Applications for jobless benefits unexpectedly dropped last week, as US firms remain unwilling to reduce their workforce.

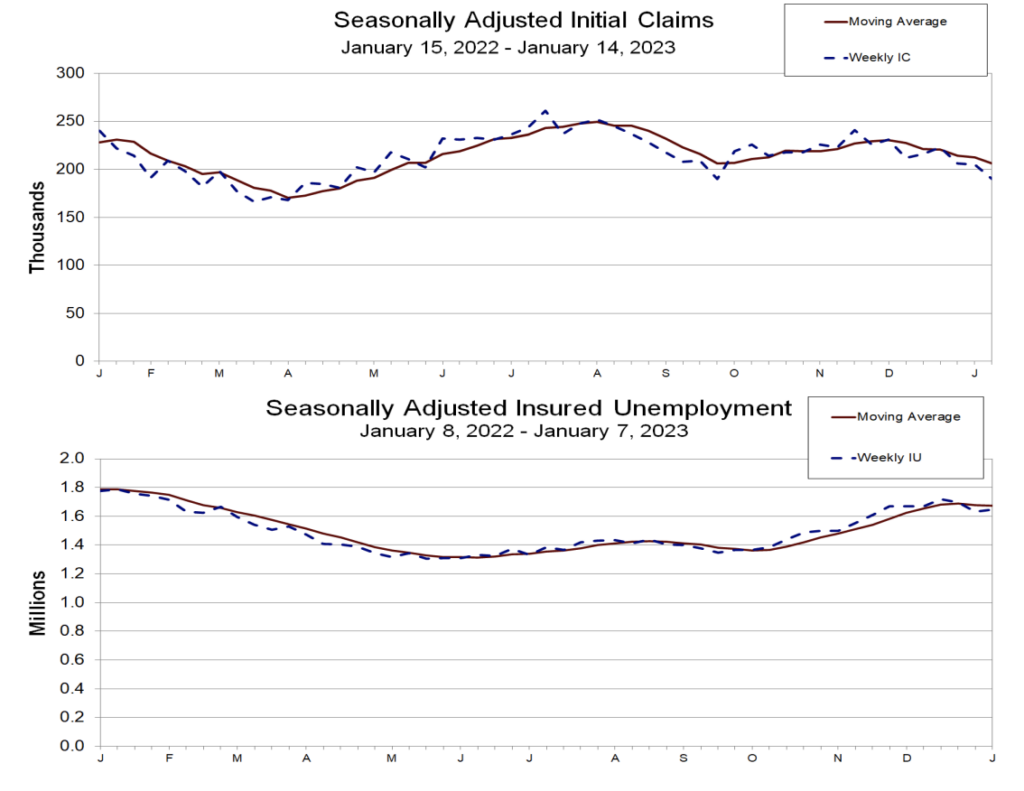

Latest data from the Department of Labour showed that initial jobless claims fell by 15,000 to 190,000 for the week ending on January 14, against economists’ forecasts calling for 214,000 unemployment applications. Continuing claims, which count the number of Americans actively receiving jobless benefits and lag one week behind initial figures, increased to 1.65 million for the week ending on January 7.

Although tens of thousands of Americans are being laid off across the tech sector, the overall US labour market remains robust. December’s unemployment rate slumped to 3.5%— the lowest in fifty years, as companies continue to hire workers thanks to ongoing strong consumer demand. However, economists cited by Bloomberg foresee more layoffs en route, as rising interest rates force businesses to cut back on expansion plans.

Information for this briefing was found via the DOL and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.