Trulieve Cannabis (CSE: TRUL) has seen a plethora of insider transactions filed with Sedi over the last several days, with most of the changes logged occurring outside of the regulatory time frame for reporting. While most changes logged related to super voting shares held be management, with most classifying them as occurring under code 97, stated as “other” there were a few notable transactions.

Lets start with the purchases. First and foremost, chief financial officer Alexander D’Amico has purchased shares on three separate transactions this week, collectively acquiring 1,500 subordinate voting shares of the issuer on the public markets at a cost of $31,900. The purchases are a strong sign for the company, given that they come from the CFO himself.

Next, is a series of super voting shares that have exchanged hands. In the case of director Thad Beshears, it appears that he moved 75,000 super shares from direct ownership to a family trust, while Jason Pernell, CIO of Trulieve, and directors Michael O’Donnell, Suber May and George Hackney did some account reorganization as well while acquiring more super voting shares.

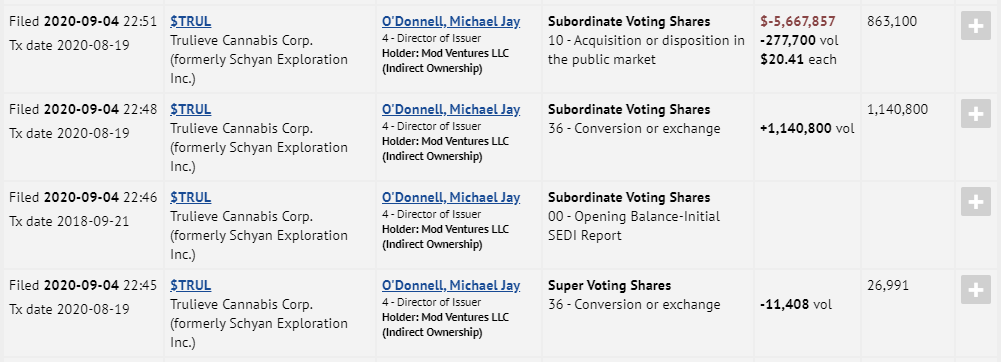

The most interesting transaction that occurred by far however was conducted by Michael O’Donnell, whom converted 11,408 super voting shares of Trulieve to 1,140,800 common shares of the issuer on August 19, which was filed today. He then subsequently sold 277,700 subordinate shares of the issuer at a price of $20.41 per share, generating gross proceeds of $5,667,857 in the process. This transaction also occurred on August 19, but was only filed this morning.

Trulieve Cannabis last traded at $25.35 on the CSE.

Information for this briefing was found via Sedar and Trulieve Cannabis Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.