March is turning out to be a busy month in public cannabis, with many of the prominent U.S cannabis names reporting fourth quarter and year-end financials. Heading into the earnings month, many of the MSO’s shares are getting sold down.

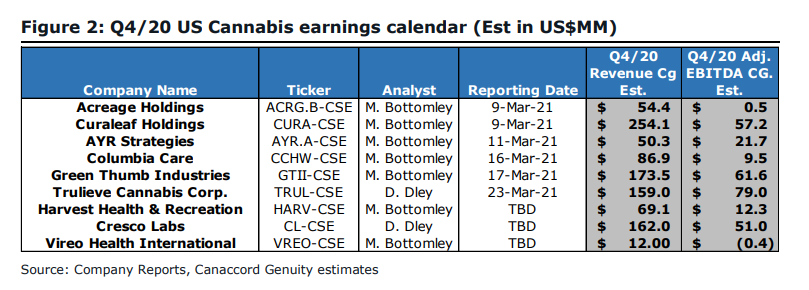

Below you can see Canaccord’s fourth quarter cheat sheet for earnings. Notably, this list excludes Cresco Labs, which announced their results will come out on March 25th before market open.

Let’s go down the line to preview what both Matt Bottomley and Derek Dley, Canaccord’s analysts, are expecting for these MSO’s earnings.

First is Acreage Holdings (CSE: ACRG.A.u); Bottomley has a U$5.50 price target and a speculative buy rating on the company. They forecast total managed revenue to come in at U$54.4 million with EBITDA flipping to U$0.5 million, which is notable as it is their first positive EBITDA quarter. Of this U$54.4 million, revenue will come in at U$37.8 million. Bottomley writes, “we note that the above growth rate will likely trail many of its MSO peers.”

Bottomley chalks up the growth in the fourth quarter to come from its direct exposure to the New England and Midwest regions. It is specifically benefitting from Illinois’s demand heavy market, the new Acreage Chicago dispensary, and improvement to the companies Ohio retail numbers.

Below you can see a more in-depth breakdown of their fourth-quarter estimates.

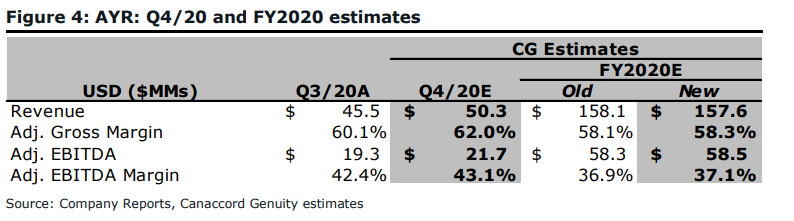

Next is Ayr Wellness (CSE: AYR.a); Bottomley has a C$60 price target and a speculative buy rating on the company. They forecast total revenue to come in at U$50.3 million, with EBITDA being U$21.7 million. Bottomley writes, “we expect Q4/20 revenue growth to be much more modest in relation to the 61% experienced in Q3/20.”

Bottomley spends most of the Ayr portion of the note explaining that they are not providing pro-forma guidance due to the assets being, “somewhat limited disclosure and various announcement dates,” but believes that the M&A is not factored into their estimates could provide a combined U$30 million in the fourth quarter.

Below you can see a more in-depth breakdown of their fourth-quarter estimates.

Next up is Columbia Care (CSE: CCHW); Bottomley has a C$15 price target and a speculative buy rating on the company. They are forecasting total managed revenue to come in at U$81.8 million, and pro-forma revenues to be U$86.9 million, with EBITDA coming in at U$9.5 million.

Bottomley believes that the growth in the fourth quarter will come from, “the first full quarter of contribution from Colorado leader TGS and approximately one-month contribution from Project Cannabis,” and the four additional store openings for the period, three being in Florida and one being in Virginia.

Below you can see a more in-depth breakdown of their fourth-quarter estimates.

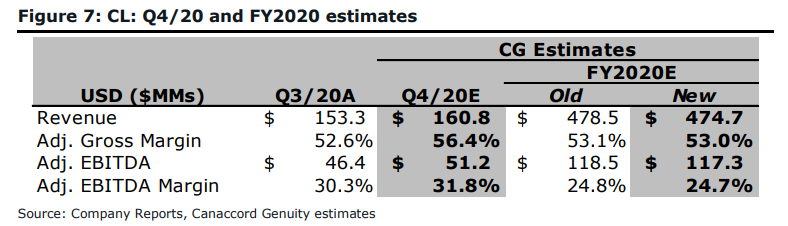

Dley currently has a C$20.50 price target and a speculative buy rating on Cresco Labs (CSE: CL). They are forecasting total revenue to come in at U$161 million and EBITDA to hit U$51 million.

