Trulieve Cannabis (CSE: TRUL) reported its second quarter financial results on Wednesday. The company announced revenues came in flat sequentially to $320.3 million. They note that retail revenues grew 3% to $298.6 million while they saw a 22% sequential decline in wholesale, licensing, and other revenues to $21.7 million.

The company’s gross profits came in at $182.2 million, up from $178.2 million last quarter, while margins saw a 1% increase to 57%. The firm posted a net loss of $22.5 million or earnings per share of ($0.12).

Trulieve also lowered its full-year guidance for revenue and adjusted EBITDA. They now expect revenues to come in in the range of $1.25 to $1.3 billion, while adjusted EBITDA is expected to be in the range of $415 and $450 million.

A number of analysts lowered their price targets on Trulieve, bringing the average down from C$58.25 to C$45.17, representing an upside of 172%. There are 17 analysts covering the stock, with five having strong buy ratings and the other twelve having buy ratings. The street high price target sits at C$65, which represents an upside of almost 300%.

In Stifel-GMP’s note on the results, they reiterate their buy rating but cut their 12-month price target from C$40.00 to C$36.50, saying the revision comes after Trulieve lowered their guidance, forcing them to revise their estimates downwards. Though, they do add that at Trulieve’s current valuation of 6x 2023 EV/EBITDA, “we believe investors are getting this for free. BUY.”

Stifel’s results say they were mixed, as the company beat on profitability but lowered its guidance, “amid macroeconomic uncertainty and the potential for industry softness across FL, PA, and AZ.” As a result, they expect Trulieve will start to slow down its production expansion.

Though they note that management offered some encouraging consumer trends data supported by other management teams, which “indicate resilient purchasing behaviors with cannabis being a sticky staple.”

Trulieve lowered guidance roughly 5% below Stifel’s estimates and says that management made this call due to “no dollar growth from YTD levels in H2/22 at the midpoint and price compression offsetting vertical integration benefits.”

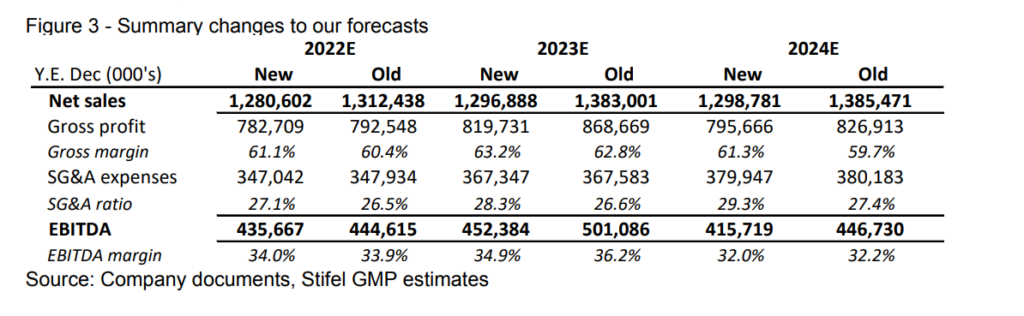

Below you can see Stifel-GMP’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.