target price to C$40 from C$28

- Cormark Securities raises price target to C$50 from C$45

- PI Financial raises price target to C$42 from C$28

- Stifel GMP raises price target to C$40 from C$35

Eleven analysts cover Trulieve. One analyst has a strong buy rating while the other ten have buy ratings. The current 12-month mean price target is C$40.11 or a 34.15% upside, Pablo Zuanic from Cantor Fitzgerald has a C$70 price target and a buy rating on the stock. In contrast, the lowest price target comes from Andrew Semple of Echelon Wealth Partners with a C$33 price target and a buy rating.

PI Financial’s analyst Jason Zandberg reiterated his buy rating while increasing his price target to C$42, saying that Trulieve beat both the revenue and EBITDA estimates of U$100.8 million and U$44 million respectively. Zandberg notes that Trulieve gained market share in the second quarter, their THC market share is now at 52% compared to 50% in the first quarter, CBD market share almost doubled to 43% from 26% last quarter.

Zandberg also notes that the Florida market has picked up massively during COVID-19, increasing by 74% and 113% for oil sales and smokable flower sales compared to the first week of January. Notably, he states, “TRUL generates more cash from ops than any other cannabis company, but this quarter was remarkable.” In the first six months of this year, Trulieve generated $58.8m, which means they can generate capital instead of going to the capital markets to obtain cash for expansions.

PI Financial has updated their full-year 2020 and 2021 estimates. Their revenue estimates are now U$487.5 million and U$599.4 million, previously U$415.8 million, and U$530.8 million, while the updated EBITDA estimates are U$217.2 million and U$260.3 million, previously U$179.2 million and U$230.3 million. The analyst notes that even though Trulieve increased their guidance, he believes it to be still too low.

Andrew Partheniou of Stifel GMP says, “TRUL flexing profit muscle in 7th Q2 EBITDA beat”. Trulieve easily beat every estimate that Stifel had, including revenue being U$117 million, adjusted EBITDA U$50.4 million, and gross margins estimated at 68%.

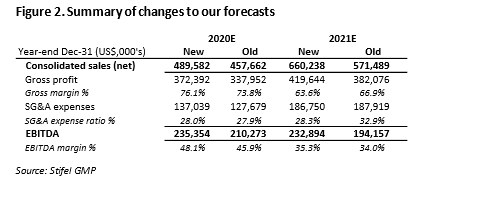

Partheniou looks at the guidance raise in a different light saying, “Updated guidance implies H2/20 margin compression.” He says that the new guidance incorporated a 10% EBITDA margin decline in the second half of 2020. Even with that, Andrew says, “we believe Q2/20’s outperformance matched with historical conservatism on the part of management could offset future headwinds.” They raised their full-year 2020 and 2021 revenue estimates to U$489.6 million and U$660.2 million, respectively.

As management suggested oil inventory increasing from 6 months to 7 months quarter over quarter, Andrew says that edibles could help with the high inventory concerns, meaning that even after decreasing their inventory by about 10 million, the inventory remains elevated unless edibles are introduced in Florida. If they are, Andrew says, “TRUL should be well-positioned to capture that opportunity without affecting the availability of its other extract SKUs.”

Matt Bottomley of Canaccord Genuity raised their 12-month price target on Trulieve from C$38 to C$45 while reiterating his speculative buy rating, citing a better-than-expected second quarter and the updated guidance as to the main driving forces behind the upgrade.

Bottomley states, “Given Trulieve’s healthy financial position, access to capital, and best-in-class profitability metrics, we believe the stock is attractive for investors looking for cannabis exposure to a high-quality operator with a proven ability to generate strong EBITDA and profitability.”

Like the last two analysts, Trulieve blew away Canaccord estimates, with revenue forecasted for U$106 million and EBITDA of U$50 million. The analyst says that Trulieve has doubled its weekly sales of concentrate and dry flower in the last seven months thanks to same-store sales increasing 30% quarter over quarter, and customers visiting a Trulieve store 2.7x per month while having an average basket of $125.

Just like every other analyst, Bottomley updated his full-year 2020 and 2021 estimates. He forecasts revenue to come in at U$473.8 million and U$562.3 million, respectively, and earnings per share between $0.74 and $1.10, respectively.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.