The US is moving to increase its tariff rate on Chinese goods, with President Donald Trump announcing an additional 10% charge on imports from China beginning March 4. This levy will come on top of the 10% tariff already in effect from earlier in the month, making the overall penalty on Chinese goods 20%.

Trump cites China’s role in the fentanyl trade as a primary factor. “Drugs are still pouring into our Country,” the president said on social media.

BREAKING: President Trump says an additional 10% tariff on Chinese goods will go live beginning March 4th.

— The Kobeissi Letter (@KobeissiLetter) February 27, 2025

This is ON TOP of the 10% tariff on Chinese goods that went live earlier this month. pic.twitter.com/S8u88Aupi1

China’s Ministry of Foreign Affairs has expressed “dissatisfaction and resolute opposition” to the planned measures. Lin Jian, a spokesperson, called the fentanyl issue an “excuse” for ramping up tariffs, noting that China has “one of the strictest” drug control policies in the world.

“Pressure, coercion, and threats are not the correct way to deal with China,” he added.

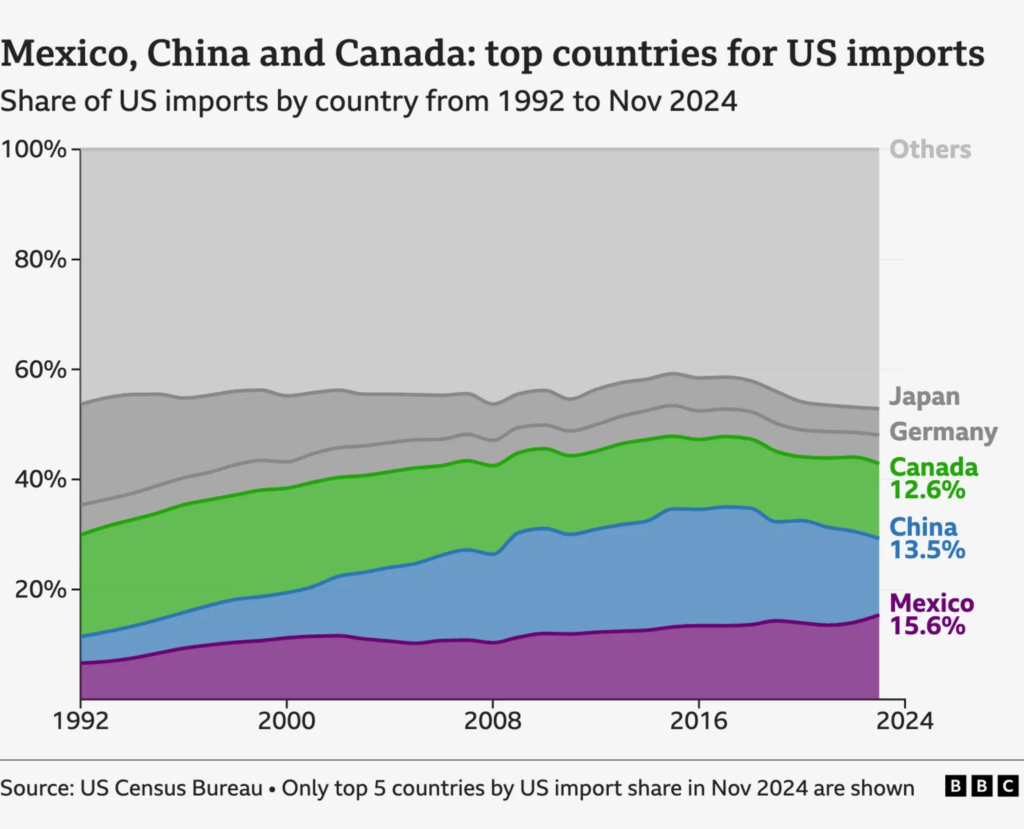

Washington’s tough stance is also set to affect two other major US trading partners, Mexico and Canada, which together with China account for more than 40% of total imports into the US. Trump reiterated his plan to impose a 25% tariff on Mexico and Canada if the two governments fail to show progress in controlling the northward flow of drugs.

Although both countries have tried to stave off these taxes—Mexico has extradited cartel leaders and Canada continues to negotiate heightened border security—Trump insists stronger enforcement is needed.

The economic impact of these measures is potentially far-reaching. Tariff-laden imports from China could drive up costs on a range of products, including consumer electronics from companies such as Apple.

Before these latest moves on China, much of the attention was on Trump’s escalating standoff with Canada and Mexico. Prime Minister Justin Trudeau vowed an “extremely strong response” if the US moves forward with the new 25% measure, while Mexican President Claudia Sheinbaum said she hopes to “reach an agreement” that can prevent economic damage on both sides of the border.

Information for this briefing was found via BBC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.