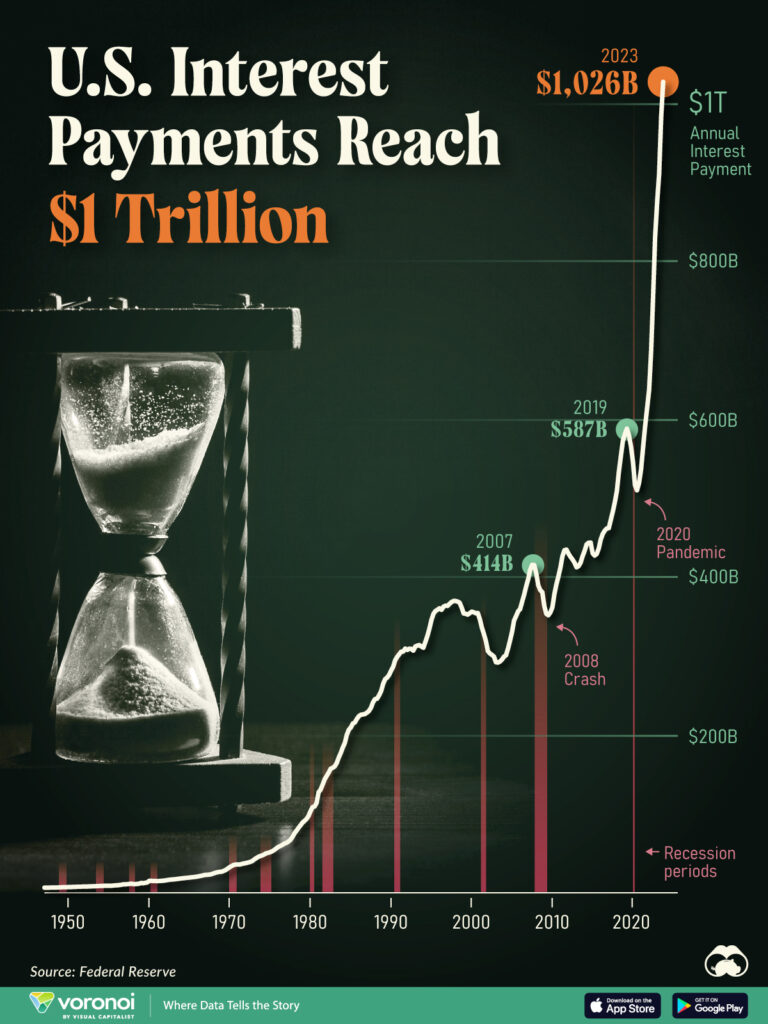

The United States government’s cost of servicing its national debt surpassed the $1 trillion mark in 2023, according to data from the Federal Reserve.

This staggering figure was driven by soaring interest rates and a record $34 trillion debt burden. Over the past decade, debt interest payments have more than doubled, fueled by massive government spending during the pandemic crisis.

The national debt is growing at an alarming rate of approximately $1 trillion every 100 days, equating to roughly $3.6 trillion per year. Consequently, the US government spent more than $2 billion per day on interest costs alone in 2023.

Moreover, the situation is exacerbated by the country’s steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This deficit has been accelerated by a 43% increase in debt servicing costs, a $31 billion increase in defense spending, and a $30 billion increase in funding for the Federal Deposit Insurance Corporation due to the regional banking crisis.

According to projections from the Congressional Budget Office (CBO), approximately 75% of the federal deficit’s increase will be attributable to interest costs by 2034, highlighting the urgency of addressing the nation’s mounting debt burden and its associated costs.

Information for this story was found via Visual Capitalist, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.