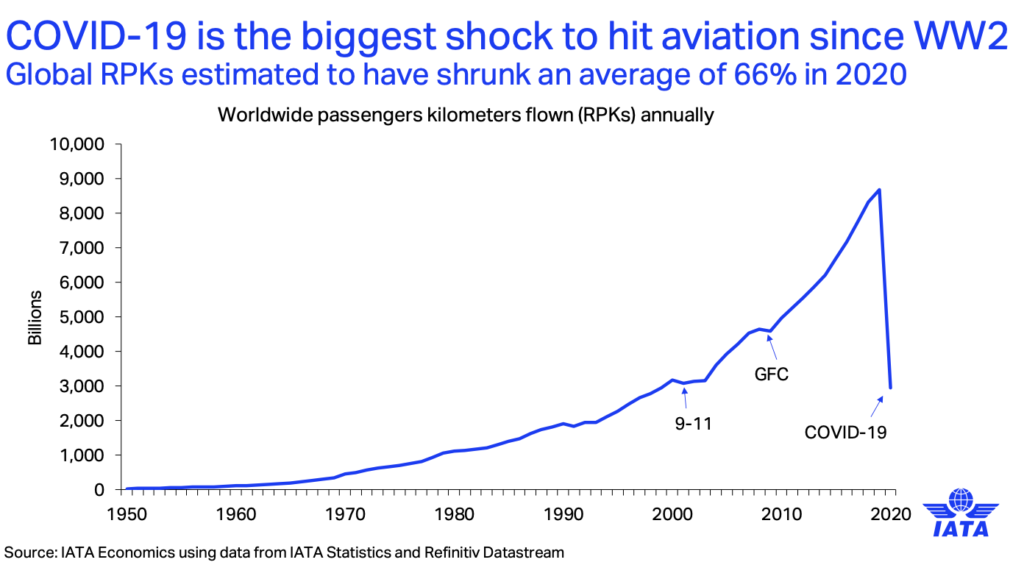

With the coronavirus pandemic decimating air travel all around the globe, the resulting financial turmoil does not appear to be ending anytime soon, especially for airlines in the US.

According to calculations conducted by data company FactSet and then reported by CNBC, net losses for airlines in America are expected to surpass $35 billion in 2020, amounting to more than 40% of all global carriers’ losses. US airlines also contributed substantially to the fourth quarter decline in the industrial sector, posting a 66% and 343% drop in revenues and earnings, respectively.

Although there has been a slight recovery in passenger traffic since the nadir witnessed at the onset of the pandemic, the final three months of 2020 were still significantly below normal levels. According to the US Department of Transportation, US carriers experienced three continuous quarters of losses, after over six years of quarterly net profits. In fact, just in the third quarter alone, airlines lost $11.8 billion, exceeding the previous three months’ losses by $800 million.

In a previous forecast by the The International Air Transport Association (IATA), the global air transport industry is expected to lose upwards of $84.3 billion due to the impacts of Covid-19. The aviation body also projects that a large incidence of those losses will be borne by North American carriers. Albeit the IATA anticipates that mass vaccinations will be the main key to air travel recovery, it could take years before the airline business returns to normal.

In the meantime, the US federal government has recently passed a second Covid-19 relief bill, that earmarks an additional $15 billion in support for the embattled airline industry. As part of the bailout agreement though, airlines are required to recall some 32,000 workers that were previously furloughed at the beginning of the crisis. However, United Airlines executives warned that the improvement in labour will likely only be temporary.

Information for this briefing was found via FactSet, CNBC, US Department of Transportation, and the IATA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.