Tweets and memes as court evidences, a peek behind the boardroom negotiations, and a tussle for power–Twitter’s (NYSE: TWTR) lawsuit filed on Tuesday against Tesla CEO Elon Musk is everything we expected it to be and more.

The tech giant followed through with its previously announced plan to take legal action against the “sophisticated” Musk after the latter reneged from his much-talked about proposed takeover.

“Having mounted a public spectacle to put Twitter in play, and having proposed and then signed a seller-friendly merger agreement, Musk apparently believes that he…is free to change his mind, trash the company, disrupt its operations, destroy stockholder value, and walk away,” the company said in its court filing.

The company claims that Musk believes the “consummation of the merger depends on the results of his fishing expedition and his ability to secure debt financing.” For Twitter, this is farthest from the stipulations of the agreement.

In Musk’s notice to Twitter on terminating the merger agreement, he cited three main grounds: purported breach of information-sharing and cooperation covenants, supposed “materially inaccurate representations” that could be considered to contribute to a material adverse effect, and purported failure to comply with the ordinary course covenant by terminating certain employees, slowing hiring, and failing to retain key personnel.

“These claims are pretexts and lack any merit,” the company answered in the suit.

After the suit was filed, Twitter shares rallied by as much as 8% on the day.

In a nutshell, Twitter made the first legal move in anticipation that Musk would take the pending fall of the acquisition talks to court. While in public, it seems that the social media firm has been hiding information from the Tesla chief–which the latter claims tantamount to a material breach of the agreement–Twitter laid out the material reasons why it’s actually Musk who breached the said merger agreement.

“He has purported to put the deal on “hold” pending satisfaction of imaginary conditions, breached his financing efforts obligations in the process, violated his obligations to treat requests for consent reasonably and to provide information about financing status, violated his non-disparagement obligation, misused confidential information, and otherwise failed to employ required efforts to consummate the acquisition,” the company added.

The Elon Musk context

The (hidden) rise to 9.6%

Twitter first made its case in understanding the context from where Musk is coming from before reaching his decision to buyout the firm.

First, the company said that Musk “had secretly accumulated a substantial position — about 5% of the company’s outstanding shares” on March 14, 2022.

“SEC regulations required that he disclose that position no later than March 24, 2022. Musk failed to disclose, and instead kept amassing Twitter stock with the market none the wiser,” the company explained.

Musk increased his Twitter stake to around 9.2% and only disclosed it on April 4, 2022, when he was already the firm’s largest stockholder to everyone’s surprise. The announcement also sent the shares rallying by as much as 27%. The company added that in just the few days between March 24 and April 4, over 112 million Twitter shares “traded in ignorance of Musk’s mounting ownership.”

The Tesla chief is currently being sued by a group of Twitter investors claiming he failed to disclose his ownership share in the firm, which ultimately helped him avoid paying an additional US$156 million.

Dillydallying with directorship

Twitter also discussed the short-lived directorship potential for Musk. The firm said that it seriously considered the businessman’s fitness to be invited to the company board, which led to an appointment offer which Musk accepted.

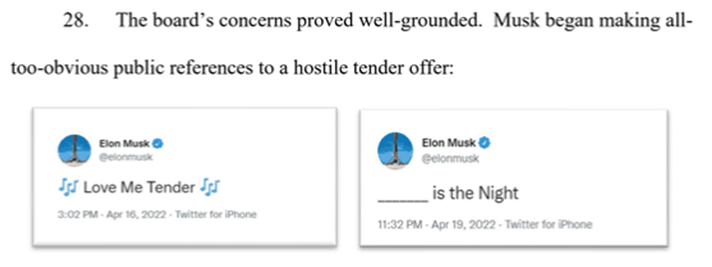

“Not a week later, Musk abruptly changed tack. On April 9, the day his appointment to the board was to become effective, Musk told Twitter he would not join the board. Instead, he would offer to buy the company,” the company explained.

Pretext of a hostile takeover

Given this context, Twitter then dived into the tumultuous buyout discussions with Musk. For the firm, the unsolicited offer came with a threat: “My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder,” said Musk.

