In her May 6 testimony before the Appropriations subcommittee of the U.S. House of Representatives, U.S. Energy Secretary Jennifer Granholm voiced support for subsidizing U.S. nuclear power plants to ensure existing facilities do not close. This is consistent with reports that the White House has privately told lawmakers that it backs taxpayer subsidies for the plants, as they are needed to achieve the Administration’s climate goals. President Biden hopes that U.S. power generation is “emissions free” by the year 2035.

Nuclear facilities would receive “production tax credits” as part of President Biden’s infrastructure bill. Tax credits will also be extended or created for wind and solar generators and for battery manufacturers.

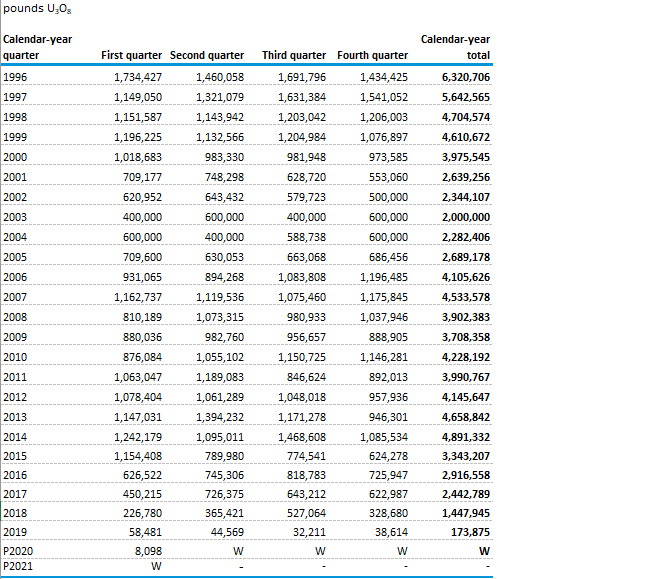

The Administration’s nuclear stance is a positive for owners of U.S. uranium projects, such as Uranium Energy Corp. (NYSE: UEC). Very little uranium has been produced in the U.S. since 2018, and effectively none since 1Q 2019. It would appear that owners of 90+ nuclear generating facilities in the U.S. will be incentivized to contract to buy uranium, causing long-suffering uranium miners to resume production of this commodity.

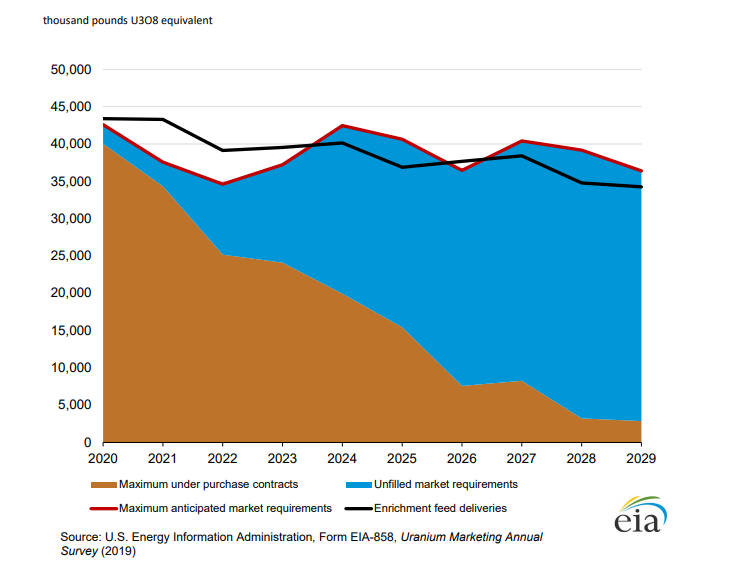

Both in the U.S. and on a worldwide basis, nuclear utilities have rather sensibly “played the price curve” over the last few years by deferring long-term contract negotiations with uranium suppliers. However, the degree to which the nuclear industry has become uncontracted has reached extreme levels. Below is a chart showing the widening gap between contracted and uncontracted nuclear fuel needs of U.S. utilities.

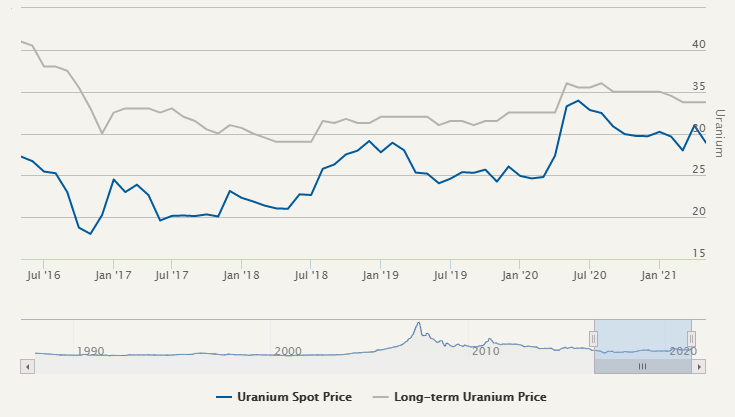

Utilities will soon have to begin reaching long-term accords with uranium suppliers to take advantage of the potential tax credits and to limit risk of potentially rising uranium prices. A significant point of tension in these negotiations will of course be price; suppliers would have little interest in reaching long-term contracts anywhere near the current spot price of around US$30 per pound.

