As states across the US have begun lifting coronavirus restrictions and allowed businesses to reopen, the rate of economic contraction has finally started to slow down, while inflationary pressure has finally caught up following months of exorbitant government monetary and fiscal policy.

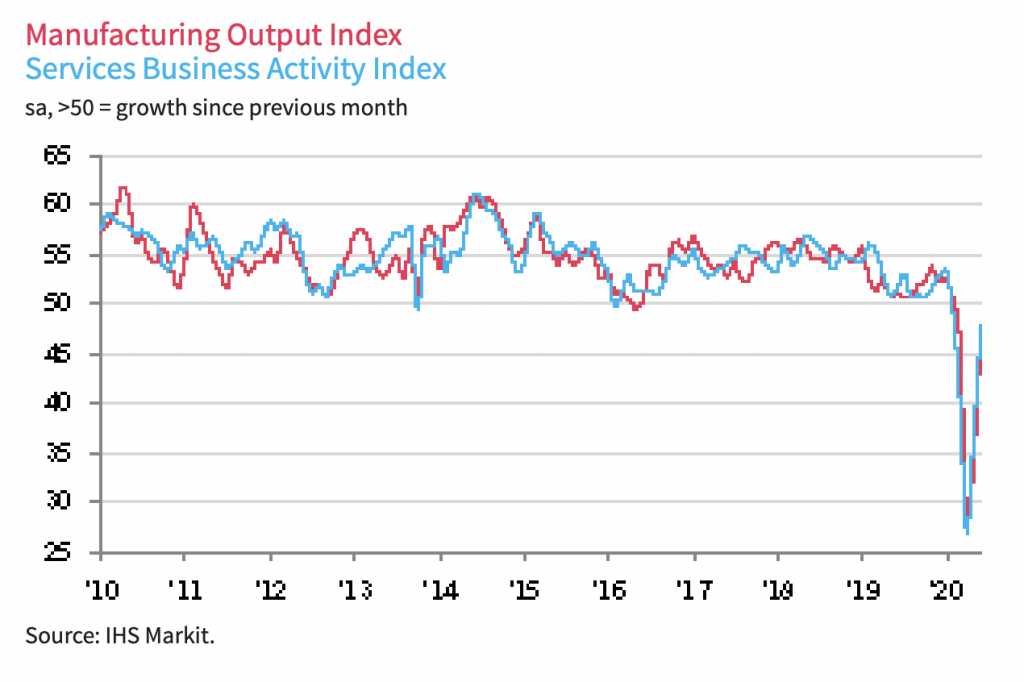

According to the latest IHS Markit PMI report, the Services Business Activity Index has increased from 37.5 in May to 47.9 by the end of the second quarter, signalling that demand amongst consumers has begun to rebound, and a market stabilization may soon be on the horizon after four consecutive months of record economic contraction. Furthermore, new export orders for business’s services suddenly spiked by most in nearly a year.

Although businesses in the service industry have begun to rebound from the recent economic turmoil brought on by the pandemic, they have not reached pre-pandemic output. Work backlogs continue to be evident, but to a lesser extent in June when compared to the previous several months. Moreover, service providers are still continuing to reduce their employee numbers, but at a slower pace than at the height of the pandemic.

With respect to the US manufacturing and services sector, the PMI Index remained recorded similar data. The June index increased from 37.0 in May, to 47.9 by the end of June. The reduced decline in the rate of contraction can be attributed to the recommencement of manufacturing operations in wake of restrictions-easing, as well as an increase in demand for new orders. Much like the services businesses, employee numbers still remain at reduced levels, but with a strengthening demand, some firms have even begun to rehire their laid off workforce.

Lastly, the new uptick in the demand has also caused overall business sentiment to rebound. By the end of the second quarter, optimism amongst US businesses has returned, following two successive months of pessimistic outlooks. Despite the comeback in confidence, the level still remains significantly restrained with respect to historic data.

Information for this briefing was found via IHS Markit. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.