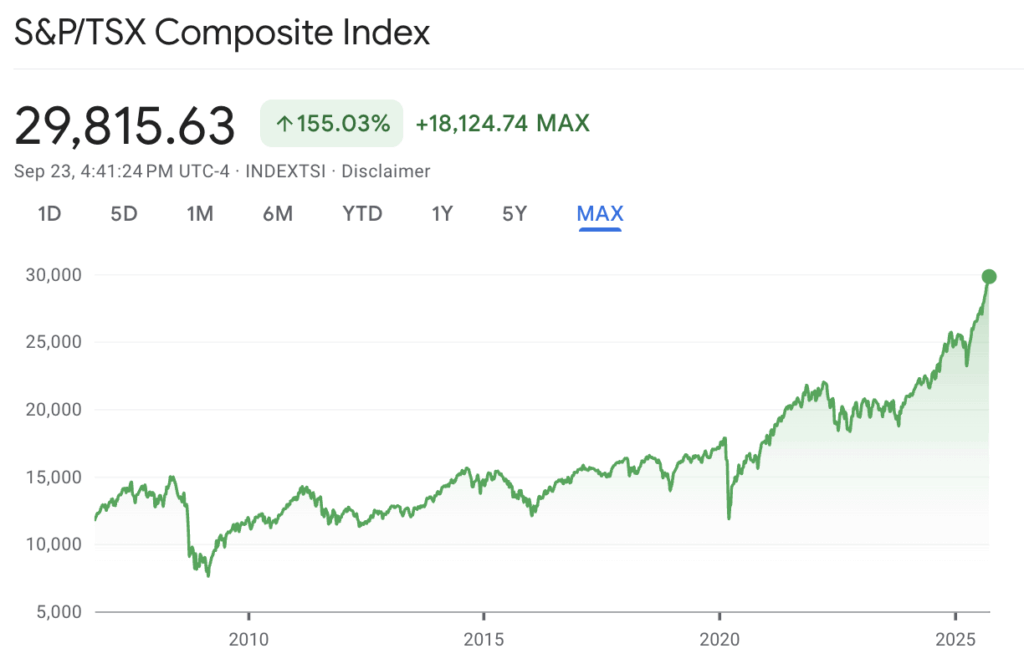

Canada’s main stock index broke through 30,000 points for the first time in its history on Tuesday, capping a remarkable recovery that has seen the S&P/TSX Composite Index climb 35% since hitting a low point in April.

The achievement is a significant milestone for Canadian equities, which have posted gains of 24.52% over the past year and outpaced the S&P 500 by eight percentage points in 2025 amid global economic uncertainty.

“Headlines and rhetoric just scared everybody, and they forgot how resilient Canadian companies are,” said Brian Belski, chief investment strategist at BMO Capital Markets.

Banking stocks drove much of the rally, with the country’s major financial institutions posting collective gains averaging 24% this year despite increasing provisions for loan losses. Toronto-Dominion Bank led the sector with gains approaching 43%, recovering strongly from compliance issues that weighed on shares last year.

Where is my TSX 30k hat?

— Canadian Banks Only (@cadbanksonly) September 23, 2025

Hello, sentiment shift: The TSX just hit 30,000

"[banks] have gained 24 per cent this year, on average, even as they set aside more money to cover bad loans and executives continue to address the uncertain economic climate."https://t.co/StjvKvo2iy

The technology sector also contributed meaningfully to the index’s performance. E-commerce giant Shopify advanced 42% this year and at one point challenged Royal Bank of Canada‘s position as the nation’s most valuable public company by market capitalization. Meanwhile, electronics manufacturer Celestica surged 165% as investors recognized its strategic role in artificial intelligence infrastructure development.

Retail companies delivered particularly strong results, with discount chain Dollarama climbing 33% while upscale fashion retailer Aritzia jumped 67% following a quarterly report showing 33% revenue growth.

Investor expectations of continued monetary easing supported the index’s strong performance, with analysts expecting Canada’s central bank to lower its key interest rate from the current 5.00% to 2.75% by the third quarter of 2026.

However, economic challenges persist, as economists forecast Canada’s gross domestic product will shrink 0.8% in both the second and third quarters of 2025 due to trade disputes and tariff pressures.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.