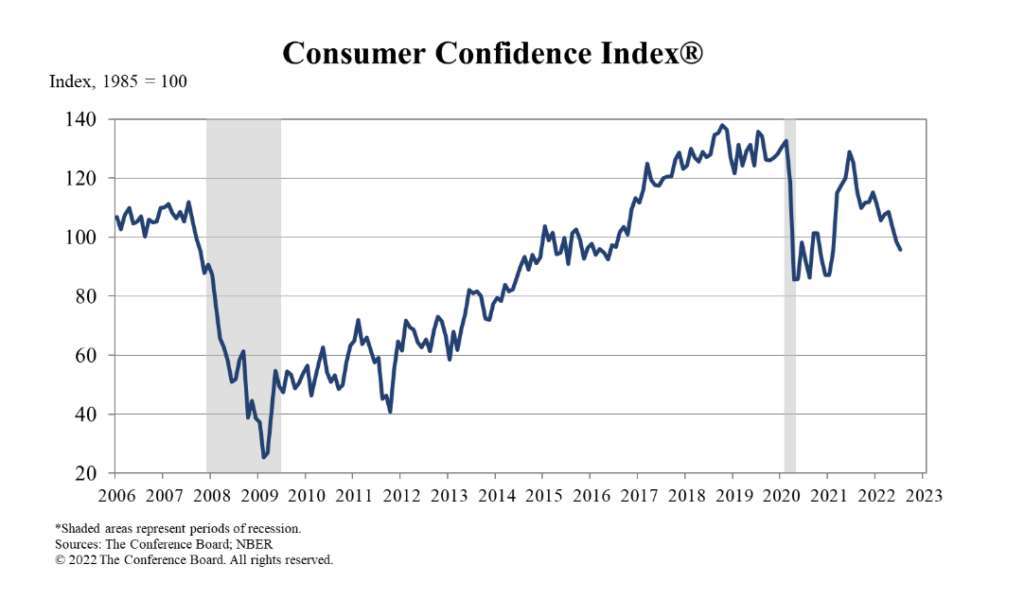

Consumer sentiment is on a downward slide once again, as Americans’ views on the US economy turn bleak amid surging inflation and rising interest rates.

The latest Consumer Confidence Index print from the Conference Board fell 2.7 points from a downwardly revised 98.4 in June to 95.7 in July. Last month’s reading was the lowest since February 2021, and marks the third consecutive month of declines. The weakening in sentiment comes as 40 year-high inflation continues to bite Americans’ pocketbooks, simultaneously as rising interest rates send debt costs substantially higher from pandemic lows.

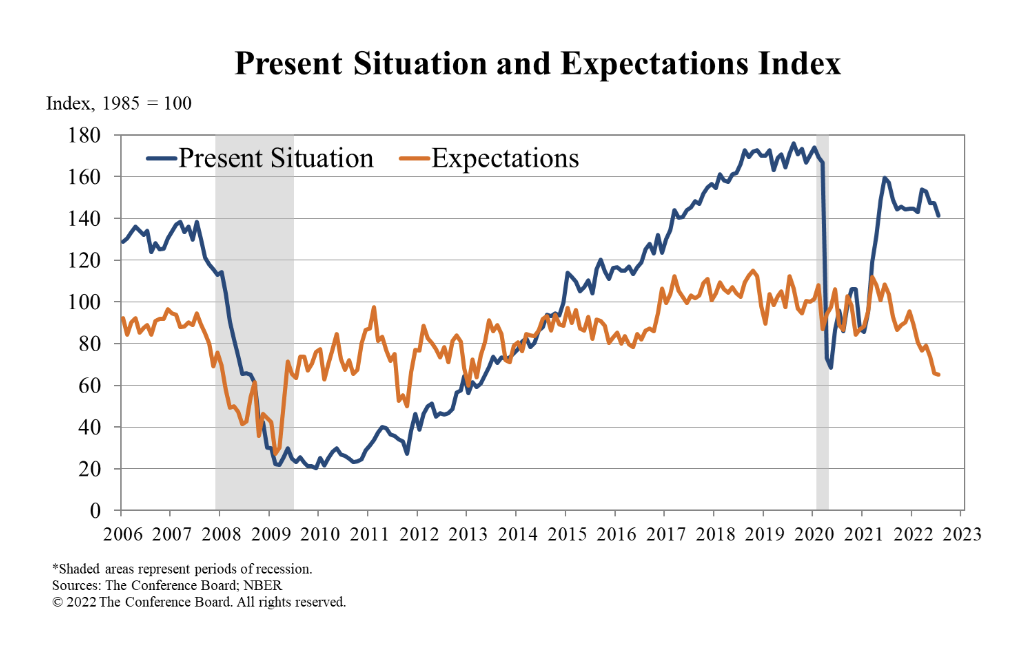

The declining confidence is indicative of an economy that is losing momentum, as consumers reduce their discretionary spending just as the Fed is backed into a corner of aggressive monetary policy tightening. The Conference Board’s gauge of future expectations slid to 65.3— the lowest since 2013, as respondents’ views on their financial prospects takes a pessimistic turn.

“Concerns about inflation— rising gas and food prices, in particular— continued to weigh on consumers,” said the Conference Board’s senior director of economic indicators Lynn Franco. “Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.”

The report also brought attention to a labour market that is rapidly losing its luster. The proportion of consumers who feel that there is still a “plentiful” amount of jobs available fell to just above 50%, a 12-month low. Indeed, an increasing number of companies are reporting dismal revenues and announcing layoffs, including Shopify, which on Tuesday announced it will be letting go 10% of its workforce.

Information for this briefing was found via the Conference Board and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.