Consumer prices in the US rose at a slower pace than previously expected in February, putting inflation fears aside— for now.

With an unprecedented level of government stimulus spending and more on the way, all eyes were on the latest CPI figure to provide a gauge into the progression of America’s economic recovery. According to the Bureau of Labour Statistics, February consumer prices rose by 0.4% from the month prior, causing year-over-year prices to rise by 1.7%. Excluding volatility from food and energy costs, core CPI came in well below estimates, increasing by 0.1% last month and rising by 1.3% from year-ago levels.

The divergence is largely the result of subdued Used Car prices, and sliding costs for Apparel and Transportation services. However, the goods that Americans are actually buying— such as Energy, Food, and Shelter, have been climbing steadily.

According to the BLS, February food prices increased by 0.2%, with Food at home rising by 0.3% while Food away from home registered a steady decline from the preceding months. On the other hand though, the latest data from the Food and Agriculture Organization (FAO) of the United Nations revealed that global food prices soared to a six-year high in February.

In fact, the food price index, which tracks monthly price changes in commonly-traded food commodities, jumped by 2.4% last month, and is a whooping 26.5% higher compared to year-ago levels.

The BLS also reported that annual shelter inflation declined from 1.62% in the month prior to 1.47% in February— the lowest level since June 2011. Likewise, rent inflation fell to 1.96% from a reading of 2.05% in January, which is also the lowest in ten years. Paradoxically however, the S&P CoreLogic Case-Shiller Indices, which measures national home prices across the US, found that prices have actually soared to a ten-year high…

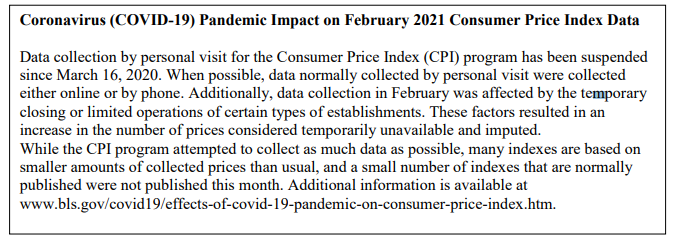

However, if the latest data comes as a surprise to many— which it likely does given the current rate of bottomless government spending (with a lot more on the way), an ongoing vaccine rollout, and increasing economic recovery optimism, it is worth noting that the Bureau of Labour Statistics acknowledged its latest CPI print suffers from significant data omission, which is likely skewing the much-anticipated results…

Nonetheless, the latest cooler than expected CPI data has caught the attention of markets, which breathed a sign of relief on the prospect of another month of subdued inflation.

Information for this briefing was found via BLS, the FAO, and S&P Dow Jones Indices. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.