On October 30, the U.S. and European Union (EU) reached an agreement to remove tariffs on more than US$10 billion of EU steel and aluminum exports. President Trump had imposed the tariffs in 2018 on the premise that EU steel and aluminum produced by an American ally represented a threat to national security.

Most economists believe the tariffs raised prices for U.S. consumers. Cynics asserted the move was designed to protect steel companies from foreign competition and, perhaps more importantly, to preserve steel worker jobs in politically important states. One think tank believes the Trump policy created 3,000 steelmaking jobs.

The EU retaliated by attaching duties to U.S. exports of motorcycles, jeans, bourbon, and other products. The EU dropped these duties in tandem with the U.S.’s October 30 actions on the base materials tariffs.

Under the late October 2021 accord, which was negotiated on the sidelines of the just-concluded Group of 20 summit, the first 3.3 million tons of EU steel exports to the U.S. will not be assessed any duties. Tariffs of 25% will be applied on amounts above that level. The U.S. imported 2.5 million and 3.9 million tons of steel from the EU in 2020 and 2019, respectively.

Steel prices have tripled in the last year, driven by robust fiscal spending programs and loose monetary policies implemented by most countries to counteract COVID-19-induced slowdowns. The recent U.S.-EU action could be the catalyst to cause this price trend to reverse.

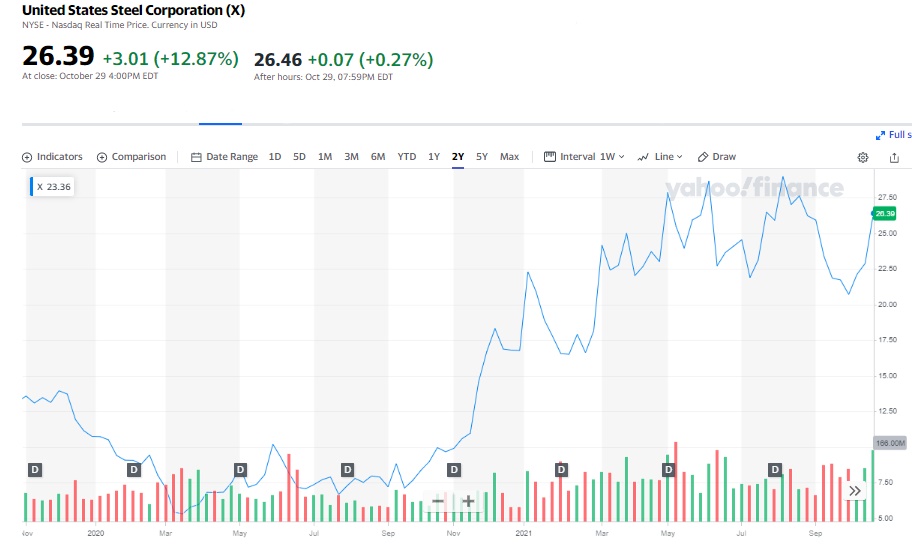

Similarly, U.S. stocks of U.S. steelmakers have soared over the last year. For example, shares of United States Steel Corporation (NYSE: X) and Nucor Corporation (NYSE: NUE) have each approximately tripled over that period. The U.S.-EU agreement could potentially interrupt those trends as well.

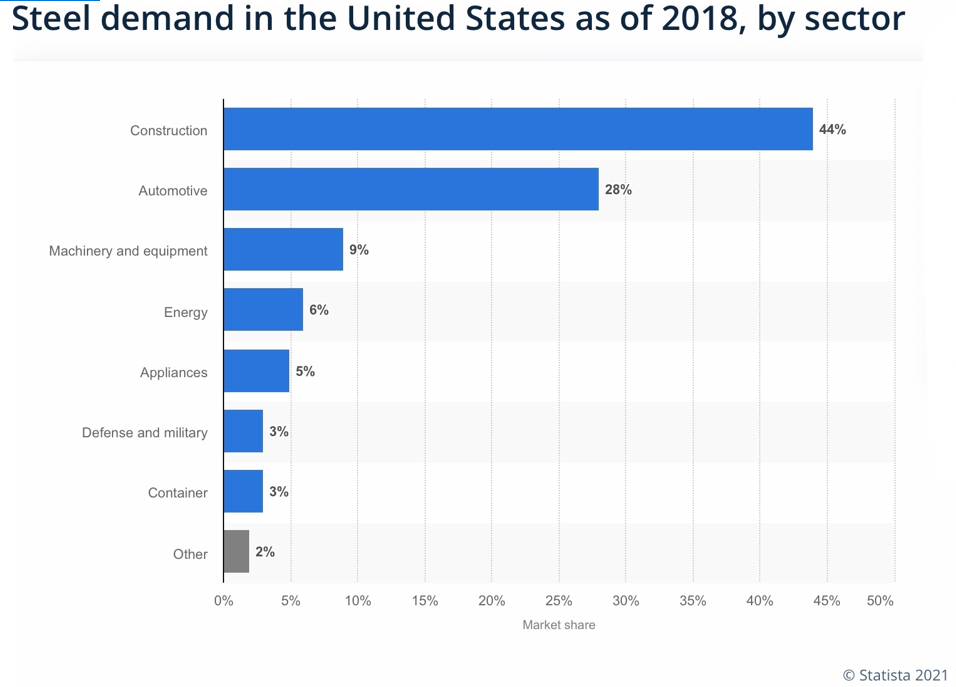

The two largest users of steel are the construction and automobile industries. As such, these industries would stand to benefit from any reduction in steel prices. By weight, steel and iron comprises about 65% of a typical passenger car. For the auto sector, a reduction in steel prices could counteract rising prices in other automotive inputs, such as semiconductors.

The October 30 U.S.-EU agreement could cause steel prices to reverse a year-long trend of increases. If so, shares of U.S. steelmakers could be negatively affected, and auto makers helped at least somewhat.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.