Although the month of June showed an initial rebound in sentiment among Americans, the recent worsening of the coronavirus pandemic has caused preliminary July data to produce disappointing results.

According to a recent report published by the University of Michigan, preliminary sentiment data showed the sentiment index fell by 4.9 points to 73.2, thus effectively eliminating the 5.8 point gain in June. The consumer expectations index fell by 6.1 points to 66.2, while the economic conditions index declined by 3.9 points to 84.2.

Although the reopening of the economy gave consumers some confidence in June, by the beginning of July much of that confidence did not carry over. The resurgence of the coronavirus has caused some Americans to become less optimistic about their future financial situations. Still, 42% reported that their income situation has improved since the rock-bottom of the pandemic, but not significantly better than the previous month’s 39%. In addition, the majority of the financial improvements were among those under the age of 45, and with household incomes in the top third.

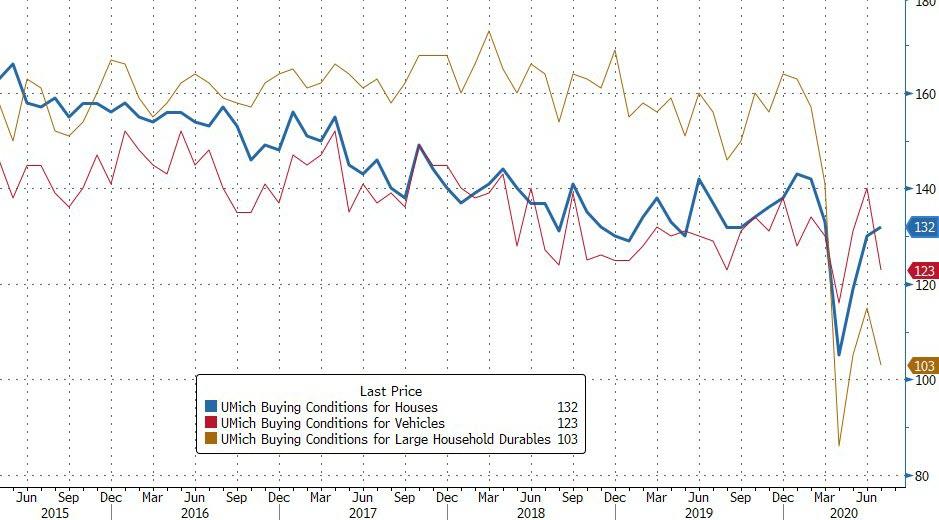

In the meantime, the beginning of July also saw an improvement in buying conditions, especially for the housing market, but declined substantially for items such as large durables and vehicles. Many consumers cited the ongoing income uncertainties and grim job prospects as the main reason for postponing purchases. According to Richard Curtin, who is the director of the survey, such declines are going to continue emerging over the next several months, given that coronavirus infections are out of control and the US economy continues to be hampered.

Information for this briefing was found via University of Michigan and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.