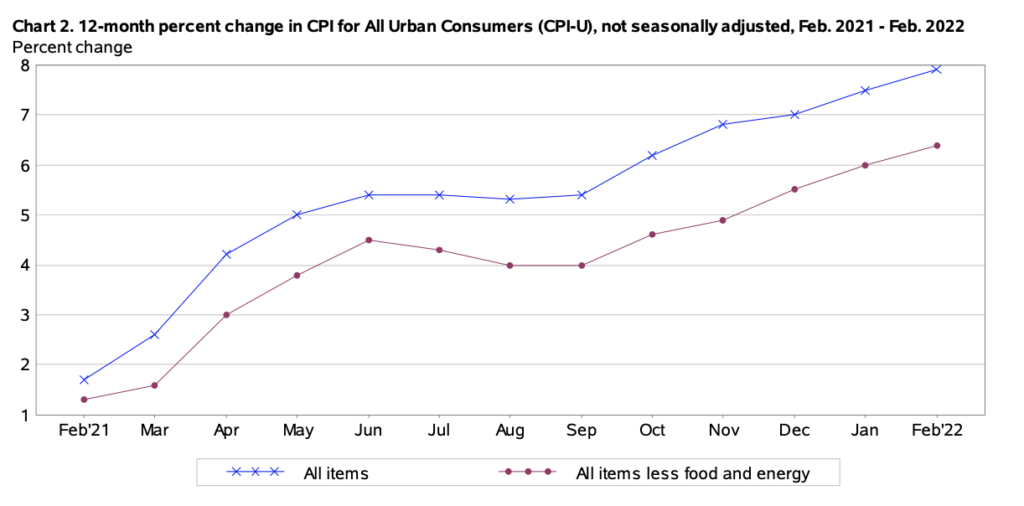

Back in January, when annual CPI hit an eye-watering 7.5%, markets were preparing for February to be the peak for inflationary pressure, because come March— the Fed will have everything under control. Well, according to the Bureau of Labour Statistics’ fresh-off-the-press CPI print, it appears that February looks more like a new baseline, because consumer prices EXPLODED by an annual 7.9%— the highest since January 1982!

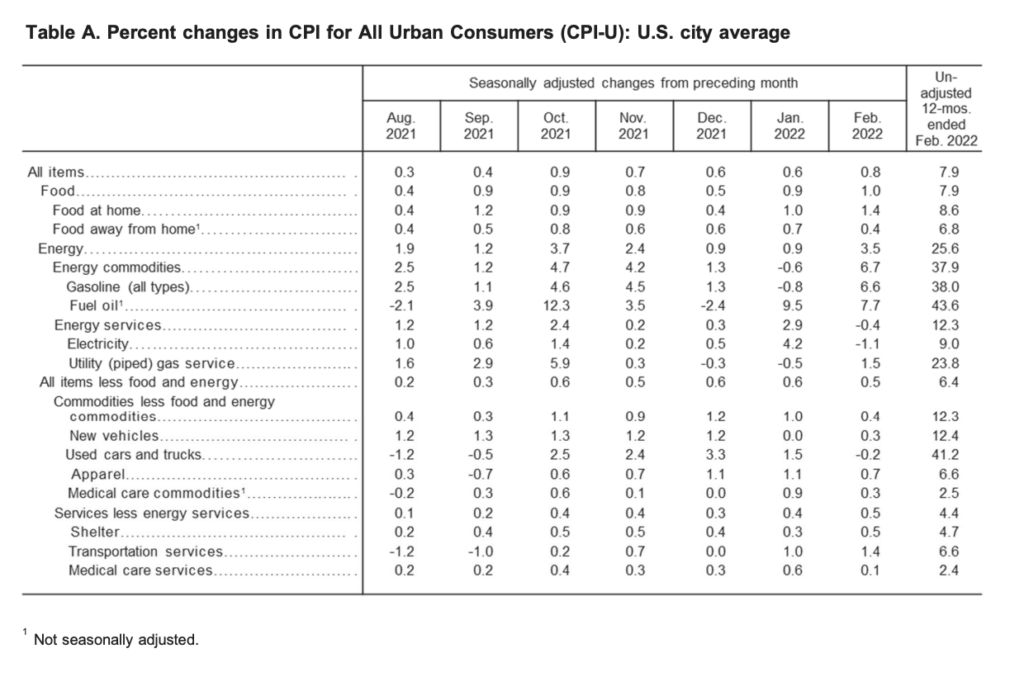

February marks the 21st consecutive month of CPI increases, with all main categories noting price gains— particularly gasoline, which accounted for one-third of the monthly increase. Core CPI, which does not account for volatile components such as food and energy, was up 6.4% since last year, marking the sharpest 12-month increase since August 1982. Continuing the record-breaking streak, the energy index was up by an annual 25.6%, while the food index jumped 7.9%— the biggest increases since July 1981.

With February’s CPI print coming in with another scorcher, Fed Chair Jerome Powell will be caught between a rock and a hard place come the next FOMC meeting. As SmallCapSteve points out, the Fed will have no choice but to raise rates into what’s looking like an inverted yield curve, with a spread of about 26 basis-points between the 2 and 10-year yield.

Jerome Powell rn: pic.twitter.com/NFvZ6WrJiU

— Hermina Paull (@HerminaPaull) March 10, 2022

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.