Dley believes that most of its growth in the fourth quarter is going to come from Cresco’s home state, Illinois. He says Illinois adult-use sales are not showing any signs of slowing down with a solid 23.4% quarter-over-quarter growth.

Below you can see a more in-depth breakdown of their fourth-quarter estimates.

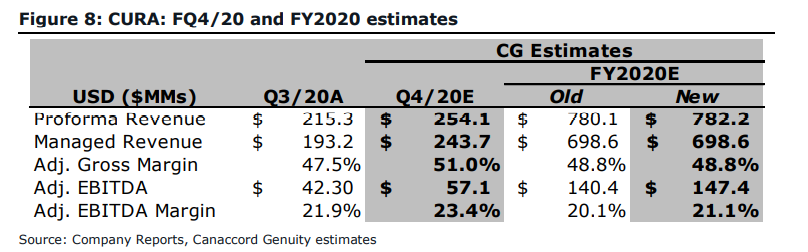

Next up is Curaleaf Holdings (CSE: CURA); Bottomley has a C$23.50 price target and a speculative buy rating on the company. They are forecasting total managed revenue to come in at U$243.7 million, pro-forma revenues to be U$254.1 million, while EBITDA is estimated at U$57.1 million.

Bottomley believes that the growth in the fourth quarter will come from its rollout of Select branded products as well as increased exposure to three of the fastest-growing markets of Ohio, Illinois, and Pennsylvania.

Below you can see a more in-depth breakdown of their fourth-quarter estimates.

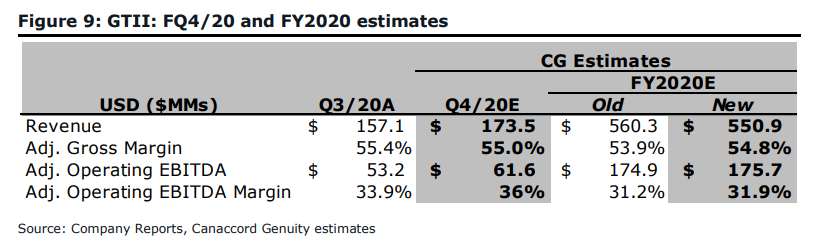

Bottomley has a C$47 price target and a speculative buy rating on Green Thumb Industries (CSE: GTII). They are forecasting total revenue to come in at U$173.5 million, with EBITDA coming in at U$61.6 million.

Bottomley thinks that fourth quarter growth will come from every state in Green Thumbs portfolio but mainly led by the same states as everyone else, Illinois and Pennsylvania.

Below you can see a more in-depth breakdown of their fourth-quarter estimates.

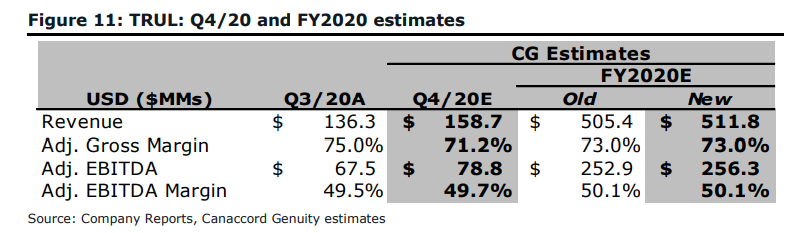

And we saved the best for last, Trulieve Cannabis (CSE: TRUL)! Dley has a C$75 price target and speculative buy on the company. He expects revenues to be U$159 million and EBITDA to be U$79 million. He writes, “Our estimates imply a 50% EBITDA margin for the quarter, which would again position the company as the industry leader in profitability.”

Of course, their earnings growth will come mainly from their Florida operations, with Dley estimating that they sold 16% more volume than last quarter.

Below you can see a more in-depth breakdown of their fourth-quarter estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Recently moved to Florida and my town has a Trulieve dispensary. I could not believe how poorly they run this dispensary, huge unnecessary indoor wait times during Covid. I’ve gone to dispensaries in CA, OR & ME and Trulieve’s dispensary would not survive in any of these states. Going online, ordering and arriving to pick up your order takes 30+ minutes after arrival (waiting indoors during Covid) while it took 1-3 minutes in all the other states. Such crappy service will reflect on their business especially as more states allow recreational use.