United Lithium Corp. (CSE: ULTH) is a relatively new Canadian lithium exploration company that is actively developing several projects to supply the rapidly growing battery industry with the lithium needed to power electric vehicles (EVs). Lithium is a critical element necessary for manufacturing Lithium-Ion batteries and demand is currently exceeding supply.

The world is quickly moving to reduce carbon emissions to meet the global warming targets established under the Paris Climate Accords, and many countries have mandated that gasoline-powered vehicles will be eliminated by 2030. This has led to a boom in global EV manufacturing, and that in turn has led to significant investment in the battery gigafactories that produce the technologies needed to power EVs.

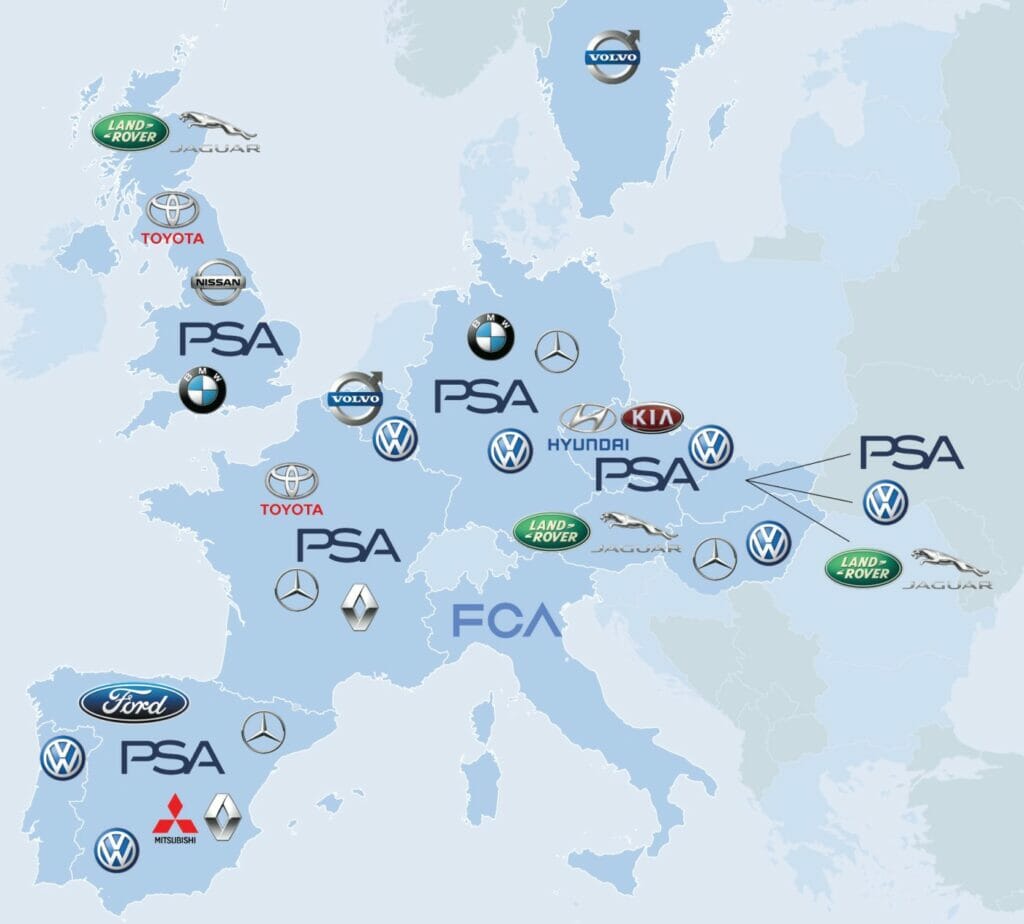

The recent global Covid-19 pandemic has underscored the need for countries to establish strategic geopolitical policies to support the creation of underlying supply chains closer to home and to reduce reliance on foreign jurisdictions such as China. Nowhere has this been more apparent than in Europe, where it is expected that the continent will have at least 16 gigafactories producing batteries by 2030.

United Lithium is well positioned to supply European factories with lithium. The company has acquired two significant Scandinavian lithium projects; the Bergby Project in Sweden, and the Kietyönmäki project in Finland, both of which are at an advanced stage of development. Both projects have excellent infrastructure and the lithium deposits are located at surface and near-surface, which will enable cost-effective mining. The lithium concentrates can then be sold into the European Union tariff-free.

The Bergby Lithium project is near a deep-water port, has excellent infrastructure, and is close to the new 16GW Northvolt lithium battery gigafactory being built in Skellefteå, Sweden. Funding for the $1 billion Northvolt project was led by Volkswagen, and a joint-venture between Volkswagen and Northvolt will see the construction of a 16 GW gigafactory in Germany. Two previous drill programs at the Bergby project identified a deposit with some high-grade concentrations of lithium. United Lithium plans to drill this year to further delineate the size and scope of the deposit and work towards defining a preliminary resource.

The Kietyönmäki lithium project is located 100 km north of Helsinki, Finland. Lithium mineralization was first discovered by the Finnish Geological Survey (GTK) in the 1980s, which drilled 17 shallow holes to test down to 70m below surface across three traverses. The previous property owners drilled 6 holes in 2016, which intersected lithium mineralization hosted as a spodumene-bearing pegmatite dyke swarm. Covid-19 protocols regarding the legal process have delayed ULTH’s acquisition of the project, which was announced by way of a Letter of Intent on May 4, 2021, which is expected to be concluded in the very near future.

Here in Canada, the company’s Barbara Lake lithium project 160 kilometres northeast of Thunder Bay, Ontario, is an early-stage project which is located within the Georgia Lake pegmatite lithium fields. The property in proximity to Rock Tech Lithium’s (TSXV: RCK) Georgia Lake advanced stage lithium project that is also planning to produce lithium-oxide for the European battery market.

The rapid growth of the EV market has essentially ensured that the lithium market will remain strong over the next decade as exploration companies race to find, develop and mine new lithium deposits to meet the rising demand. United Lithium is well-positioned to potentially supply the European market with lithium concentrates, should its assets prove-out. The company is well financed, and has a very experienced management and professional team who understand all aspects of the lithium industry, and have acquired a portfolio of strong, strategically located lithium assets.

With only 44.45 million shares outstanding and a modest market capitalization of $44.8 million, we believe United Lithium Corp. represents a reasonably modest-risk lithium exploration play with direct exposure to the strong European EV and battery markets. Once drilling commences, the company’s shareholders could expect a steady supply of news as ULTH continues to develop its projects.

FULL DISCLOSURE: United Lithium is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover United Lithium on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.