“Faced with Musk’s rapid accumulation of Twitter stock and take-it-or- leave-it offer, and concerned that he might launch a hostile tender offer without notice, the board adopted a customary shareholder rights plan to protect its stockholders from ‘coercive or otherwise unfair takeover tactics,'” explained the company. This plan, in effect, prevents anyone from making a hostile takeover through open market accumulation.

Despite this, the company said its chairman, Bret Taylor, engaged with Musk and his “best and final” offer. The firm added that the equity commitments the buyer was able to secure gave confidence in Musk’s capacity to close the deal, with him being adamant about his offer borderlined a desire to unilaterally complete the merger.

“Musk’s counsel sent over a draft agreement, reiterated that Musk’s offer was not contingent on any due diligence, and underscored that the form of the proposed agreement was ‘intended to make this easy on all to get to a deal asap’,” the company added.

“Seller friendly agreement”

What Twitter negotiated

In his pursuit to immediately close the buyout, Musk promised a “seller friendly agreement.” But Twitter said it did its due diligence to its shareholders and “secured other key concessions” to make it even more friendly.

Contrasting Musk’s initial draft of the merger agreement that stipulated any “hiring and firing of an employee at the level of vice president or above” without Musk’s approval is tantamount to violation of the ordinary course covenant. Twitter negotiated successfully to strike that provision out–making the company in charge of employment at all levels without the need for Musk’s approval.

The company also further defined what can be excluded from “Company Material Adverse Effect” coming from the initial draft. The final definition excluded matters relating to “Musk’s identity or communications, ‘performance’ of the agreement, and any matter already disclosed by Twitter in its SEC filings.”

Also negotiated to be added in the agreement is Twitter’s “robust right to demand specific performance of the agreement’s terms,” essentially compelling Musk to close the deal. Contrary to what Musk is claiming publicly, the firm said that in the agreement itself that there were “no financing or diligence conditions” to close the deal.

“Twitter had been buffeted by Musk’s reversals before. For the benefit of stockholders and employees, the board needed assurance that this agreement would stick. It received that assurance in the terms it was able to negotiate,” the company said.

However, one item that dragged on is Twitter’s desire to keep its employee retention program. After multiple attempts to negotiate this with Musk, the latter’s counsel stated that “Elon is not supportive of this program and has declined to grant consent for it,” adding later that he “doesn’t believe a retention program is warranted in the current environment.”

Closing the deal, “hell or high water”

For his part, Musk’s task is making sure that the financing needed for the deal is secured and sufficient. Baked in the agreement is what Twitter calls his “hell-or-high-water” obligation to close on their financing commitments for the transaction.

Musk has agreed to “take, or cause to be taken, all actions and… do, or cause to be done, all things necessary, proper or advisable to arrange, obtain and consummate the financing at or prior to the closing on the terms,” adding a specific stipulation to his obligation in securing equity financing.

The two parties inked the merger agreement on April 25, 2022. Under the agreement, Musk’s subsidiary firm will merge into Twitter, and will continue as a private corporation wholly owned by him. Twitter stockholders will receive US$54.20 per share in cash, and the company’s common stock will be delisted from the New York Stock Exchange.

The deal just needs to secure a majority stockholder vote and regulatory approvals to push through.

The legal battle points

Musk’s financing efforts

To finance the US$44 billion Twitter buyout, Musk was promised credit financing by Morgan Stanley Senior Funding. Initially, it comprised of a senior secured term loan of US$6.5 billion, a revolving facility of US$500 million, a senior secured bridge loan of US$3.0 billion, and a senior unsecured bridge loan of US$3.0 billion.

In addition, the financing firm also committed a margin loan of US$12.5 billion to be secured by US$62.5 billion worth of Musk’s Tesla stock, about 62 million shares at the time of signing.

Musk also provided an equity commitment letter to provide the remaining US$21 billion. Like the majority of his assets, this equity capital is mostly tied to his Tesla shares.

Twitter then narrated that a week after the merger agreement was executed, “Musk elected to sell 9.8 million Tesla shares to finance the merger at prices as low as $822.68 per share,” at a time that the shares were trailing down in trading price.

