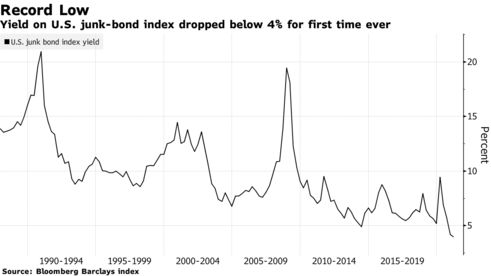

For the first time ever, the US junk bond average yield fell below 4%, as a frenzy of investors piled into junk bonds in search of higher returns.

The asset class, which has always been known for its high yields at the expense of high risk, has seen an unprecedented level of demand over the past several months. Yield-hungry investors have been flocking to the junk bond market in search of higher returns, after loosing appetite for the “not so high” yields offered by lower risk bonds, such as Treasury’s. As a result, the Bloomberg Barclays U.S. Corporate High-Yield index dropped to 3.96% on Monday, marking the sixth straight session of declines.

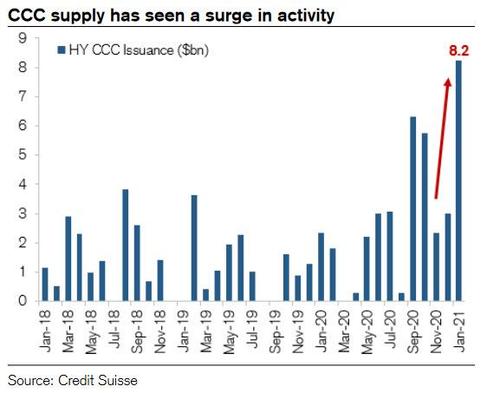

The soaring demand for junk bonds, many of which have notably been backed by the Federal Reserve (which in 2020 indulged in a buying spree of numerous high yield ETFs), has even spilled into the riskiest rated CCC tier, forcing supply levels to record-lows. In fact, the demand for debt rated CCC has exceeded supply so much, that some money managers have begun instructing companies to borrow, rather than wait for deals to emerge.

As Credit Suisse points out, the growing fondness for the lowest quality paper has lead to a surge in issuance, as January recorded $8.2 billion in CCC supply — the most active month for the tranche since the financial crisis. With bonds rated CCC significantly outperforming the remainder of the market for three straight months, it means there is essentially no difference between the numerous junk bond tranches, with notes rated BB averaging a yield of 3.05%, and single-B notes yielding around 4.3%.

Although the barrage of junk buying has ignited optimism amongst zombie companies that can now delve into further cash burning to fund their subsistence, the entire situation sends a strong signal to investors holding bonds at the top of the market: even the slightest bump in the road would send yields surging. However, it appears that even the institutional investors have no cause for concern — in fact, some of them want the junk bond party to continue on.

According to TwentyFour Asset Management head of US credit David Norris, CCC bonds may be the best kind of credit this year yet: “this robust new issue pipeline of lower-quality credit is worth poring over as there are likely to be some good stories in here for investors with sufficient liquidity to get involved,” he told Bloomberg. However, momentarily plummeting back to the fundamentals, suggests that the party will only continue… as long as the central bank continues funneling billions of dollars into the market.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Bond Junkies: Federal Reserve to Start Buying High Yield Corporate Bonds

In the duration of a month, over 16 million of unemployed Americans have been desperately...