With each passing month, the Fed continues to incrementally lose its grip on inflation, as prices consecutively exceed expectations and broad-based increases creep into all sectors of the economy.

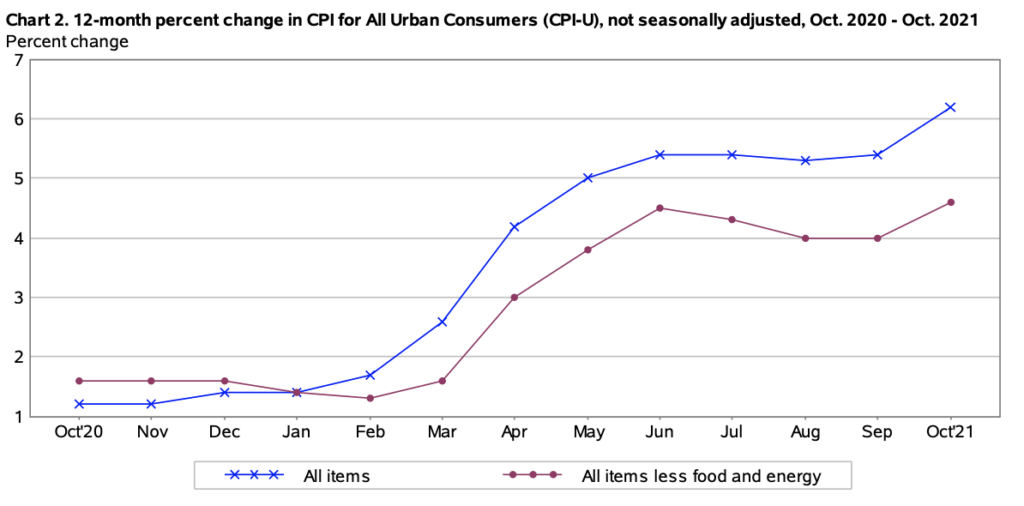

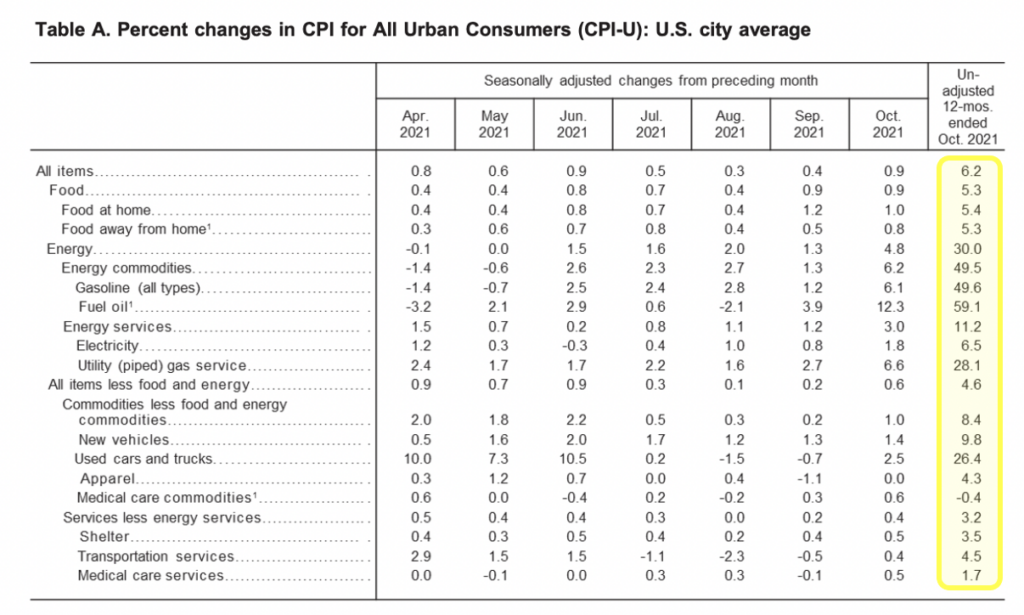

Following a troubling PPI print that hit record-highs in October, the latest CPI figures just released from the Bureau of Labour Statistics further corroborate that inflationary pressures are anything but transitory. Prices paid by consumers jumped another 0.9% from the month prior to an annualized 6.2% in October, marking the sharpest increase since 1990 and outpacing the 5.9% consensus estimate among economists. Core inflation, which does not take volatile components such as food and energy into account, was up 0.6% from September and 4.2% from the same period one year ago, and also the largest increase since 1991.

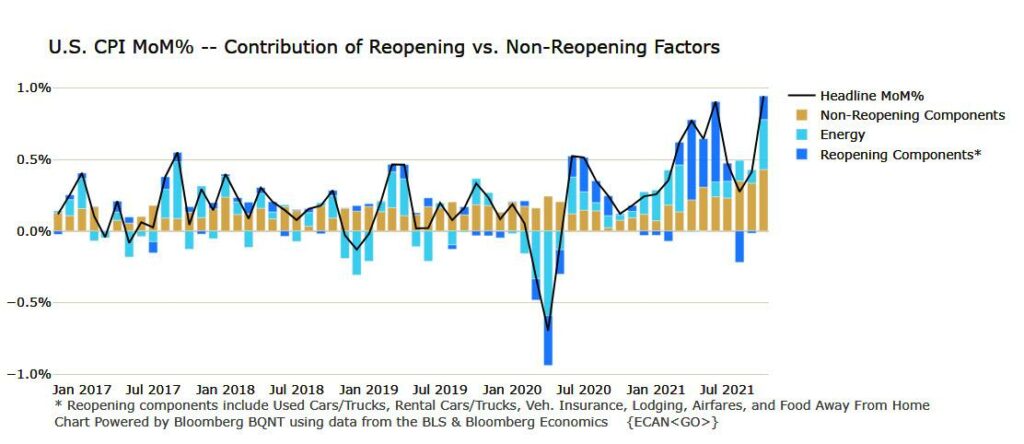

As Bloomberg highlights, last month’s jump in CPI was increasingly driven by price acceleration across components unrelated to the economic reopening, suggesting that persistent inflation is gaining momentum.

Consumers paid an eye-watering 30% more for energy compared to October 2020, as skyrocketing gasoline and natural gas prices continue to hammer already-strained pocketbooks. Prices for used cars and trucks were also alarmingly higher in October, rising by more than 26% year-over-year as ongoing chip shortages weigh down on the supply of vehicles. The shelter index also maintained its momentum upwards, rising another 0.5% to an annualized 3.5%, while food prices accelerated 5.3% from one year ago.

Last month’s alarming gain in inflation further pins the Fed against an even bigger rock and a hard place, as price pressures become stubbornly more persistent and higher than Fed Chair Jerome Powell and his minions firmly asserted. In the meantime, US President Joe Biden took the latest CPI print as a nudge to finally begin freaking out about inflation, and unlike the Fed, he will be doing something about it!

“I have directed my National Economic Council to pursue means to try to further reduce these costs, and have asked the Federal Trade Commission to strike back at any market manipulation or price gouging in this sector,” he said in a statement. Indeed, Biden is correct in that it finally time to shed some crocodile tears over soaring prices, but in the amusingly ironic world that we live in, all of his initiative is happening just as the White House is planning to shove trillions of dollars more in fiscal stimulus into the economy, which will create even higher prices— but I digress.

Information for this briefing was found via BLS and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.