The falling Tesla share price triggered a possibility to increase the number of shares tied to the US$12.5 margin loan so as to not exceed the 20% value requirement. Soon after, Musk dropped the margin loan component of the financing and instead agreed to a new increased equity commitment of US$33.5 billion. Twitter claims it wasn’t notified with this plan prior to executing it.

Company Material Adverse Effect

One of the main contentions in this potential legal battle would have to center on what each party considers a breach to the agreement that led to “company material adverse effect.” Parties could trigger the termination of the agreement should a materially adverse effect materialize.

As negotiated and corollary outlined in the signed merger agreement, Twitter enumerated what aspects are excluded from the definition, including the identity of Elon Musk, any litigation he and his companies are facing, changes in market, and any matter already disclosed in SEC filings.

A point of argument would be characterizing the financing and due diligence requirement to close the deal, which Twitter believes is not existent in the merger agreement.

“[The parties] each acknowledge and affirm that it is not a condition to the closing or to any of its obligations under this agreement that [Musk or his companies] obtain any financing (including the debt financing) for any of the transactions contemplated by this agreement,” the company referenced.

“There is no financing contingency and no diligence condition. The deal is backed by airtight debt and equity commitments. Musk has personally committed US$33.5 billion,” the company added.

Disclosures

With a controversial personality like Musk, another contention for the lawsuit is defining the parameters of the supposed lack in disclosing necessary information.

Twitter cites the agreement that says Musk must keep Twitter, “reasonably informed on a current basis of the status of [their] efforts to arrange and finalize the financing.”

For its part, Twitter is required to use its “commercially reasonable best efforts” to assist Musk with arranging financing. However, the company emphasized that the agreement also stipulates that it does not need to “prepare or provide any financial statements or other financial information” other than the financial information provided to the SEC.

The agreement also defines that Musk is allowed “reasonable access” to information about Twitter’s “business, properties and personnel” as long as it must be for a “reasonable business purpose related to the consummation of the transactions contemplated by this agreement.” The firm also has the right decline a request if it would “cause significant competitive harm to the company” or would “violate applicable law,” including privacy laws.

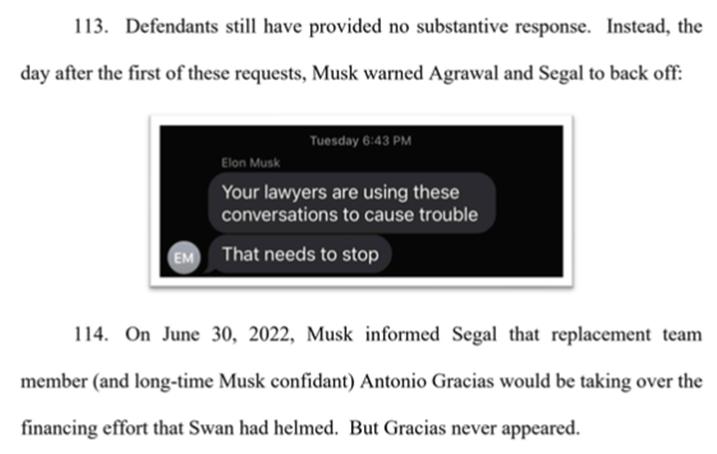

Twitter claims that Musk had overreached his requests for information multiple times.

On June 17, in particular, Musk is said to have demanded a “working, bottoms-up financial model for 2022,” budget plans with underlying modeling, and a “working copy” of Goldman Sachs’s “valuation model underlying its fairness opinion.”

“This demand is extremely unusual in merger transactions, and neither in conveying the demand nor at any time since have defendants pointed to a request from any lender that would justify it,” the firm reasoned out.

As part of the agreement, Twitter has formally sought information about the status of Musk’s financing. The businessman’s reply is not what it expected.

The agreement also contains “standard language requiring each side to consult with the other before issuing certain public statements,” including a specific reference to Musk’s incessant use of the platform to discuss his business dealings. Musk may so tweet only “so long as such tweets do not disparage the company.”

As we now know, Musk didn’t follow this.

