It’s unofficially official: central banks are losing control of galloping inflation, as the “transitory” deterioration of purchasing power becomes in fact, permanent.

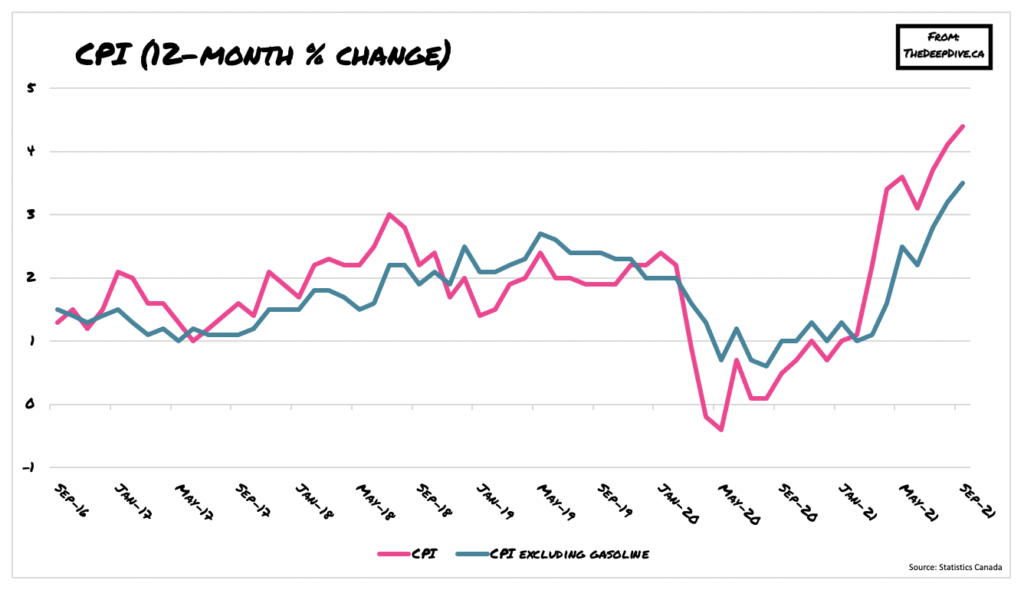

For the sixth month in a row, “transitory” inflation has risen above the Bank of Canada’s control range, as a variety of factors — most stemming from supply bottlenecks — become stubbornly persistent. On Wednesday, Statistics Canada reported that the consumer price index jumped another 0.2% between August and September, and is now sitting 4.4% higher compared to the same period one year ago. This is the sharpest increase since February 2003, and outpaces expectations calling for an annual inflation reading of 4.3% by economists polled by Bloomberg. Core inflation, which excludes gasoline, was up 3.5% year-over-year.

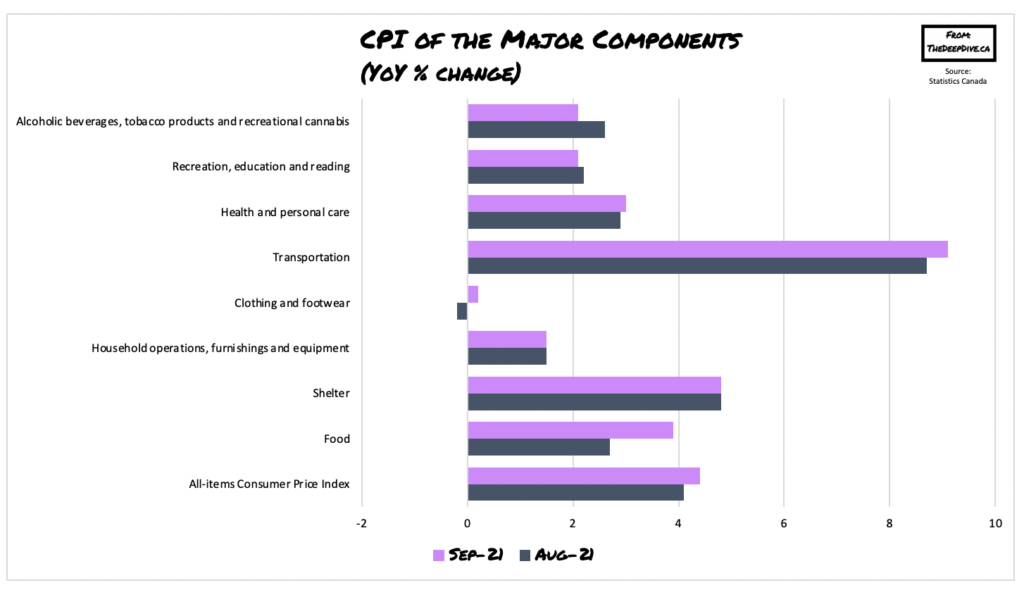

Indeed, the internals went from bad to worse, as all major components of the index were up, with transportation, shelter, and food prices contributing the most to last month’s increase. Consumers paid 32.8% more for gasoline compared to September 2020, as major oil-producing nations continue to keep output curbed despite a strengthening recovery in global demand.

