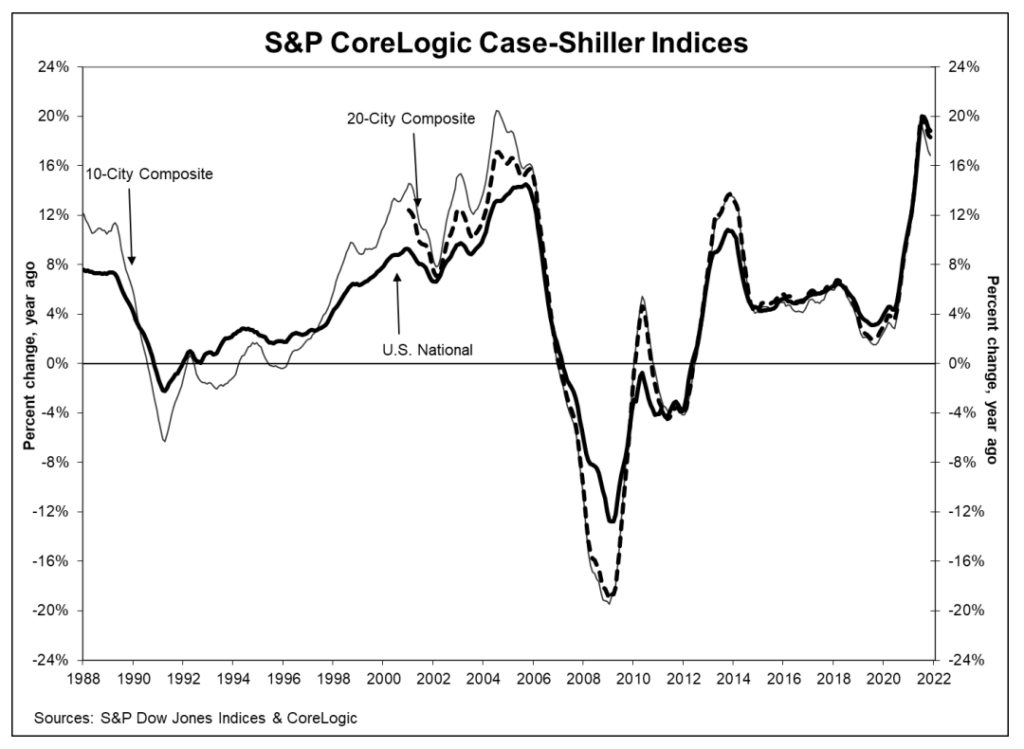

US home prices continued their upward trend to finish off 2021, albeit at a slower rate, as the housing market entered its traditionally slower season in November.

The S&P CoreLogic Case-Shiller National Home Price Index reading for November showed that home prices rose 18.8% in November, marking yet another substantial annual gain for America’s housing market. However, the increase was at a slower pace compared to October’s 19% year-over-year gain, as real estate prices show signs of decelerating for the fourth straight month.

But, even despite November’s deceleration, the index reading was still the sixth-highest on records dating back 34 years. Housing markets in the Phoenix, Tampa, and Miami areas reported some of the sharpest annual increases, with gains of 32.2%, 29%, and 26.6%, respectively.

In the meantime, the 30-year mortgage rate remained relatively unchanged at around 3% to 3.25% between October and November. Although they were modestly higher compared to last summer, mortgage rates are still historically low, giving homebuyers more purchasing power and helping fuel home prices even higher.

Information for this briefing was found via S&P Global. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.