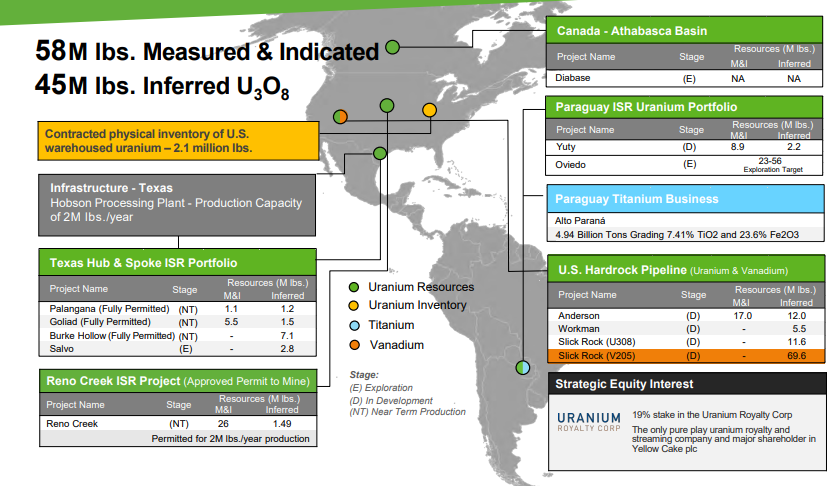

Uranium Energy Corp.’s Assets

UEC has three fully permitted in-situ recovery (ISR) uranium projects (Palangana, Goliad and Burke Hollow) in Texas which can enter production in the near term, and it controls the Reno Creek Project in Wyoming, the largest permitted pre-construction ISR project in the U.S. The company also owns the Hobson Processing Plant in Texas, which can process 2 million pounds of uranium per year.

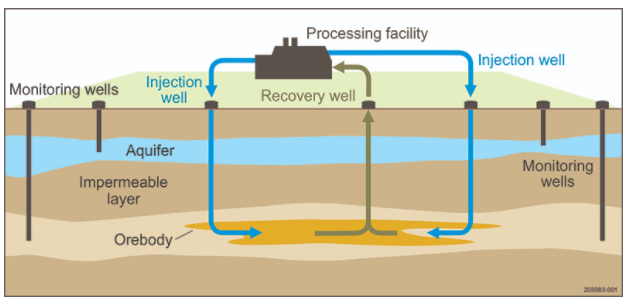

An environmentally friendly mining method, ISR mining is injected-solution mining which dissolves the uranium from the sandstone host material. The uranium-bearing solution, which also includes water and chemicals that accelerate the process, is pumped back to the surface. ISR mining causes little surface disturbance or dust generation, both of which are associated with underground mining.

UEC’s Financials

Factoring in US$12 million of equity raised in April 2021, UEC could now be in a slight positive net cash position. Its net debt totaled US$9.2 million as of January 31, 2021. Over the last five reported quarters, the company’s operating cash flow shortfall has averaged about US$2.7 million per quarter.

| (in thousands of US dollars, except for shares outstanding) | 2Q FY21 | 1Q FY21 | 4Q FY20 | 3Q FY20 | 2Q FY20 |

| Operating Income | ($3,524) | ($3,387) | ($3,461) | ($3,159) | ($3,800) |

| Operating Cash Flow | ($3,028) | ($2,575) | ($2,538) | ($2,787) | ($2,802) |

| Cash | $8,713 | $6,701 | $5,148 | $7,407 | $10,272 |

| Debt – Period End | $17,906 | $20,621 | $20,177 | $19,473 | $19,045 |

| Shares Outstanding (Millions) | 200.1 | 197.4 | 184.6 | 184.1 | 183.7 |

Passage of President Biden’s infrastructure plan is not a certainty; therefore, introduction of subsidies for U.S. nuclear plant operators are likewise not a given. Passage of such benefits could be necessary to re-start production at U.S. uranium mines, including those owned by UEC.

UEC is a speculative play on potentially improving fundamentals for uranium miners. Ensuring that U.S. nuclear plants continue to operate is a key plank of President Biden’s environmental strategy. If he gets his infrastructure bill enacted, and the legislation includes these nuclear plant subsidies, a well-funded and well-positioned U.S. uranium miner like UEC would likely stand to benefit.

Uranium Energy Corp. last traded at US$3.12 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.