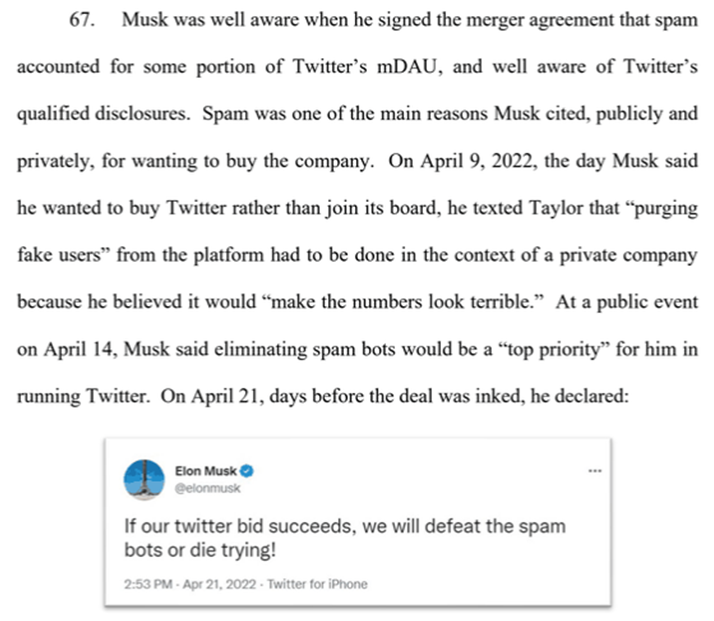

Spambots

“One of the chief reasons Musk cited on March 31, 2022 for wanting to buy Twitter was to rid it of the ‘[c]rypto spam’ he viewed as a “major blight on the user experience,” the company said in its suit. It was even part of his reasoning in taking the company private, because “purging spam would otherwise be commercially impractical.”

In its SEC filings, Twitter reported that it estimates the average of false or spam accounts on its platform “represented fewer than 5%” of the monetizable daily active users (mDAU). Despite this, the company said it has been upfront with the disclaimers to the estimate, saying that the calculation of mDAU is not based on an industry methodology, may differ from other parties’ estimates, and may not accurately reflect the actual number. The firm discussed that the spambot estimate is achieved through “an internal review of a sample of accounts” which may also “not accurately represent the actual number.”

In a meeting with Musk and his team–covered by confidentiality agreement–Twitter discussed mDAU and spam-related subjects. Musk’s bankers are said to have asked how does the platform estimate that “fewer than 5% of mDAU are false or spam accounts,” which the representatives addressed.

“In addition to deploying automated and manual processes that suspend on average more than a million suspicious accounts each day, the company undertakes a rigorous, daily process using human reviewers to estimate spam or false accounts remaining on its platform after automated filtering and manual review,” the company explained.

The company was then surprised to see Musk’s tweet saying the acquisition is on hold pending proof of the estimate.

Still committed to acquisition

— Elon Musk (@elonmusk) May 13, 2022

“Twitter’s deal counsel called Musk’s deal counsel. Two hours after the “on hold” Tweet was published, Musk belatedly Tweeted that he was still “committed” to the deal,” the company narrated.

