US Antimony (NYSE: UAMY) is directly challenging Perpetua Resources’ (TSX: PPTA) “American antimony” thesis, with CEO Gary Evans calling Stibnite “a gold mine with a little bit of antimony” and arguing the Idaho ore is not a feasible feedstock for military-grade antimony products.

Bloomberg reporting cites industry experts and multiple military officials who say Stibnite is not the best route to secure domestic antimony, with Perpetua’s recoverable output framed as enough for only about two years of US demand, while the ore grade is substantially lower than deposits elsewhere.

With gold above $4,300 per ounce in December, Perpetua’s planned 4.2 million ounces over 15 years implies more than $18 billion of in-ground value, and the company says gold could be up to 95% of project revenue.

John Paulson, Perpetua’s largest shareholder with a 26% stake, described the attraction as buying “gold in the ground” at roughly $450 per ounce.

Not mining hype

Perpetua has received more than $80 million from the Pentagon to test whether its antimony can be refined to military standards, and the company has argued that Defense Production Act funding was pivotal to keeping the project moving.

The firm has also said plainly that antimony alone would not carry the economics, with its vice president for external affairs stating in July that “it’s only the gold that makes the plan feasible” and that it “wouldn’t be economic to just get the antimony out of the ground.”

The technical hurdle is grade and spec. Perpetua’s feasibility study says the highest-grade ore from Yellow Pine Pit contains 0.46% antimony, while other Western deposits are cited at 6 to 12 times higher grade.

The US military standard for antimony trisulfide requires at least 70.5% antimony, and low-grade stibnite commonly carries arsenic that must be removed to meet specifications.

Perpetua’s spokesperson counters that feasibility study grades are life-of-mine averages that do not reflect prioritized antimony feed for military purposes. The company says it can refine antimony on-site to a 54.3% concentrate, which still implies additional off-site processing to reach a 70.5% military trisulfide standard.

The antimony crowd will want to read this

— Yellow Lab Life Capital (@YellowLabLife) December 19, 2025

Bloomberg pointing out Perpetua's $PPTA Stibnite basically just a gold mine with a small antimony credit

But the real story, they got US Antimony $UAMY CEO on record saying Stibnite is not feasible as source of antimony for military use…

Processing flow argument

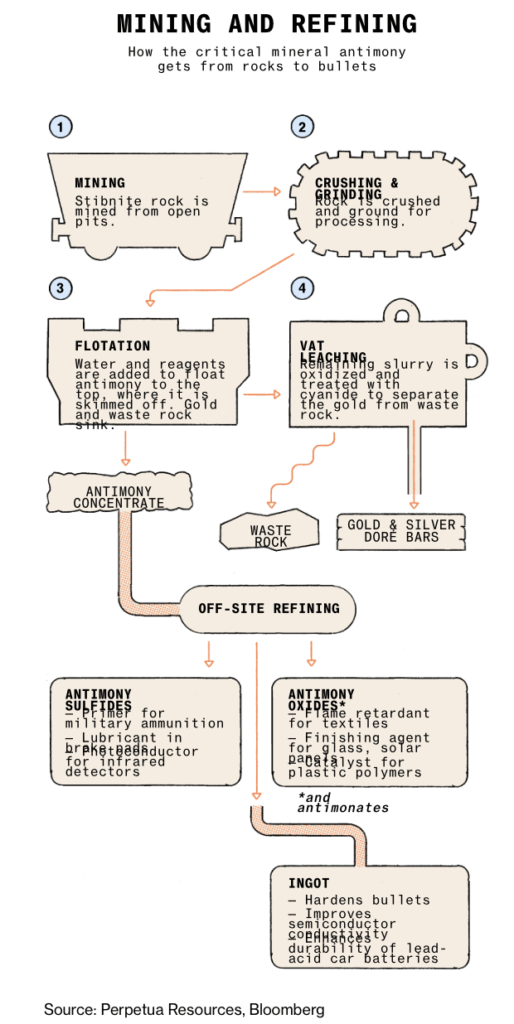

Perpetua’s flowsheet highlights why the “antimony mine” label gets contested. Mining feeds crushing and grinding, then flotation separates antimony concentrate, while vat leaching treats oxidized slurry with cyanide to pull out gold and silver to create doré bars, leaving waste rock streams that must be managed in parallel. The antimony path then depends on off-site refining into products like antimony sulfides, oxides, and ingots used across munitions and industrial applications.

US Antimony is using contract wins to underline credibility. In September, it announced a $245 million contract to supply antimony ingots to the National Defense Stockpile, saying deliveries would begin immediately. In the same announcement, it argued that “low quality” antimony ores controlled by others would not meet stringent US military requirements after analyzing samples from multiple countries, including within the continental US.

Perpetua’s plan spans three open pits (Yellow Pine, West End, and Hangar Flats) plus a processing plant area and a proposed tailings storage facility on national forest land. The company has cited $400 million already invested in exploration and cleanup work, and said blocking the mine would harm property rights and asserted national security interests.

Environmental risk and waste scale remain central to opposition. Perpetua’s plans describe tailings filling an area the size of 300 football fields to a height of 465 feet, with sodium cyanide used in processing and naturally occurring arsenic remaining in waste streams. Of this, the firm says it has already spent $20 million moving 325,000 tons of old tailings away from groundwater before reprocessing, and has argued that doing nothing would allow one ton of arsenic to leach into the river annually.

All these happen on the background of the Export-Import Bank evaluating a potential $2 billion loan for Perpetua, with a decision expected next year, while JPMorgan and Agnico Eagle announced $255 million of investments in Perpetua. Perpetua does not expect production until 2029, keeping antimony “near-term solution” messaging exposed to execution, refining, and timeline risk even as gold economics appear to carry the project.

Information for this story was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

The CEO of UAMY seems quite frustrated after their miserable low ball offer to acquire Lavrotto- an ASX company that was fully funded to production, has the 8th largest antimony deposit l, with the first 8 years of 100% antimony offtake already agreed to be purchased by a UK Company. Given Lavrotto was fully funded to build their gold mine- the offer was pathetically low that didn’t recognise the project was all but derisked and should have been offered a significant premium of 50-70% above what they offered.UAMY share price collapses as a result

Next UAMY began attacking Nova Minerals who was awarded a DoW 65 million aud grant so they could build a small refinery as the first in country miner and producer of Antimony in the US- as UAMY has always sourced their antimony out of country. UAMY sals were lousy- they have to ramp up production 500% and President Trump had to get China to reduce their antimony ban in order for UAMY to continue getting their antimony ore- after a years time UAMY are in a lot of trouble again to then have to source antimony ore.

UAMY then attacked Nova saying that UAMY was the only in country supplier of Antimony. Which is true for now but not for long- Defence need supply

And it would appear UAMY are desperately trying to prevent others producing any kind of antimony so they can keep a monopoly on antimony refining in the US- and unfortunately monopolies are never good for economic welfare of a country-they(UAMY) are concerned as more antimony suppliers come on board this may lower antimony prices (good for the US) but bad for UAMYs business model

Too bad, so sad; how about UAMY find their own mine with stibnite in it- and stop all this complaining about other companies encroaching on what they think is their space