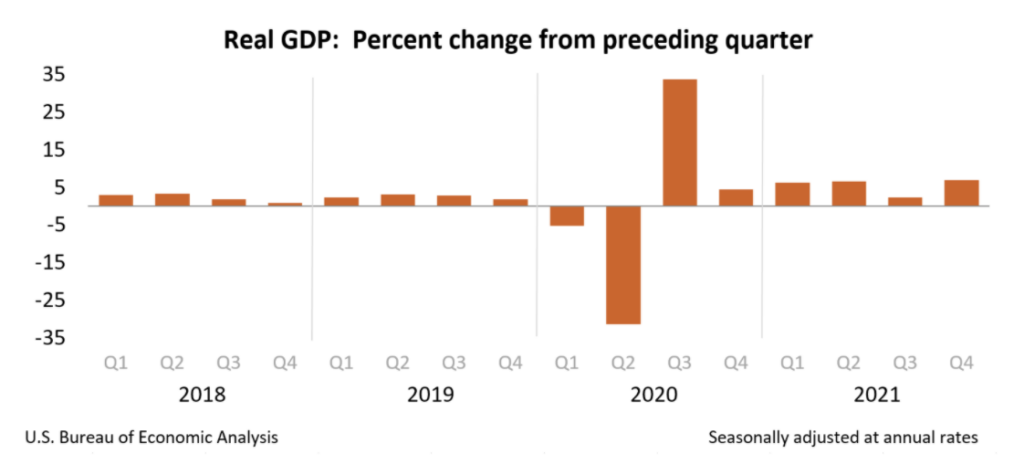

America’s economy expanded by more than forecast in the final three months of 2021, further indicating that the recovery is gaining momentum and overcoming challenges created by the pandemic.

Preliminary data from the Commerce Department showed that GDP rose from an annualized 2.3% to 6.9% in the fourth quarter of last year, substantially surpassing consensus forecasts from economists polled by Bloomberg, which called for a growth of 5.5%. The majority of the gains primarily came from private inventory investment, business spending, and a strong boost in consumer spending, bringing the pace of annualized GDP growth to 5.7%— the sharpest pace since 1984.

Inventories contributed 4.9 percentage points to the economy’s growth in the fourth quarter, as ongoing global supply chain disruptions prompted businesses to maintain adequate inventory levels in face of soaring demand for goods. Gross private domestic investment, which measures the amount of business spending, surged 32%. In the meantime, consumer outlays, which accounted for over two-thirds of economic output, were up 3.3% between October and December.

However, the emergence of the Omicron variant may have stifled economic production since the fourth quarter, as an increased number of Americans stayed home and further indented consumer demand. Moreover, the three month period ending in December also coincided with the holiday shopping season, which typically helps temporarily boost consumer spending.

Nonetheless, the latest GDP reading comes just as consumer prices continue to soar to the highest in nearly 40 years, due to supply chain disruptions, unprecedented quantitative easing, robust demand, and material shortages. With that mind, the Fed signalled during its latest policy meeting that it was prepared to begin tightening interest rates as early as March, as well as begin phasing out asset purchases and unwind bond holdings.

Information for this briefing was found via the Commerce Department and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.