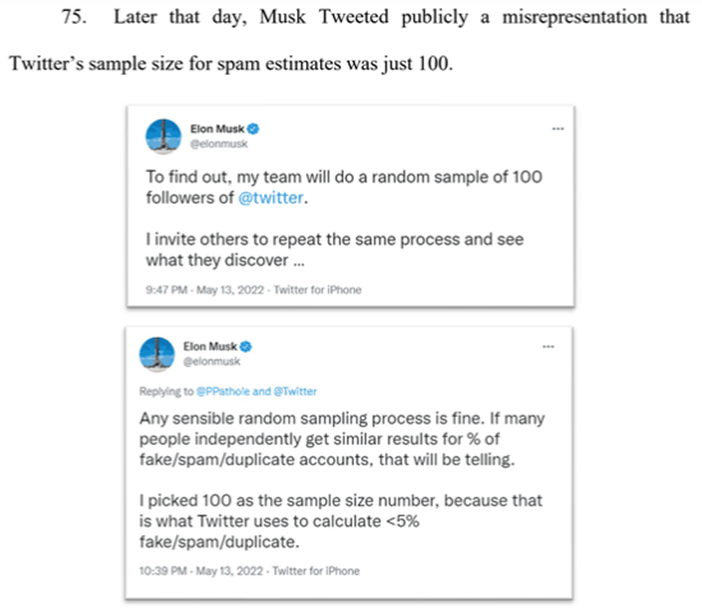

Also during the closed-door session, Twitter explained that its “spam estimation process entails daily sampling for a total set of approximately 9,000 accounts per quarter that are manually reviewed.”

However, Musk tweeted otherwise.

Twitter believes it tried its best to accommodate Musk’s requests for information to give him light on the spambot estimation. The Tesla chief’s counsel said that “granting access to 30 days’ worth of historical firehose data would satisfy Musk’s request for the firehose data.” The company said it complied, giving Musk’s team about 49 tebibytes’ worth of data, “even though the merger agreement did not require the sharing of this information.”

Soon after, Musk complained through counsel that Twitter purportedly had “placed an artificial cap on the number of searches” that could be run on the firehose data. The company refuted the claim, saying the said limit is actually due to Musk’s team hitting the “default 100,000-per-month limit on the number of queries.”

“With his undisclosed team of data reviewers working behind the scenes, Musk had hit that limit within about two weeks. Twitter immediately agreed to, and did, raise the monthly search query limit one hundred-fold, to 10 million–more than 100 times what most paying Twitter customers would get,” said the company.

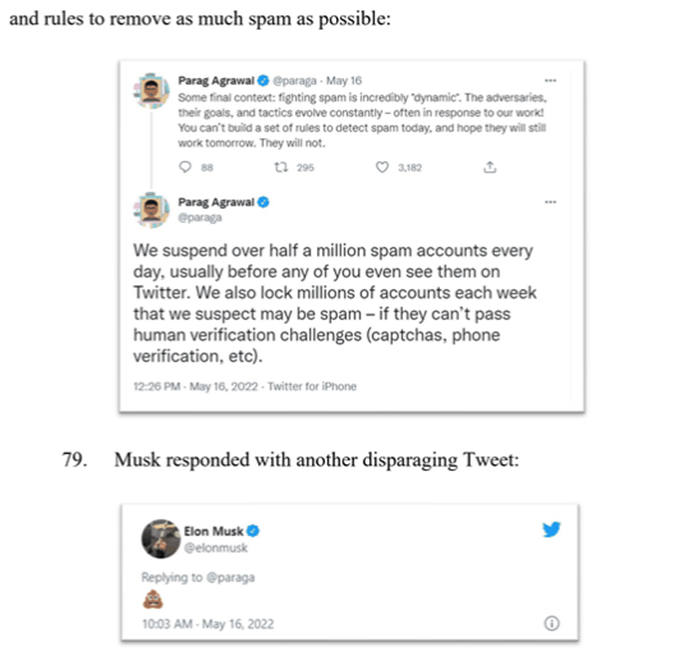

Since then, Musk has been publicly tweeting about the supposed lack of cooperation from the platform to provide him information about the spambot estimation, even threatening the deal and eventually accusing Twitter of a material breach of the agreement.

In a tweet after the suit came out, Musk clarified that the poop emoji meant “bs”.

💩 = bs

— Elon Musk (@elonmusk) July 13, 2022

Premature termination

The long and winding information expedition has led to Musk’s counsel seding a letter to Twitter to terminate the merger agreement on July 8, 2022. His reasons for the termination include purported breach of information-sharing and cooperation covenants, supposed materially inaccurate representations, and purported failure to comply with the ordinary course covenant.

Twitter belied each claim in its filed suit.

On breaching the information-sharing part of the agreement, Twitter claims that it actually, “has bent over backwards to provide Musk the information he has requested.”

“In their termination notice, defendants list categories of information they claim Twitter has withheld. Most of this information does not exist, has already been provided, or is the subject of requests only made recently,” the company said.

