The Federal Reserve has elected to maintain interest rates yet again, keeping them between 5-1/4 to 5-1/2 percent. This decision comes against the backdrop of solid economic expansion, marked by robust job gains and a persistently low unemployment rate. Despite a slight easing, inflation continues to hover above the desired level.

The Federal Reserve remains focused on getting to anchor inflation back to its 2 percent target over the longer horizon, while ensuring maximum employment. The Committee’s latest evaluation suggests a balancing of risks pertaining to its employment and inflation goals, albeit under the shadow of an uncertain economic outlook.

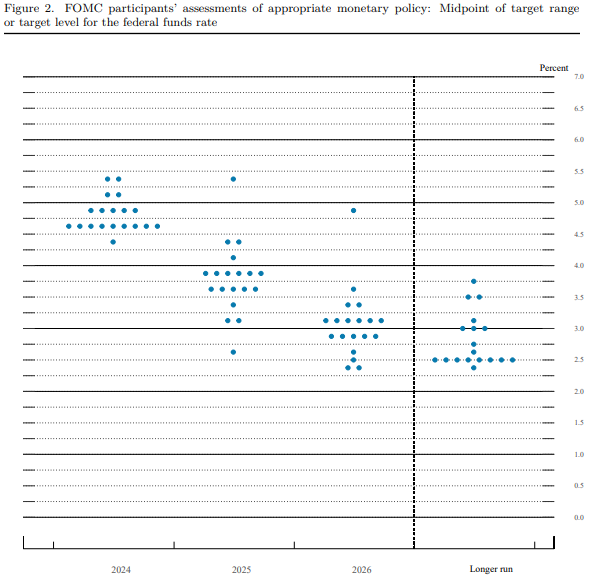

For those looking for interest rate relief, the latest dot plot released by the Federal Reserve suggests that as much as three rate cuts may occur yet before the end of the year, which would bring rates to a range of 4.5% to 4.75% by years end.

Forecasts for 2025 however have cut back from four rate cuts to just three.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.