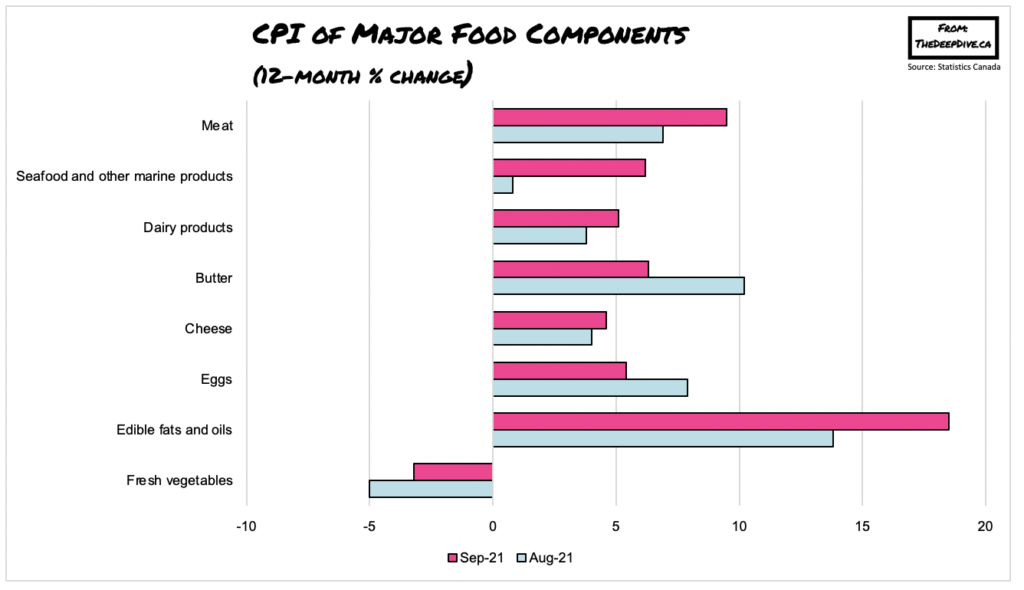

Food prices also continued their acceleration, rising 3.9% year-over-year in September, following a gain of 2.7% in the prior month. Meat prices were up 9.5% across nearly all sectors, marking the fastest increase since April 2015. Dairy products jumped 5.1% last month, while prices for seafood products were 6.2% higher compared to September 2020. In contrast, fresh vegetable prices subsided last month, falling 3.2%.

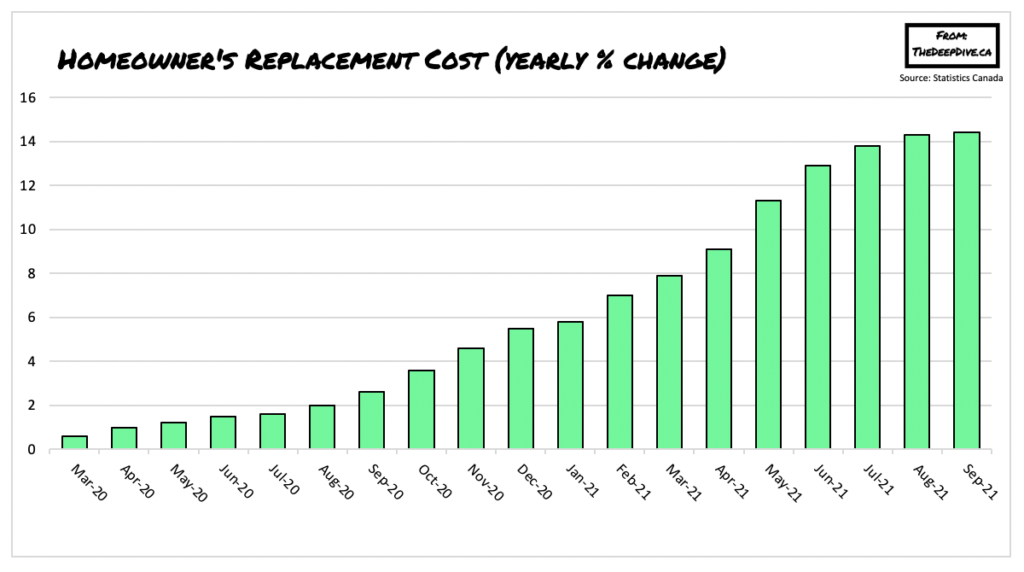

But wait, it gets worse: to underscore the point of out-of-control inflation, the homeowners’ replacement cost index— which is related to the price of new homes, continues to accelerate by the fastest pace in over 30 years. The index jumped another 14.4% in September after rising 14.3% in August, as elevated construction costs and historically low interest rates continue to keep Canada’s real estate market red-hot.

The latest rip-your-face-off inflation figures pose an inconvenient dilemma for Bank of Canada Governor Tiff Macklem, whom has up until now insisted that rising price pressures are merely temporary. “The fastest rate of price inflation since 2003 will mean the Bank of Canada will need to acknowledge the risk that pressures may persist,” said Bloomberg economist Andrew Husby.

Although Macklem may have had an epiphany in recent weeks when he finally acknowledged that the worsening global supply chain disruptions may in fact, persevere longer than expected, when he conceded that inflation is taking “a little longer to come back down.” Despite this, though, the Bank of Canada is not expected to raise its policy rate anytime soon, but will reduce its weekly government bond purchases from $2 billion to $1 billion come its October 27 policy decision.

following the report, the Canadian dollar jumped to a session high, before paring back gains and settling at around $1.232 at the time of writing.

With prices continuously skyrocketing into the exosphere that would make even Jeff Bezos shed a tear, when is this “transitory” part of inflation supposed to start? Asking for a friend.

Information for this briefing was found via Statistics Canada and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.