Back in April, oil prices entered negative territory as coronavirus pandemic wreaked havoc across the US. The global supply cuts that followed helped oil prices rebound, but now that restrictions are slowly being lifted and Americans are starting to leave their homes after months of lockdown orders, the demand for oil is also starting to make a comeback. However, the oversupplied market still has a long way to go before it achieves equilibrium, and there are certainly going to be significant volatilities along the way.

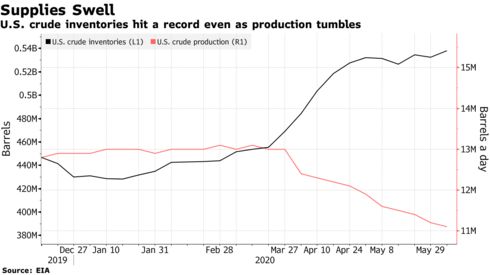

According to the Energy Information Administration (EIA), crude inventories suddenly increased last week, despite a decrease in oil production. Crude stockpiles in the US increased by 5.72 million barrels to a total of 538.1 million barrels, which is the highest on Bloomberg’s records which date back to 1982. Simultaneously, oil production declined for the tenth week in a row, at oil supplies at Cushing, Oklahoma fell below 50 million barrels. As a result, futures fell by 4.1%, causing oil to trade at $38 per barrel, ultimately eliminating all gains from the last two sessions.

On a slightly positive note however, ocean-going tankers that have been idly sitting for weeks are beginning to see some of the housed glut of North Sea oil diminishing. Since the onset of the pandemic, millions of barrels of crude oil has been stored on these vessels for the time being.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.