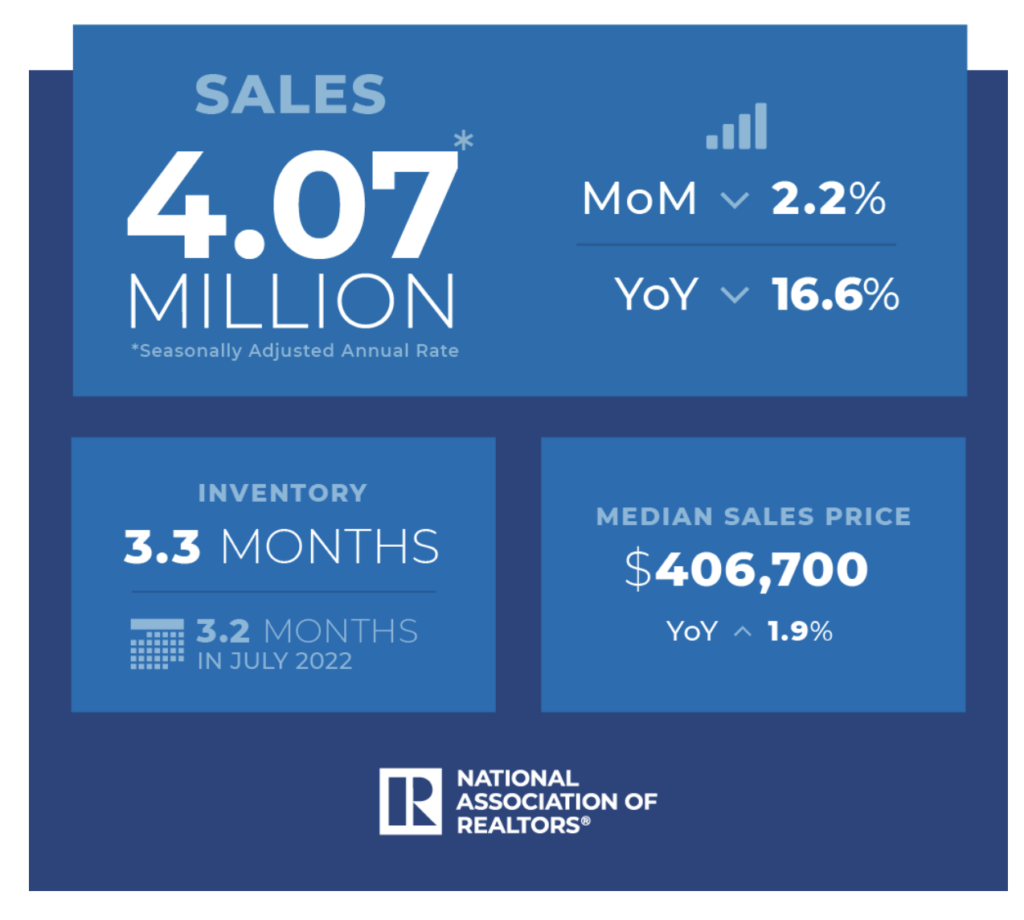

In July, previously owned home sales saw a decrease of 2.2% to an annualized rate of 4.07 million units, marking the slowest July since 2010, the National Association of Realtors (NAR) reported.

The latest figure marks a 16.6% drop from the sales levels witnessed a year ago, with factors behind the decline including mortgage rate increases to over 7% and a constrained housing supply, which is now at its lowest since 1999.

Existing home sales just fell 2.2% in July, putting existing sales down 16.6% over the last year.

— The Kobeissi Letter (@KobeissiLetter) August 22, 2023

Now, existing homes sales are at their lowest since 2010.

We are about to see new home prices drop BELOW existing home prices for the first time since 2005.

Truly historic.

(1/7) pic.twitter.com/XHgMP87hyn

At July’s end, there were only 1.11 million homes available— 50% less than pre-Covid levels, which is equivalent to a 3.3-month supply. Historically, a balanced market typically has a six-month supply. This scarcity continues to heighten competition and inflate prices, with the median home price in July being $406,700— a 1.9% year-over-year increase.

The market still signals strong demand as three-quarters of sold homes were listed for under a month, with nearly a third selling above their list price. Danielle Hale of Realtor.com notes that homeowners are choosing to stay in their current homes, which is restricting available options. Notably, luxury homes priced over $1 million saw the smallest sales decline, likely due to their abundant supply.

Interestingly, first-time home buyers made up 30% of July sales, revealing a resurgence in their market participation, and a preference for Federal Housing Administration loans due to their minimal down payments.

Information for this story was found via NAR and the sources mentioned within the article. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.