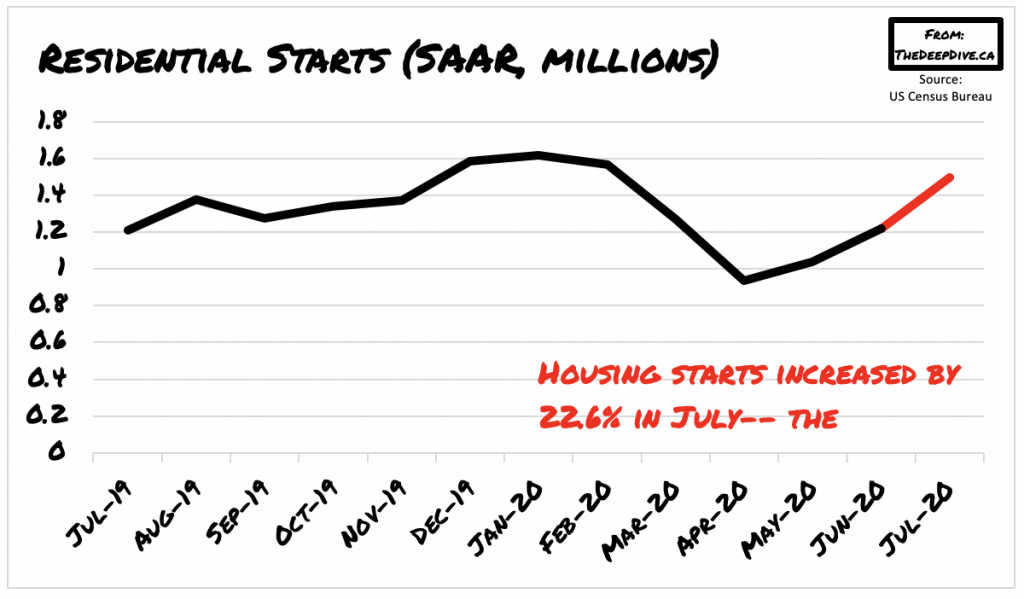

It appears that housing starts and applications in the US significantly surpassed expectations, suggesting that home builders are acknowledging the surge in demand amid historically-low interest rates.

According to a report released on Tuesday, residential housing starts climbed by 22.6% between June and July – the biggest jump since 2016. Previously, Bloomberg analysts were calling for a 1.25 million increase, but to their surprise, housing starts topped by an annualized rate of 1.5 million from the month prior. Single-family starts increased to 940,000, while multi-family starts, which have a tendency to become volatile given that the category also includes condos and apartment buildings, rose by an annualized rate of 556,000, which translates to a staggering increase of 58.4%.

In the meantime, building applications, which serve as an indicator of future developments, rose by 18.8% in July, the highest spike since 1990. Bloomberg economists had initially projected the annualized rate to reach 1.33 million, but to everyone’s surprise the rate of permits skyrocketed by 1.5 million, suggesting the surge in demand amid record-low interest rates has surpassed February’s pre-pandemic levels. Moreover, the backlog of residential projects that have not yet begun but have been authorized increased to 101,000 in July.

The increase in demand for housing specifically for residential and single-family units is likely due to the fact that many Americans have been recently high-tailing it out of packed urban areas in search of more room and safety from the country’s soaring infection rates. That, coupled with record-low interest rates is contributing to the housing industry’s apparent resiliency.

However, the resiliency in the housing market has also caused the demand for building supplies to increase, and consequently spurring an increase in lumber prices as well. The supply of lumber has contracted significantly as tiny beetles have been destroying timber supplies around the world. In fact, British Columbia has lost over 15 years worth of log supplies, which is enough material to supply the construction of 9 million single-family homes.

Information for this briefing was found via the Wall Street Journal and CNN. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.