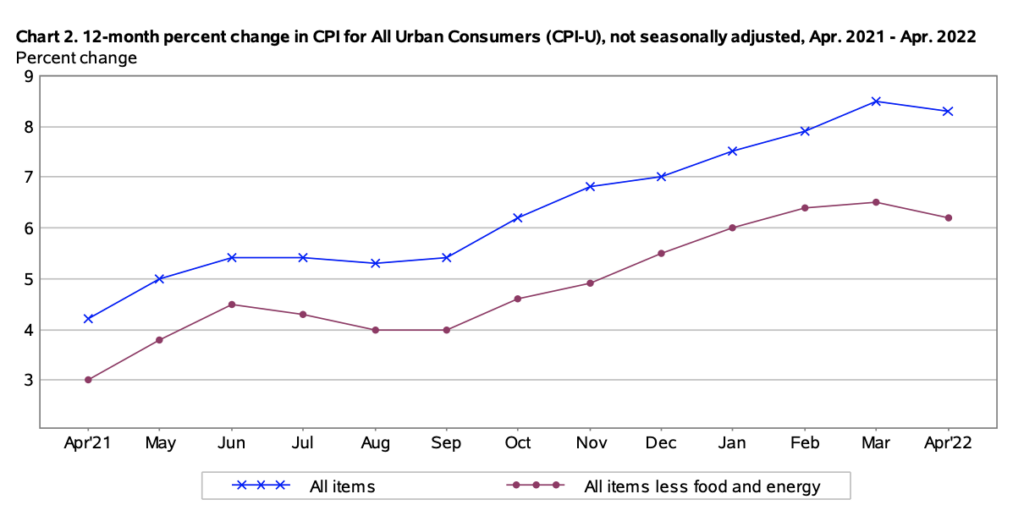

Following March’s jaw-dropping 8.5% surge in consumer prices, last month’s print was forecast to show the Fed has been working hard at cooling inflation, with forecasts calling for inflation to come in at 8.1% year-over-year as per Dow Jones estimates.

However, it appears that Fed Chair Jerome Powell hit the snooze button once again, because fresh-off-the-print CPI data from the BLS still shows an eye-watering print of 8.3%, the second-highest figure since 1982. Core CPI, which does not account for food and energy volatility, was up another 0.6% to an annual 6.2% advance against forecasts calling for a 6% increase.

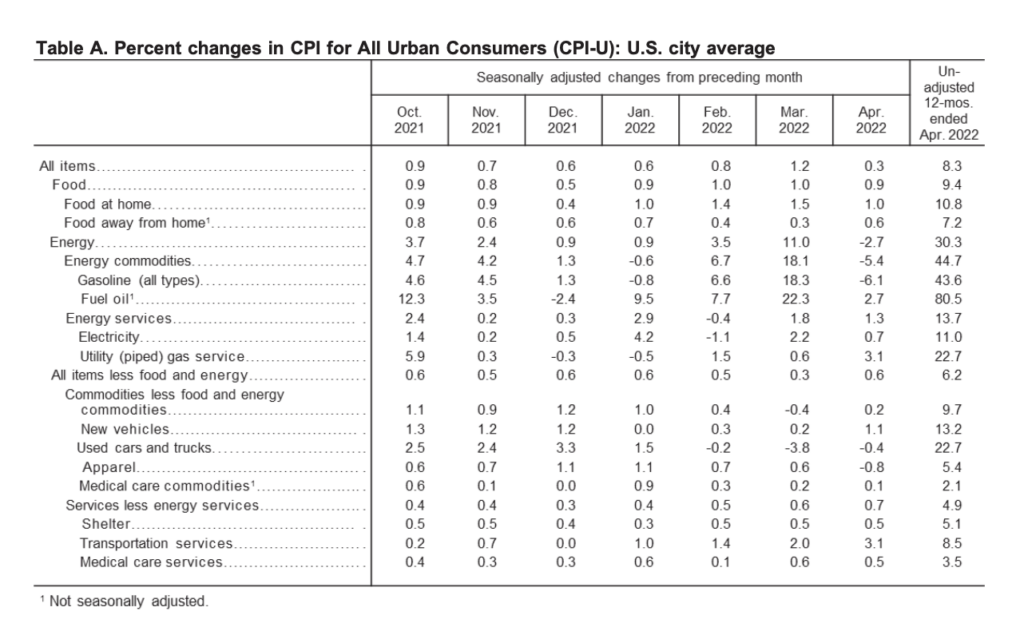

Although a month-over-month pullback in energy prices helped ease some of the pressure on the CPI, the ongoing surge in shelter, food, airline fares, and new vehicles kept consumer costs elevated last month. In fact, April’s print was just another record-setting month, with the food at home index rising 10.8% year-over-year, the biggest annual increase since November 1980, while the index for meat, poultry, fish, and eggs jumped a staggering 14.3% since April 2021, marking the largest yearly gain since May 1979.

Likewise, to keep a roof over one’s head also remained astronomically high last month, rising 5.14% since April 2021— the highest since March 1991, while rent inflation hit an annualized 4.82%, also the highest since 1991. Although energy prices modestly subsided last month, they were still up 30.3% since last year, forcing Americans to pay a staggering 43.6% more for gasoline, and 22.7% more for natural gas.

Lastly, and what is perhaps the most concerning for the average American, is that real wages slid for the 13th consecutive month in a row. So in other words, last month’s CPI print further cemented the notion that the Fed will turn up the hawkish rhetoric and continue increasing rates during each of the forthcoming FOMC meetings. Markets, brace yourselves.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.