It added that all of these information requests “sweeps far beyond what is reasonably necessary to close the merger.” In addition, the platform also asserted that the agreement does not obligate it to provide financial information not already in existence and provide valuation models of its bankers.

“Parent, not Twitter, is responsible for providing the ‘prospects, projections and plans for the business and operations of’ the company,” the firm asserted.

On failing to comply with covenants pertaining to employment, Twitter said that while it let go of two executives and announced a pause on most hiring and backfill, it also clarified that Musk’s counsel was “notified of those decisions at the time and raised no objection.”

Twitter also recently announced a 30% workforce cut, which it said is “aligned with Musk’s own stated priorities,” adding that he texted Taylor saying his “biggest concern is headcount and expense growth.”

Finally, even if Twitter did have accuracy issues with its representations, it claims that Musk has “no right for defendants to terminate unless there is a breach sufficiently significant to cause failure of a closing condition,” that couldn’t be addressed after a 30-day notice first.

It’s Musk who breached

Twitter turned the tables and outlined that it’s actually Musk who repeatedly breached the confines of the signed merger agreement.

Among these include the breach to the obligation to use reasonable best efforts to complete the merger and the “hell-or-high-water” financing covenant baked into it. Musk also supposedly breached the contract by failing to provide Twitter with updates on debt financing status, unreasonably withholding consent to operational decisions, and not seeking the company’s consent to public comments about the deal or the disparaging content it may contain.

The firm also claims Musk breached his obligation not to misuse confidential information.

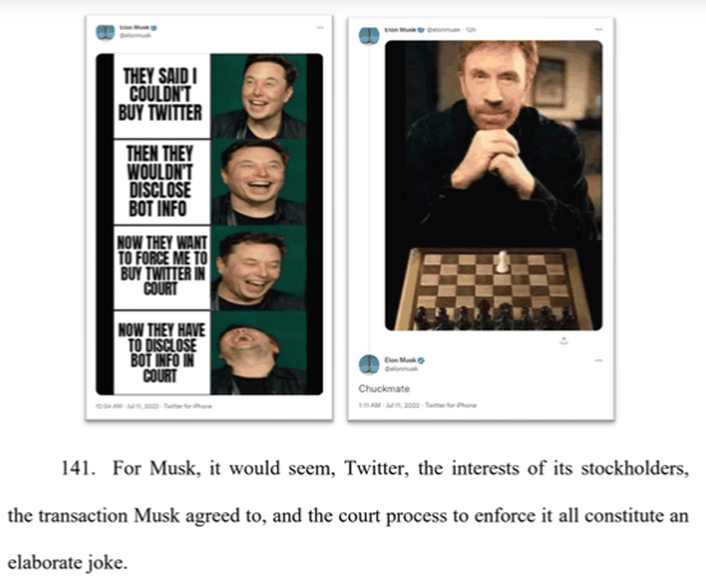

After the suit was filed, Musk tweeted his apparent answer.

Oh the irony lol

— Elon Musk (@elonmusk) July 12, 2022

Twitter also complained that even after terminating the deal, Musk continued to breach a number of his obligations. This includes a tweet tagging SEC to investigate the company, an act that could be seen falling under making disparaging remarks on the company.

What happens now

Twitter is bent on seeing the deal through. Notwithstanding Musk’s withdrawal, the expected closing date for the merger is fast approaching as far as the firm is concerned. The only remaining regulatory nod needed is underway, with the company seeing no foreseeable obstacle.

“Defendants’ actions in derogation of the deal’s consummation, and Musk’s repeated disparagement of Twitter and its personnel, create uncertainty and delay that harm Twitter and its stockholders and deprive them of their bargained for rights,” the company claims. “Swift remedial action in the form of specific performance and injunctive relief is warranted.”

In summary, Twitter is asking the Delaware’s Court of Chancery to grant the firm all of the relief it requested, order Musk and other defendants to honor their obligations under the merger agreement, and finally to close the merger.

All eyes will be on the next chapter of this budding legal battle, potentially featuring interpellations filled with tweets and memes.

Twitter last traded at US$36.40 on the NYSE.

Information for this briefing was found via Twitter and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.