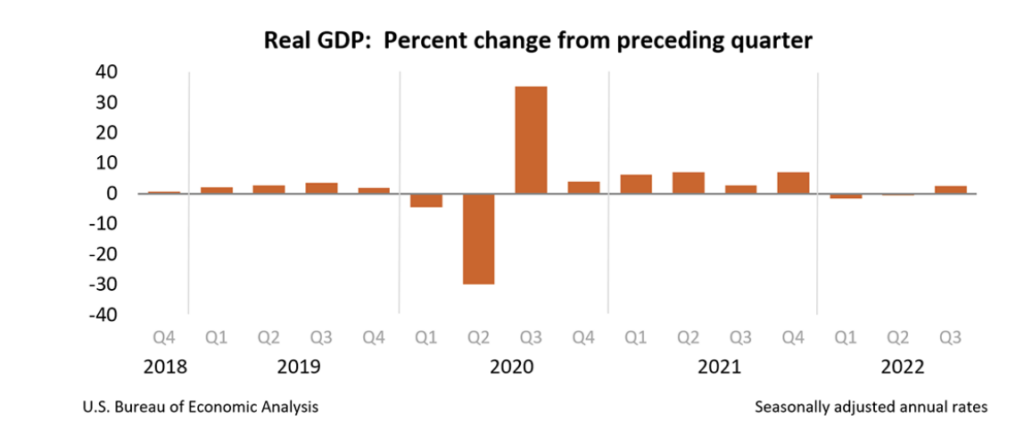

The US economy appears to have climbed itself out of the recessionary slump evident in the first half of the year, with GDP posting its first increase in the third quarter.

According to preliminary estimates from the Bureau of Economic Analysis, GDP grew 2.6% between July and September, coming in substantially higher than the 2.3% forecast by Dow Jones. The latest reading comes after two consecutive quarters of negative growth, which met the National Bureau of Economic Research’s official definition of recession. Much of last quarter’s GDP increase was attributed to a narrowing trade deficit, which economists consider to be a rare occurrence that likely won’t happen in forthcoming quarters.

Exports rose 14.4% in the third quarter, while imports, which are subtracted from GDP, fell 6.9%. As a result, net exports contributed 2.77 percentage points to overall economic output, meaning that the headline figure would have remained essentially unchanged from the prior quarter. The increase in economic output was also due to a rise in consumer spending, nonresidential fixed investment, and government spending. The BEA report showed that Americans shifted their spending from goods to services, with spending on the former falling 1.2% and the latter rising 2.8%.

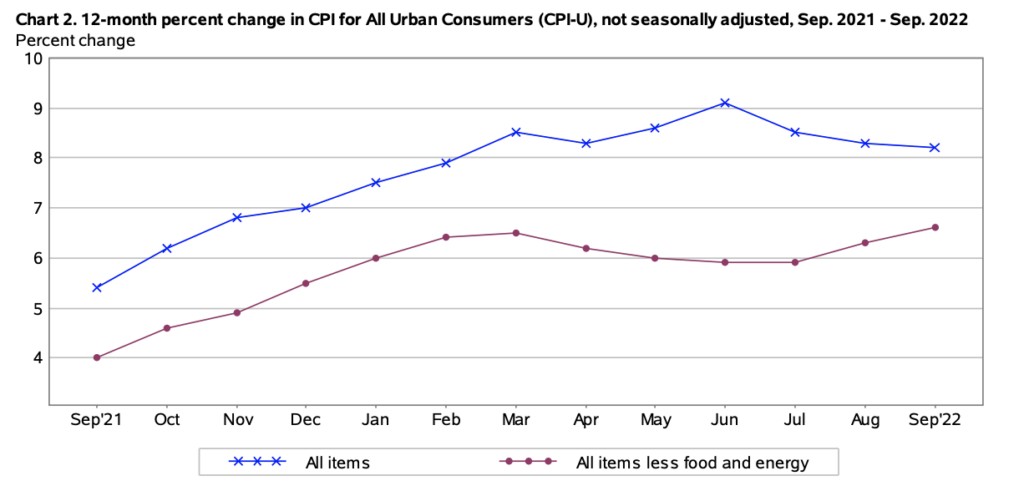

“Overall, while the 2.6% rebound in the third quarter more than reversed the decline in the first half of the year, we don’t expect this strength to be sustained,” said Capital Economics economist Paul Ashworth, as cited by CNBC. “Exports will soon fade and domestic demand is getting crushed under the weight of higher interest rates. We expect the economy to enter a mild recession in the first half of next year,” he added. The latest report comes against an economic backdrop of decades-high inflation and a central bank pulling out all its hawkish monetary policy tools to unwind its unprecedented money-printing spree— even if it risks tipping the US economy into yet another recession.

Information for this briefing was found via the BEA and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.