Mortgage rates in the United States have surged back up to 7% for the 30-year fixed rate, indicating another potential collapse in homebuyer demand and urging sellers to prepare for price cuts during the summer.

The recent increase in mortgage rates poses a significant challenge for prospective homebuyers, limiting their affordability and ability to qualify for mortgages. An analysis from Reventure’s Nick Gerli says high mortgage rates are expected to further decrease homebuyer demand during a time when it should be at its peak.

A comparison between the cost of buying a house and renting an apartment reveals the current lack of affordability in the US housing market. Renting is currently a much more affordable option, with the median rent in America being approximately $1,850 per month, about 30% cheaper than the median cost to buy, which stands at $2,700 per month. This disparity in cost between buying and renting is the largest in US history, indicating a historical lack of affordability that may contribute to a decline in homebuyer demand.

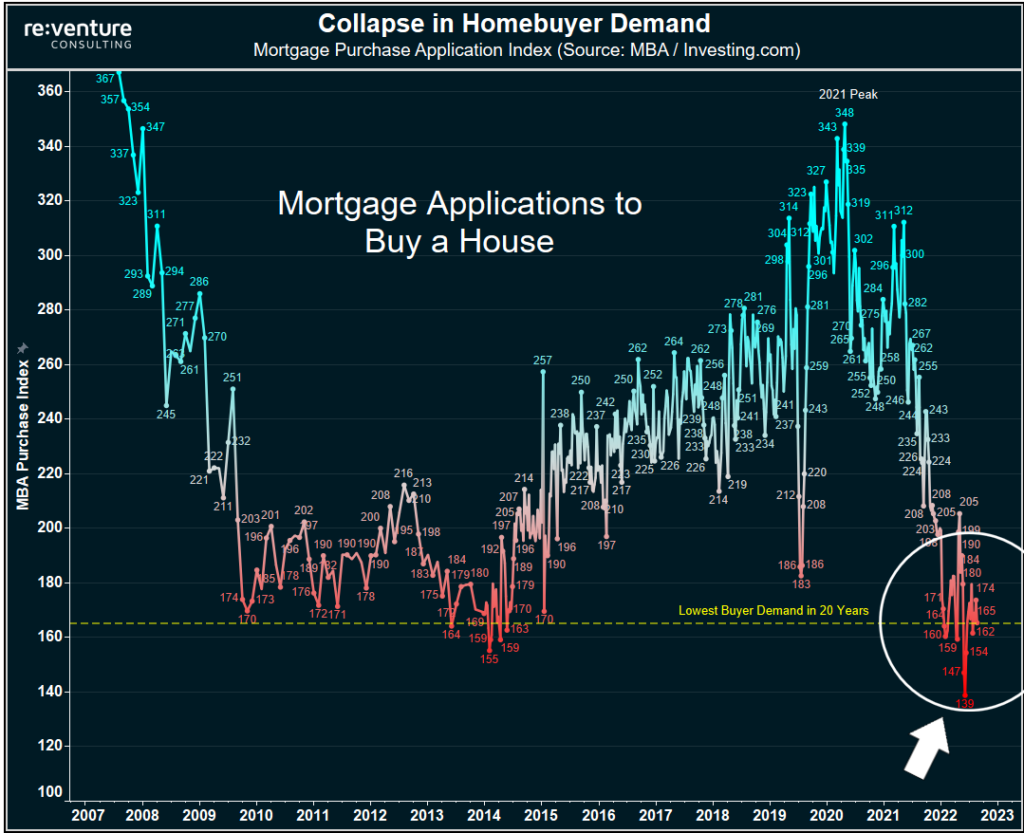

Notably, buyer demand is already at an extremely low point. Mortgage applications for home purchases in May were down 26% compared to the previous year and over 50% compared to the peak of the pandemic in 2021. Citing data from the Mortgage Bankers Association, Gerli points out a 20-year low in buyer demand.

The impact of higher mortgage rates is expected to be most pronounced in expensive markets, where the cost of buying a house is significantly higher than renting. Locations like Los Angeles-Orange County, where the typical buyer needs to spend $5,400 per month on mortgage interest, taxes, and insurance, compared to $2,900 per month for renting an apartment, may experience a decline in both demand and home prices.

California cities, along with metros like Seattle, Salt Lake City, Austin, and Portland, dominate the list of unaffordable markets.

Interestingly, there are still a few cities in the US where buying is cheaper than renting but the price difference is marginal, if not almost equal. Memphis, Tennessee, for example, has a slightly lower cost to buy at $1,469 compared to renting at $1,491. These cities may fare better in the current high mortgage rate environment.

Overall, the most affordable markets are located in the Midwest and Deep South, where lower appreciation rates in the past decade allow for more affordable housing options.

The sudden surge to 7% mortgage rates has caught many by surprise, as expectations were for rates to decline. According to Gerli, the rise in rates may be influenced by global factors, considering Canada and the United Kingdom are also seeing the same trends.

“Perhaps global bond buyers are expecting inflation to get worse in coming months. And demanding higher yields on government bonds as a result to compensate for higher inflation into the future,” he wrote, adding that the recent numbers have all been confusing, “lots of mixed signals are being sent throughout the economy.”

The analyst says he doesn’t see the high mortgage rate holding up for long as the economy and financial system are not equipped to handle them, pointing out that ”the last time rates went to these levels in early March, Silicon Valley Bank happened.”

Other analysts mirror the outlook.

“The 30-year fixed-rate mortgage increased modestly for the second straight week, but with the rate of inflation decelerating rates should gently decline over the course of 2023,” Sam Khater, chief economist at Freddie Mac’s Economic and Housing Research division, said in a press statement last week. “The prospect of lower mortgage rates for the remainder of the year should be welcome news to borrowers who are looking to purchase a home.”

Information for this story was found via Reventure, Mortgage Bankers Association, Forbes, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.