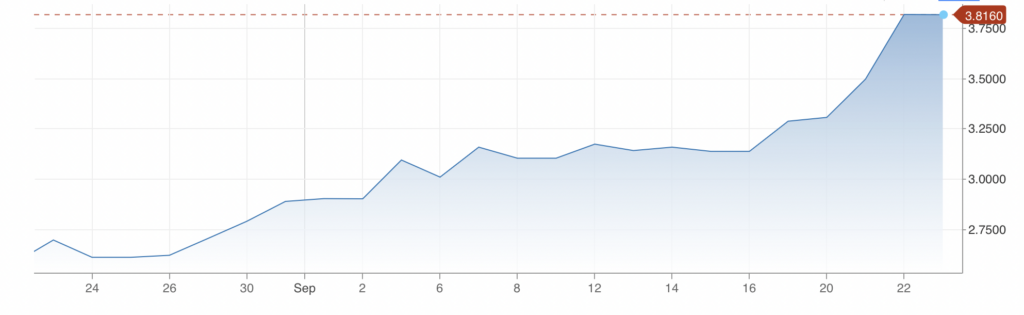

The newly installed UK government’s September 23 decision to enact a sweeping program of tax cuts and investment incentives seems like bad policy and was greeted as such by equity, debt and currency markets. UK and worldwide stocks fell at least partly due to the news; and UK and other European government bonds as well as the pound sterling and the euro all lost substantial value.

Among other things, the UK kept its corporate tax rate at 19%, canceling a planned increase to 25%; reduced the basic tax rate for individuals to 19% from 20%; reduced marginal tax rates on annual incomes over 150,000 pounds sterling to 40% from 45%; and reversed a recent 1.25% increase in National Insurance contributions.

While the short-term declines in stock and bond prices and currencies are unwelcome, two much larger negative implications could be drawn from the UK’s actions. First, much like in the U.S. and Canada, inflation is running far too hot in the UK; the Consumer Price Index (CPI) in that country rose 8.6% in the twelve months ended August 2022. However, new Prime Minister Liz Truss’ implementation of an expansionary fiscal policy will, according to economic theory, add to inflation and undercuts the Bank of England’s September 22 decision to boost overnight interest rates 50 basis points (bp) to 2.25% to combat overall price increases.

If governments of other western countries decide they too have to bow to populist pressure and relieve some of the pain brought by higher overnight interest rates put in place by central banks, the fight to bring worldwide inflation to much lower levels might be conceded. This could result in much higher levels of structural inflation (4%-5% ??) than the 2% level sought by the U.S. Federal Reserve.

Second, the UK government’s decision to put in place the surprise tax cuts could mean that the economies across the pond and perhaps in other countries have turned down faster and more decidedly than officials had expected. A piece of anecdotal evidence which could corroborate this is the People’s Bank of China’s mid-August decision to cut overnight rates by 10 bp. Prior to that action, and despite a much weaker-than-expected 0.4% growth in 2Q 2022 GDP, China’s central bank had been reluctant to cut rates given concerns about the risk of rising debt levels, consumer inflation, and pressure on the Chinese yuan.

We note that the UK is better positioned than some countries, including the U.S., to take on more government debt. At the end of August, its government debt as a percentage of GDP was about 97%, according to the UK Parliament’s House of Commons Library. The corresponding figures for the U.S. and Canada are around 125% and 102%, respectively.

Information for this briefing was found via CNBC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.