As many Americans continue to struggle to meet their debt obligations amid the coronavirus pandemic, it appears first-time homeowners have been hit the hardest.

According to a recent report by the Mortgage Bankers Association, the second quarter of 2020 saw mortgage delinquencies soar by 8.22%, after increasing 4% from the previous quarter. This is the sharpest jump in the survey’s history, suggesting that the economic effects from the coronavirus pandemic are far from over.

The report also found that some homeowners are struggling significantly more than others. FHA mortgages, which are specific to first-time homebuyers and those that are considered low-income, saw delinquencies amount to nearly 16% – the highest on record. Although many of those homeowners that are facing difficulties in making their mortgage obligations are able to defer their payments for up to a year as per the mortgage forbearance program, the slow labour market recovery is beginning to raise some concern.

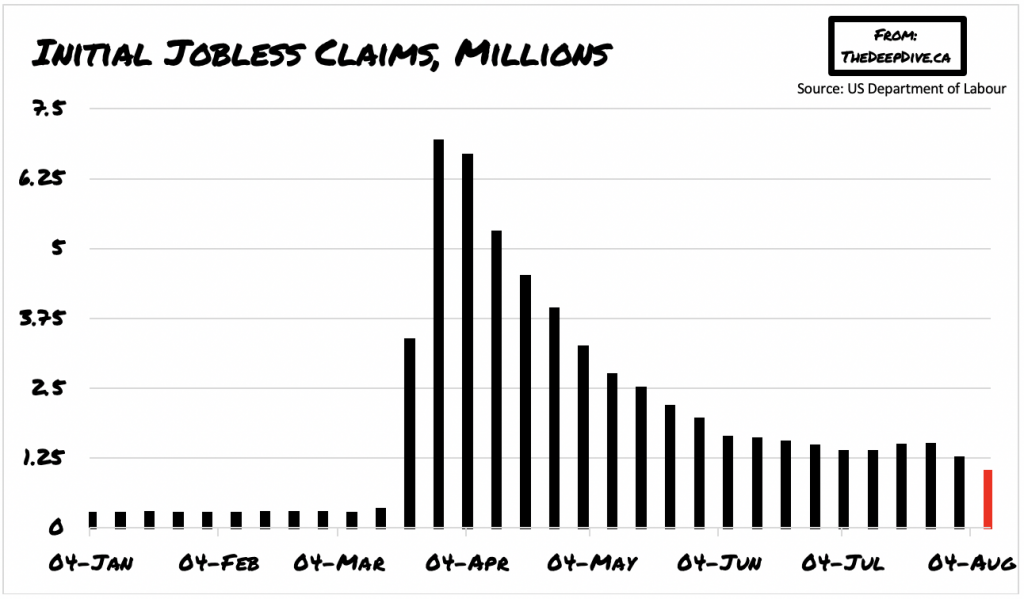

Given that mortgage delinquencies tend to positively correlate with job availability, the slow recovery in the labour market suggests that some homeowners will continue to be impacted. Following April’s record job losses, there are still 13 million more jobs that need to be recovered before pre-pandemic levels are achieved – hence the elevated unemployment rate of 10.2% as of July.

However, many job losses and ultimately mortgage delinquencies are clustered in several states in particular. Mortgage delinquency rates surged in states that have a higher number of hospitality and leisure jobs, such as Florida, Nevada, Hawaii and New Jersey. Evidently, the hospitality industry has been hit the hardest by the pandemic, and with some states taking initiative to roll back reopening plans, the issue of mortgage delinquency may persist even longer.

Information for this briefing was found via the Mortgage Banker’s Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.